Question: Please provide the formula you use to get the answer in the cells, thank you! 4. Exhibit919 presents the income statement and balance sheet for

Please provide the formula you use to get the answer in the cells, thank you!

Please provide the formula you use to get the answer in the cells, thank you!

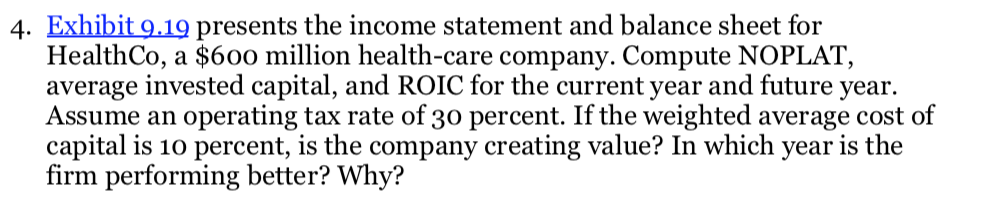

4. Exhibit919 presents the income statement and balance sheet for HealthCo, a $600 million health-care company. Compute NOPLAT, average invested capital, and ROIC for the current year and future year. Assume an operating tax rate of 30 percent. If the weighted average cost of capital is 10 percent, is the company creating value? In which year is the firm performing better? Why? EXHIBIT 9.19 HealthCo: Income Statement and Balance Sheet $million Last Current Next year yearer Balance sheet 1,00 1,210 1,307 Operting cash Last Current Next Income statement Revenues year year year 24 Excess cash and marketable Cost of sales securities Selling, general, and 220 242 330 363 663 703 763 administrative Depreciation EBIT Interest expense Gain (loss) on sale of assets EBT Taxes Net income (165) 182) 196) Accounts receivable (33) (36) (39) nventory 132 121 15) 15 15) 261 392 57 Current assets 40484 50 (10) Property, plant, and equipment Equity investments 523 - 142 (35) 29) (43) 82 67 99 Total assets 1,153 1,237 1,336 Dividends 27 40 Accounts payable 275 90 Short-term debt Accrued expenses Current liabilities 303 327 90 165 182 196 530 574 613 90 210 210 Long-term debt Common stock 210 100 100 100 313 353 413 Retained earnings Total liabilities and equity 1,153 1,237 1,336 5. Using the reorganized financial statements created in Question 4, what is the free cash flow for HealthCo in the current year and next year? 6. Many companies hold significant amounts of excess cash, or cash above the amount required for day-to-day operations. What would happen to the ROIC for HealthCo if you included excess cash in its calculation? Why should one exclude excess cash from the calculation? 4. Exhibit919 presents the income statement and balance sheet for HealthCo, a $600 million health-care company. Compute NOPLAT, average invested capital, and ROIC for the current year and future year. Assume an operating tax rate of 30 percent. If the weighted average cost of capital is 10 percent, is the company creating value? In which year is the firm performing better? Why? EXHIBIT 9.19 HealthCo: Income Statement and Balance Sheet $million Last Current Next year yearer Balance sheet 1,00 1,210 1,307 Operting cash Last Current Next Income statement Revenues year year year 24 Excess cash and marketable Cost of sales securities Selling, general, and 220 242 330 363 663 703 763 administrative Depreciation EBIT Interest expense Gain (loss) on sale of assets EBT Taxes Net income (165) 182) 196) Accounts receivable (33) (36) (39) nventory 132 121 15) 15 15) 261 392 57 Current assets 40484 50 (10) Property, plant, and equipment Equity investments 523 - 142 (35) 29) (43) 82 67 99 Total assets 1,153 1,237 1,336 Dividends 27 40 Accounts payable 275 90 Short-term debt Accrued expenses Current liabilities 303 327 90 165 182 196 530 574 613 90 210 210 Long-term debt Common stock 210 100 100 100 313 353 413 Retained earnings Total liabilities and equity 1,153 1,237 1,336 5. Using the reorganized financial statements created in Question 4, what is the free cash flow for HealthCo in the current year and next year? 6. Many companies hold significant amounts of excess cash, or cash above the amount required for day-to-day operations. What would happen to the ROIC for HealthCo if you included excess cash in its calculation? Why should one exclude excess cash from the calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts