Question: Please provide the excel formulas. For the answer to be graded as correct, you must use an excel formula: 1)Begin each formula with an =

Please provide the excel formulas.

For the answer to be graded as correct, you must use an excel formula:

1)Begin each formula with an = sign

2) Reference cells, instead of entering values.

Example: =B3+C3

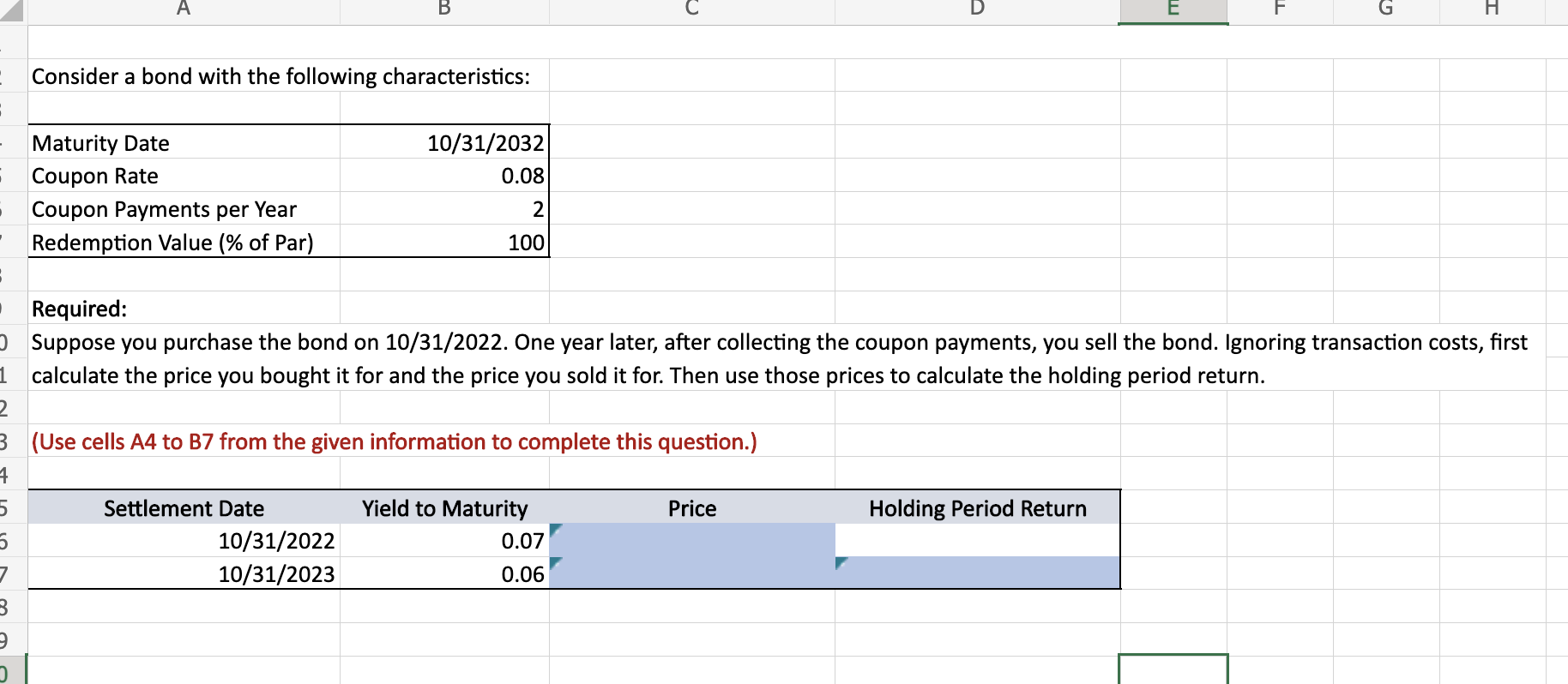

A B D E G H Consider a bond with the following characteristics: 10/31/2032 0.08 Maturity Date - Coupon Rate Coupon Payments per Year Redemption Value (% of Par) 2 100 Required: o Suppose you purchase the bond on 10/31/2022. One year later, after collecting the coupon payments, you sell the bond. Ignoring transaction costs, first 1 calculate the price you bought it for and the price you sold it for. Then use those prices to calculate the holding period return. 2. 3 (Use cells A4 to B7 from the given information to complete this question.) 1 5 Settlement Date Yield to Maturity Price Holding Period Return 5 10/31/2022 0.07 7 10/31/2023 0.06 3 > . A B D E G H Consider a bond with the following characteristics: 10/31/2032 0.08 Maturity Date - Coupon Rate Coupon Payments per Year Redemption Value (% of Par) 2 100 Required: o Suppose you purchase the bond on 10/31/2022. One year later, after collecting the coupon payments, you sell the bond. Ignoring transaction costs, first 1 calculate the price you bought it for and the price you sold it for. Then use those prices to calculate the holding period return. 2. 3 (Use cells A4 to B7 from the given information to complete this question.) 1 5 Settlement Date Yield to Maturity Price Holding Period Return 5 10/31/2022 0.07 7 10/31/2023 0.06 3 >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts