Question: Please provide the answers to all the parts of the questions. Today is April 1, 2017. The current level of the S&P 500 index is

Please provide the answers to all the parts of the questions.

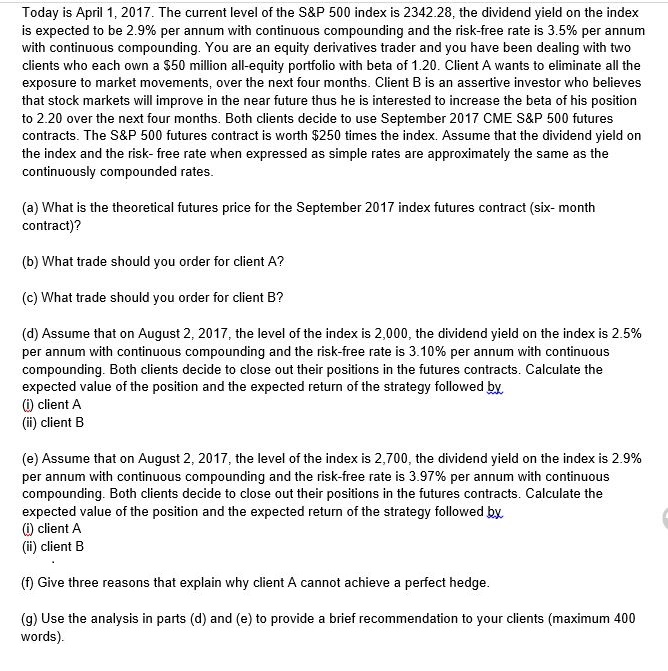

Today is April 1, 2017. The current level of the S&P 500 index is 2342.28, the dividend yield on the index is expected to be 2.9% per annum with continuous compounding and the risk-free rate is 3.5% per annum with continuous compounding. You are an equity derivatives trader and you have been dealing with two clients who each own a S50 million all-equity portfolio with beta of 1.20. Client A wants to eliminate all the exposure to market movements, over the next four months. Client B is an assertive investor who believes that stock markets will improve in the near future thus he is interested to increase the beta of his position to 2.20 over the next four months. Both clients decide to use September 2017 CME S&P 500 futures contracts. The S&P 500 futures contract is worth $250 times the index. Assume that the dividend yield on the index and the risk- free rate when expressed as simple rates are approximately the same as the continuously compounded rates. (a) What is the theoretical futures price for the September 2017 index futures contract (six- month contract)? (b) What trade should you order for client A? (c) What trade should you order for client B? (d) Assume that on August 2, 2017, the level of the index is 2,000, the dividend yield on the index is 2.5% per annum with continuous compounding and the risk-free rate is 3.10% per annum with continuous compounding. Both clients decide to close out their positions in the futures contracts. Calculate the expected value of the position and the expected return of the strategy followed by, (i) client A (ii) client B (e) Assume that on August 2, 2017, the level of the index is 2, 700, the dividend yield on the index is 2.9% per annum with continuous compounding and the risk-free rate is 3.97% per annum with continuous compounding. Both clients decide to close out their positions in the futures contracts. Calculate the expected value of the position and the expected return of the strategy followed by (i) client A (ii) client B (f) Give three reasons that explain why client A cannot achieve a perfect hedge. (g) Use the analysis in parts (d) and (e) to provide a brief recommendation to your clients (maximum 400 words)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts