Question: Please provide the calculation, Formula /workings & answer . Please also provide the comment, comparison, decision making & recommendation based on the answer. Your company

Please provide the calculation, Formula /workings & answer. Please also provide the comment, comparison, decision making & recommendation based on the answer.

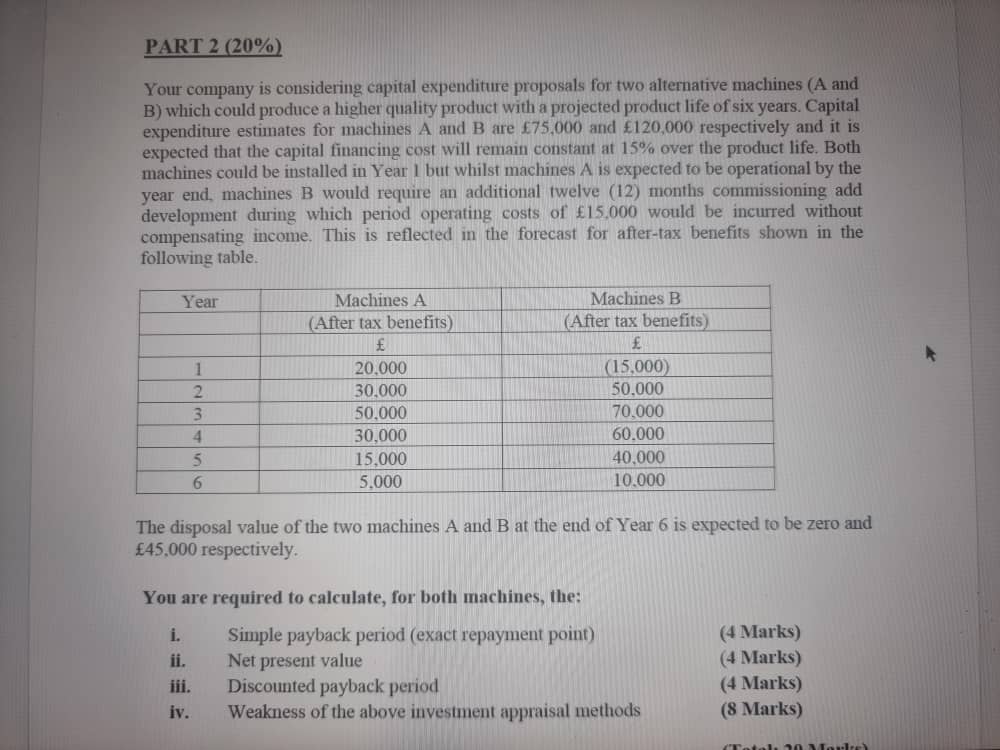

Your company is considering capital expenditure proposals for two alternative machines (A and B) which could produce a higher quality product with a projected product life of six years. Capital expenditure estimates for machines A and B are $75,000 and 120,000 respectively and it is expected that the capital financing cost will remain constant at 15% over the product life. Both machines could be installed in Year 1 but whilst machines A is expected to be operational by the year end, machines B would require an additional twelve (12) months commissioning add development during which period operating costs of 15,000 would be incurred without compensating income. This is reflected in the forecast for after-tax benefits shown in the following table. The disposal value of the two machines A and B at the end of Year 6 is expected to be zero and 45,000 respectively. You are required to calculate, for both machines, the: i. Simple payback period (exact repayment point) (4 Marks) ii. Net present value (4 Marks) iii. Discounted payback period (4 Marks) iv. Weakness of the above investment appraisal methods (8 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts