Question: Please provide the correct answer for question 7 with work. Thank you 6. Jarrett Bay preferred stock has a redemption value of $70 and a

Please provide the correct answer for question 7 with work. Thank you

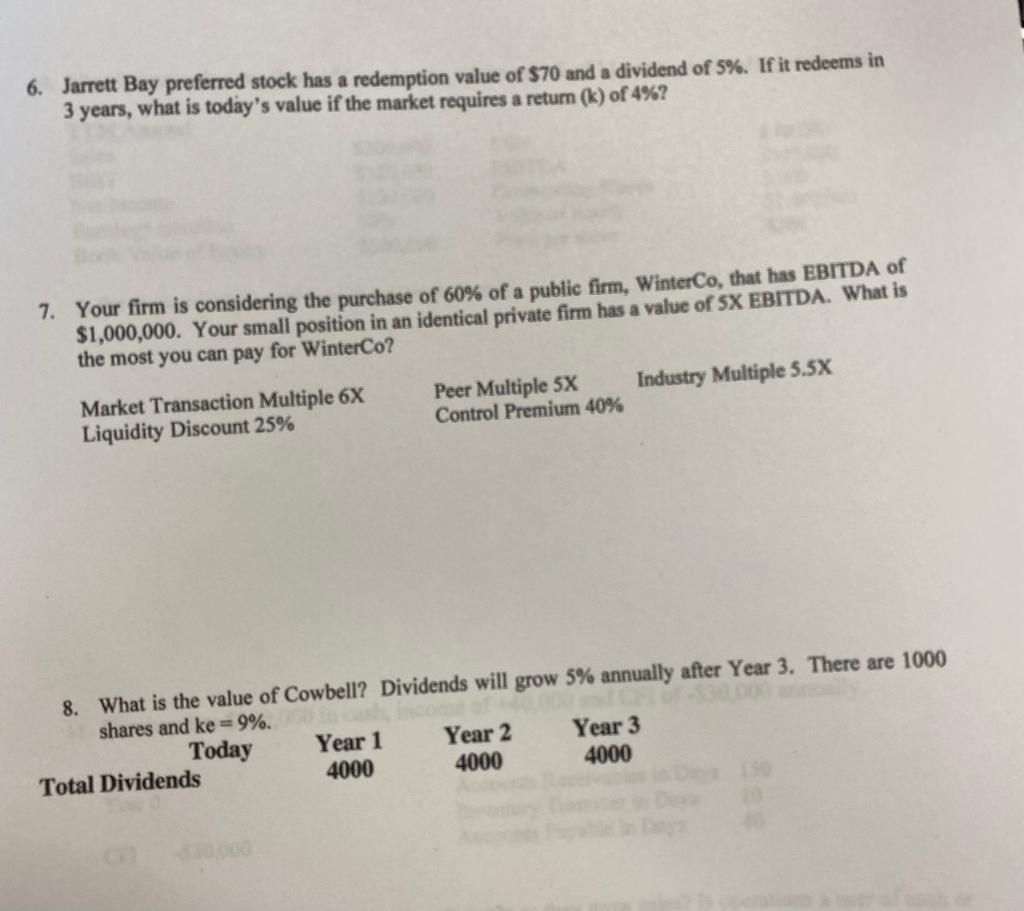

6. Jarrett Bay preferred stock has a redemption value of $70 and a dividend of 5%. If it redeems in 3 years, what is today's value if the market requires a return (k) of 4%? 7. Your firm is considering the purchase of 60% of a public firm, WinterCo, that has EBITDA of $1,000,000. Your small position in an identical private firm has a value of 5X EBITDA. What is the most you can pay for WinterCo? Industry Multiple 5.5X Market Transaction Multiple 6X Liquidity Discount 25% Peer Multiple 5X Control Premium 40% 8. What is the value of Cowbell? Dividends will grow 5% annually after Year 3. There are 1000 shares and ke=9%. Today Year 1 Year 2 Year 3 Total Dividends 4000 4000 4000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts