Question: Please provide work and steps (Excel formulas, etc.) 1. A news article reported that Bill Ackman, who runs Pershing Square Capital Management, recently proposed the

Please provide work and steps (Excel formulas, etc.)

Please provide work and steps (Excel formulas, etc.)

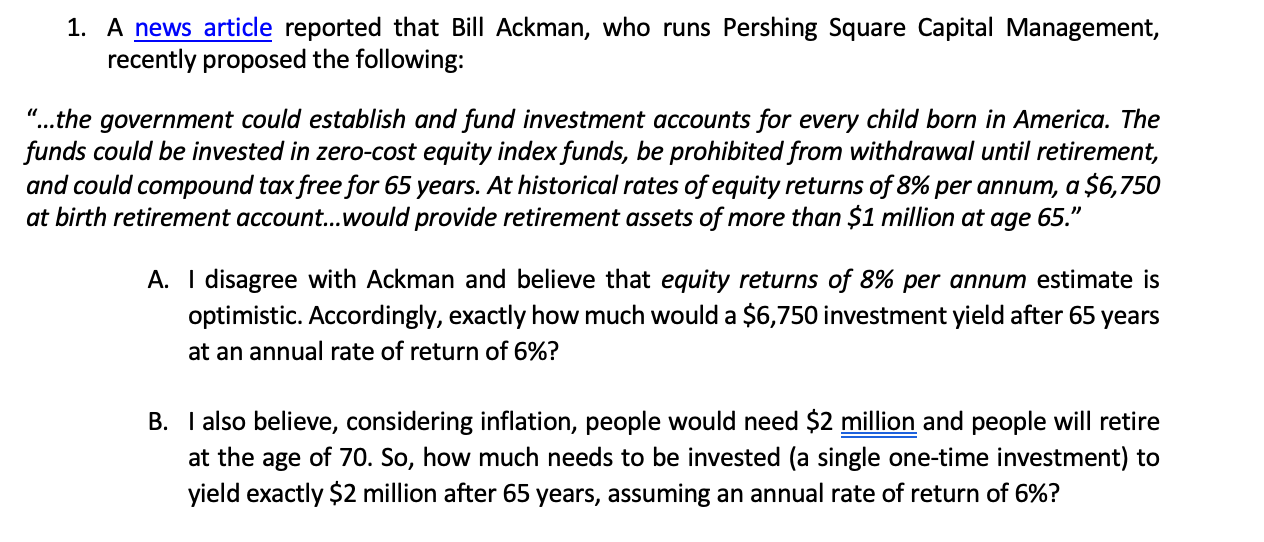

1. A news article reported that Bill Ackman, who runs Pershing Square Capital Management, recently proposed the following: "...the government could establish and fund investment accounts for every child born in America. The funds could be invested in zero-cost equity index funds, be prohibited from withdrawal until retirement, and could compound tax free for 65 years. At historical rates of equity returns of 8% per annum, a $6,750 at birth retirement account...would provide retirement assets of more than $1 million at age 65." A. I disagree with Ackman and believe that equity returns of 8% per annum estimate is optimistic. Accordingly, exactly how much would a $6,750 investment yield after 65 years at an annual rate of return of 6%? B. I also believe, considering inflation, people would need $2 million and people will retire at the age of 70. So, how much needs to be invested (a single one-time investment) to yield exactly $2 million after 65 years, assuming an annual rate of return of 6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts