Question: Please provide work on how you got solutions, not just answers. Product-Costing Accuracy, Consumption Ratios Plata Company produces two products: a mostly handcrafted soft leather

Please provide work on how you got solutions, not just answers.

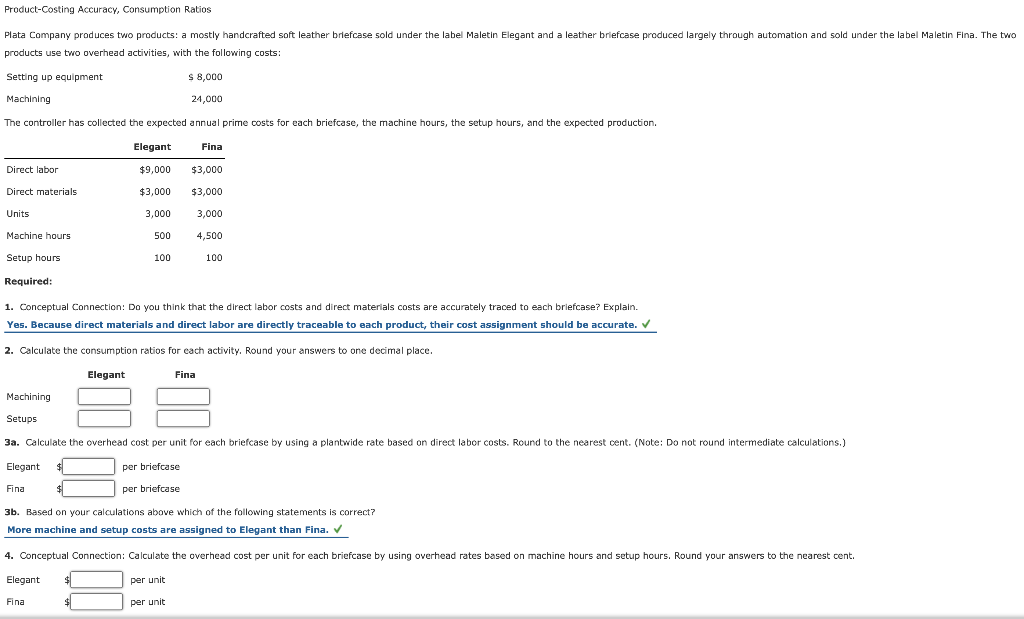

Product-Costing Accuracy, Consumption Ratios Plata Company produces two products: a mostly handcrafted soft leather briefcase sold under the label Maletin Elegant and a leather briefcase produced largely through automation and sold under the label Maletin Fina. The two products use two overhead activities, with the following costs: Setting up equipment S 8,000 Machining 24,000 The controller has collected the expected annual prime costs for each briefcase, the machine hours, the setup hours, and the expected production. Elegant Fina Direct labor $9,000 $3,000 Direct materials $3,000 $3,000 Units 3,000 3,000 Machine hours 500 4,500 Setup hours 100 100 Required: 1. Conceptual Connection: Da you think that the direct labor costs and direct materials costs are accurately traced to each briefcase? Explain. Yes. Because direct materials and direct labor are directly traceable to each product, their cost assignment should be accurate. 2. Calculate the consumption ratios for each activity. Round your answers to one decimal place. Elegant Fina Machining Setups 3a. Calculate the overhead cost per unit for each briefcase by using a plantwide rate based on direct labor costs. Round to the nearest cent. (Note: Do not round intermediate calculations.) Elegant per briefcase Fina per briefcase 3b. Based on your calculations above which of the following statements is correct? More machine and setup costs are assigned to Elegant than Fina. 4. Conceptual Connection: Calculate the overhead cost per unit for each briefcase by using overhead rates based on machine hours and setup hours. Round your answers to the nearest cent. Elegant per unit Fina $ per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts