Question: please provide the correct answer from the choices no solutions needed ASAP please For the next 9 questions, including this number: You are about to

please provide the correct answer from the choices no solutions needed ASAP please

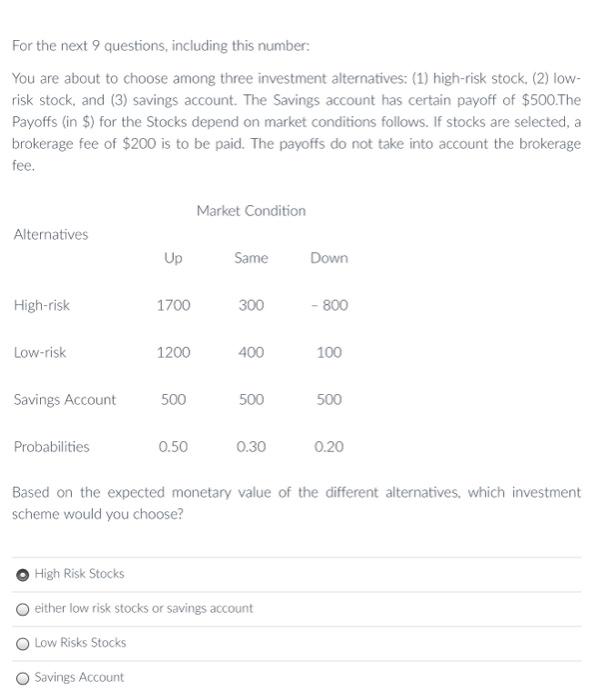

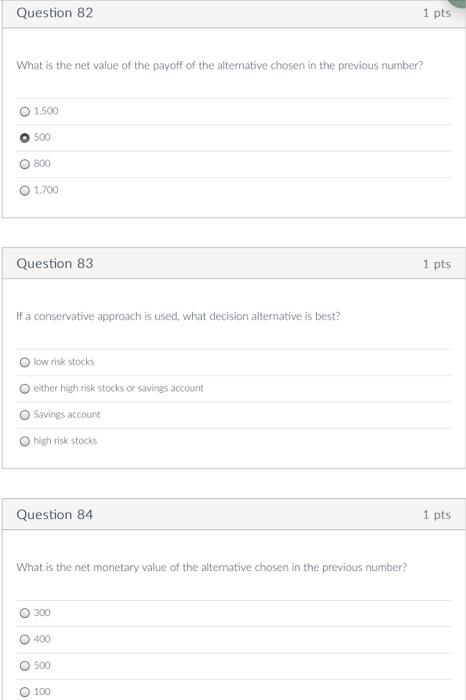

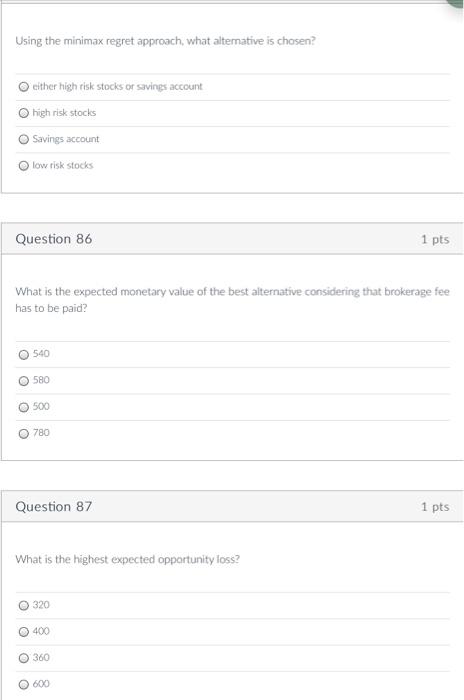

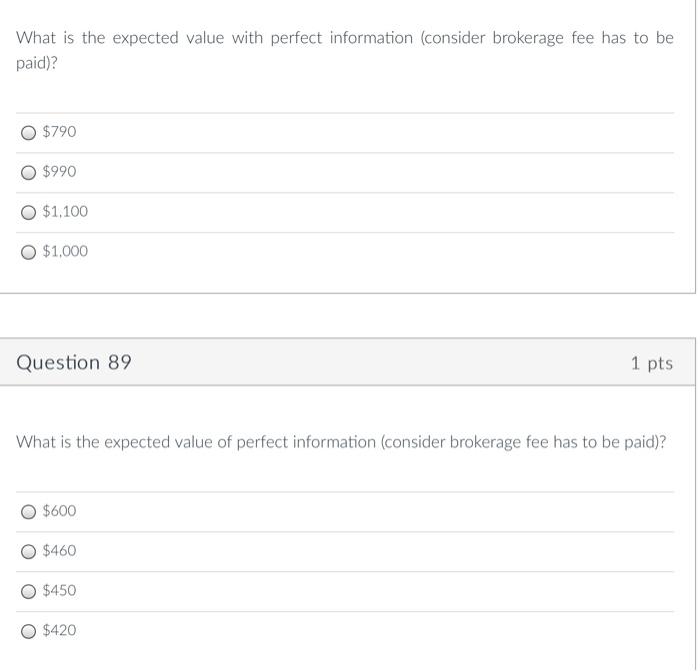

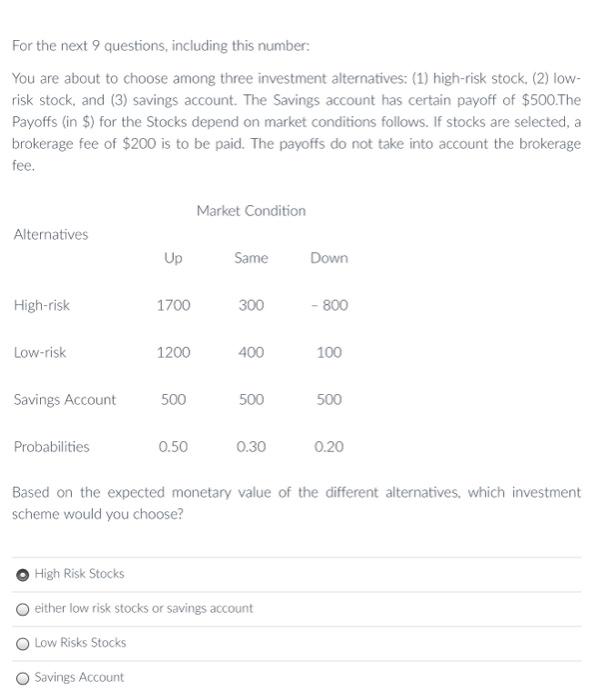

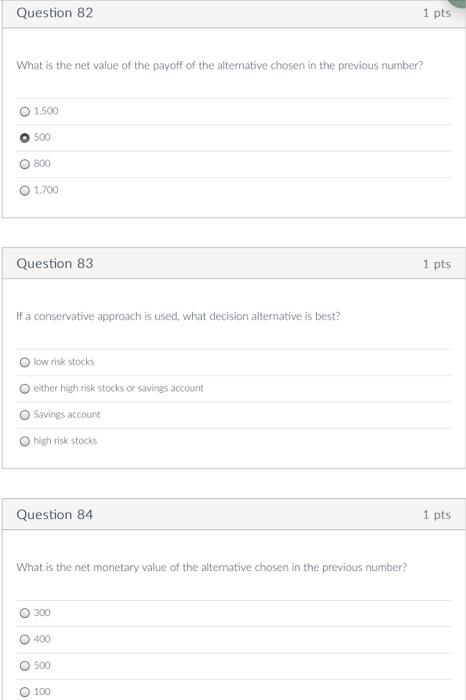

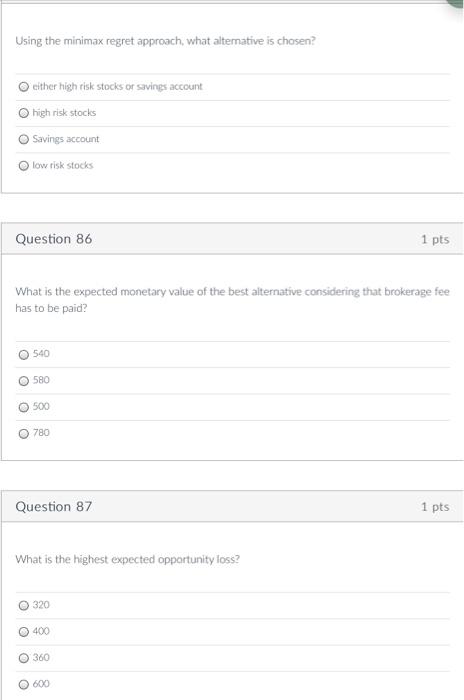

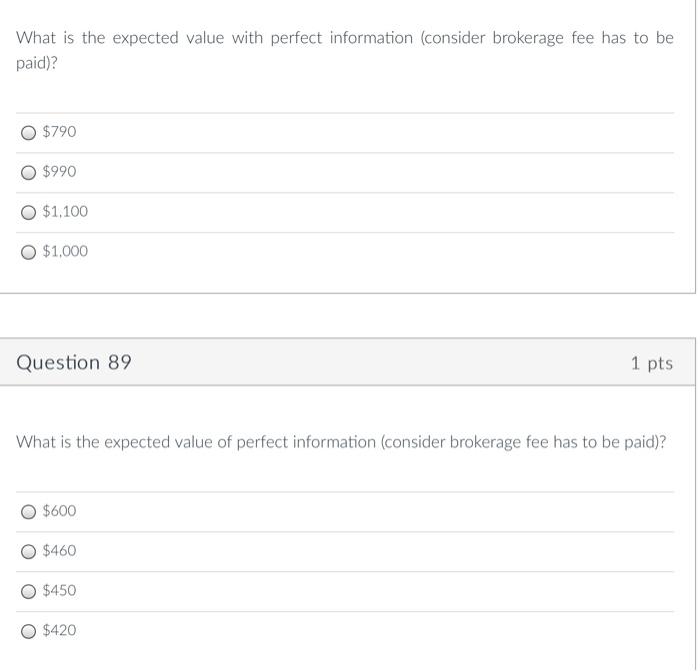

For the next 9 questions, including this number: You are about to choose among three investment alternatives: (1) high-risk stock, (2) low- risk stock, and (3) savings account. The Savings account has certain payoff of $500. The Payoffs (in $) for the Stocks depend on market conditions follows. If stocks are selected, a brokerage fee of $200 is to be paid. The payoffs do not take into account the brokerage fee. Market Condition Alternatives Up Same Down High-risk 1700 300 - 800 Low-risk 1200 400 100 Savings Account 500 500 500 Probabilities 0.50 0.30 0.20 Based on the expected monetary value of the different alternatives, which investment scheme would you choose? High Risk Stocks either low risk stocks or savings account Low Risks Stocks Savings Account Question 82 1 pts What is the net value of the payoff of the alterative chosen in the previous number? 1,500 500 o 800 1.700 Question 83 1 pts If a conservative approach is used, what decision alternative is best? low risk stocks either high risk stocks or savings account Savings account high risk stocks Question 84 1 pts What is the net monetary value of the alternative chosen in the previous number? 300 400 500 O 100 Using the minimax regret approach, what alternative is chosen? either high risk stocks or savings account high risk stocks Savings account low risk stocks Question 86 1 pts What is the expected monetary value of the best alternative considering that brokerage fee has to be paid? 540 o 580 500 o 780 Question 87 1 pts What is the highest expected opportunity loss? 320 400 o 360 O 600 What is the expected value with perfect information (consider brokerage fee has to be paid)? $790 $990 $1,100 O $1,000 Question 89 1 pts What is the expected value of perfect information (consider brokerage fee has to be paid)? O $600 $460 $450 $420

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock