Question: **PLEASE PROVIDE THE WORKING FOR THE FIGURES** Thank you Two investment projects are available, with the following relevant cash flows: tel Table 4.2 Cash flows

**PLEASE PROVIDE THE WORKING FOR THE FIGURES**

Thank you

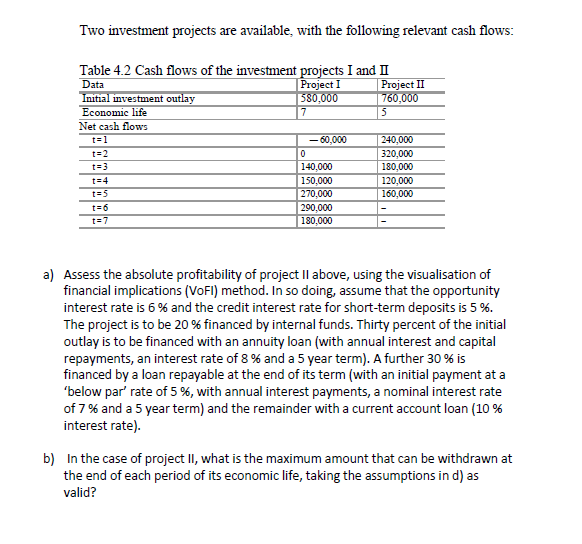

Two investment projects are available, with the following relevant cash flows: tel Table 4.2 Cash flows of the investment projects I and II Data Project I Project II Initial investment outlay 580,000 760,000 Economic life 7 5 Net cash flows - 60,000 240,000 t=2 0 320,000 t=3 140.000 180,000 150,000 120,000 t=5 270,000 160,000 t=6 290,000 t=7 180.000 t=4 a) Assess the absolute profitability of project II above, using the visualisation of financial implications (VoFI) method. In so doing, assume that the opportunity interest rate is 6% and the credit interest rate for short-term deposits is 5 %. The project is to be 20 % financed by internal funds. Thirty percent of the initial outlay is to be financed with an annuity loan (with annual interest and capital repayments, an interest rate of 8 % and a 5 year term). A further 30 % is financed by a loan repayable at the end of its term (with an initial payment at a 'below par' rate of 5 %, with annual interest payments, a nominal interest rate of 7 % and a 5 year term) and the remainder with a current account loan (10% interest rate). b) In the case of project II, what is the maximum amount that can be withdrawn at the end of each period of its economic life, taking the assumptions in d) as valid? Two investment projects are available, with the following relevant cash flows: tel Table 4.2 Cash flows of the investment projects I and II Data Project I Project II Initial investment outlay 580,000 760,000 Economic life 7 5 Net cash flows - 60,000 240,000 t=2 0 320,000 t=3 140.000 180,000 150,000 120,000 t=5 270,000 160,000 t=6 290,000 t=7 180.000 t=4 a) Assess the absolute profitability of project II above, using the visualisation of financial implications (VoFI) method. In so doing, assume that the opportunity interest rate is 6% and the credit interest rate for short-term deposits is 5 %. The project is to be 20 % financed by internal funds. Thirty percent of the initial outlay is to be financed with an annuity loan (with annual interest and capital repayments, an interest rate of 8 % and a 5 year term). A further 30 % is financed by a loan repayable at the end of its term (with an initial payment at a 'below par' rate of 5 %, with annual interest payments, a nominal interest rate of 7 % and a 5 year term) and the remainder with a current account loan (10% interest rate). b) In the case of project II, what is the maximum amount that can be withdrawn at the end of each period of its economic life, taking the assumptions in d) as valid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts