Question: please provide working notes Vector Enterprises is preparing their annual financial statements at December 31. The following information will be needed: 1. Services provided to

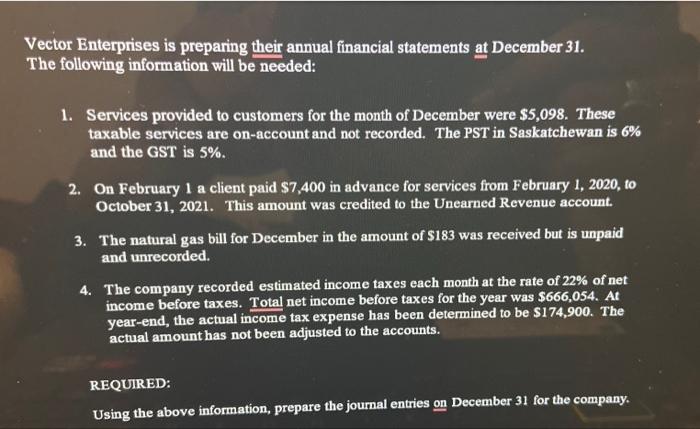

Vector Enterprises is preparing their annual financial statements at December 31. The following information will be needed: 1. Services provided to customers for the month of December were $5,098. These taxable services are on-account and not recorded. The PST in Saskatchewan is 6% and the GST is 5%. 2. On February 1 a client paid $7,400 in advance for services from February 1, 2020, to October 31, 2021. This amount was credited to the Unearned Revenue account. 3. The natural gas bill for December in the amount of $183 was received but is unpaid and unrecorded. 4. The company recorded estimated income taxes each month at the rate of 22% of net income before taxes. Total net income before taxes for the year was $666,054. At year-end, the actual income tax expense has been determined to be $174,900. The actual amount has not been adjusted to the accounts. REQUIRED: Using the above information, prepare the journal entries on December 31 for the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts