Question: please provide the clear answer Manager Cafe Raiton is considering investing in 2 (two) projects. Project X is an investment of $ 75,000 to replace

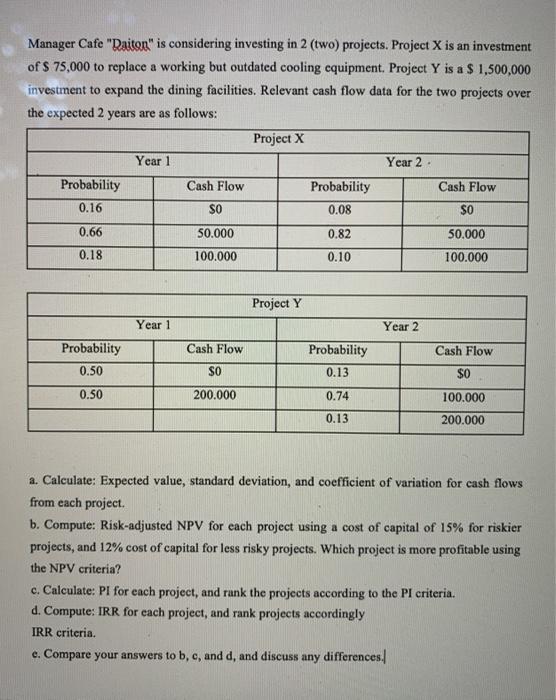

Manager Cafe "Raiton" is considering investing in 2 (two) projects. Project X is an investment of $ 75,000 to replace a working but outdated cooling equipment Project Y is a $1,500,000 investment to expand the dining facilities. Relevant cash flow data for the two projects over the expected 2 years are as follows: Project X Year 1 Year 2 Probability Cash Flow Probability Cash Flow 0.16 SO 0.08 SO 0.66 50.000 0.82 50.000 0.18 100.000 0.10 100.000 Project Y Year 1 Year 2 Cash Flow Cash Flow Probability 0.50 Probability 0.13 SO $0 0.50 200.000 0.74 100.000 0.13 200.000 a. Calculate: Expected value, standard deviation, and coefficient of variation for cash flows from each project. b. Compute: Risk-adjusted NPV for each project using a cost of capital of 15% for riskier projects, and 12% cost of capital for less risky projects. Which project is more profitable using the NPV criteria? c. Calculate: PI for each project, and rank the projects according to the PI criteria. d. Compute: IRR for each project, and rank projects accordingly IRR criteria. e. Compare your answers to b, c, and d, and discuss any differences. Manager Cafe "Raiton" is considering investing in 2 (two) projects. Project X is an investment of $ 75,000 to replace a working but outdated cooling equipment Project Y is a $1,500,000 investment to expand the dining facilities. Relevant cash flow data for the two projects over the expected 2 years are as follows: Project X Year 1 Year 2 Probability Cash Flow Probability Cash Flow 0.16 SO 0.08 SO 0.66 50.000 0.82 50.000 0.18 100.000 0.10 100.000 Project Y Year 1 Year 2 Cash Flow Cash Flow Probability 0.50 Probability 0.13 SO $0 0.50 200.000 0.74 100.000 0.13 200.000 a. Calculate: Expected value, standard deviation, and coefficient of variation for cash flows from each project. b. Compute: Risk-adjusted NPV for each project using a cost of capital of 15% for riskier projects, and 12% cost of capital for less risky projects. Which project is more profitable using the NPV criteria? c. Calculate: PI for each project, and rank the projects according to the PI criteria. d. Compute: IRR for each project, and rank projects accordingly IRR criteria. e. Compare your answers to b, c, and d, and discuss any differences

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts