Question: Please provide the mapping as the 2n screen shot Consider the following income statement for the Heir Jordan Corporation: HEIR JORDAN CORPORATION Income Statement Sales

Please provide the mapping as the 2n screen shot

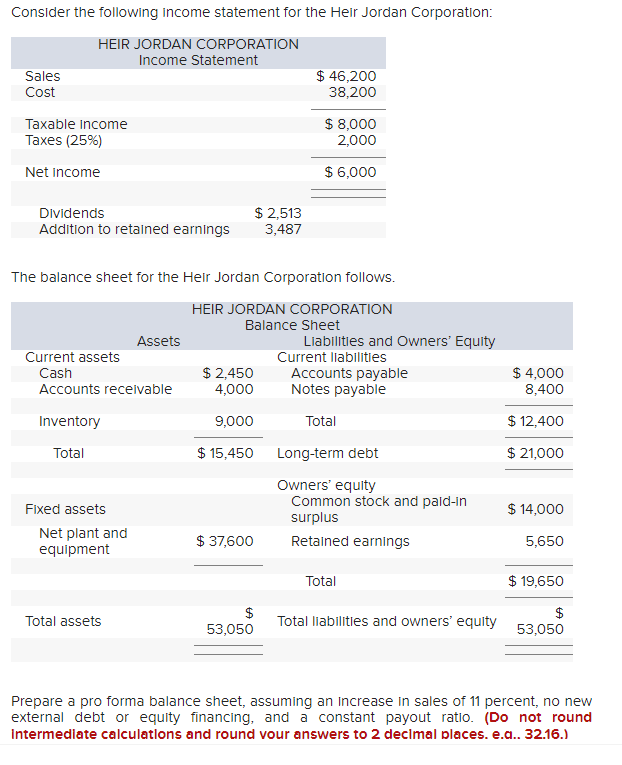

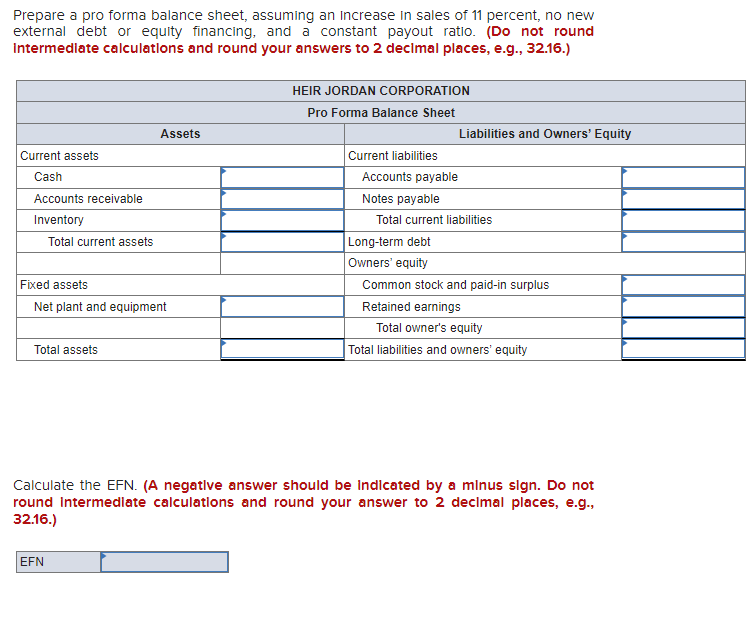

Consider the following income statement for the Heir Jordan Corporation: HEIR JORDAN CORPORATION Income Statement Sales $ 46,200 Cost 38,200 $ 8,000 2,000 Taxable income Taxes (25%) Net income $ 6,000 Dividends Addition to retained earnings $ 2,513 3,487 The balance sheet for the Heir Jordan Corporation follows. HEIR JORDAN CORPORATION Balance Sheet Assets Liabilities and Owners' Equity Current assets Current liabilities Cash $ 2,450 Accounts payable Accounts receivable 4,000 Notes payable Inventory 9,000 Total $ 4,000 8,400 $ 12,400 Total $ 15,450 Long-term debt $ 21,000 Owners' equity Common stock and pald-in surplus Retained earnings Fixed assets Net plant and equipment $ 14,000 $ 37,600 5,650 Total $ 19,650 Total assets $ 53,050 Total liabilities and owners' equity $ 53,050 Prepare a pro forma balance sheet, assuming an increase in sales of 11 percent, no new external debt or equity financing, and a constant payout ratio. (Do not round Intermediate calculations and round vour answers to 2 decimal places. e.a.. 32.16.) Prepare a pro forma balance sheet, assuming an increase in sales of 11 percent, no new external debt or equity financing, and a constant payout ratio. (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Assets Current assets Cash Accounts receivable Inventory Total current assets HEIR JORDAN CORPORATION Pro Forma Balance Sheet Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total current liabilities Long-term debt Owners' equity Common stock and paid-in surplus Retained earnings Total owner's equity Total liabilities and owners' equity Fixed assets Net plant and equipment Total assets Calculate the EFN. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) EFN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts