Question: Please provide your answer through calculations to the problem, by presenting the formulas you use the calculations, the result and its interpretation Analyse if the

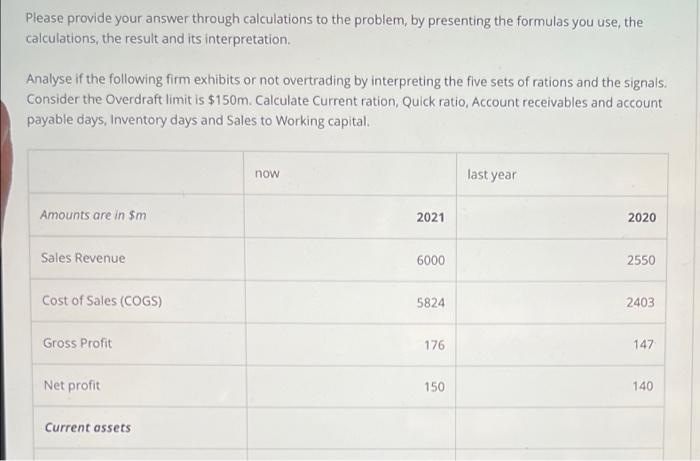

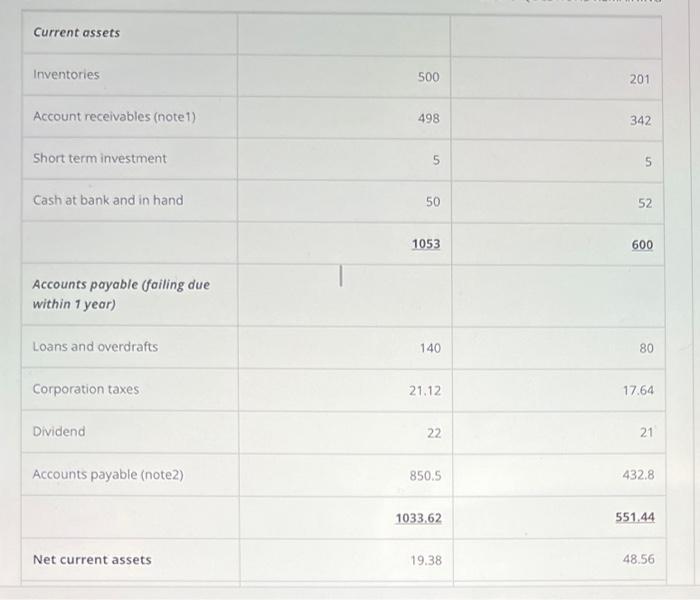

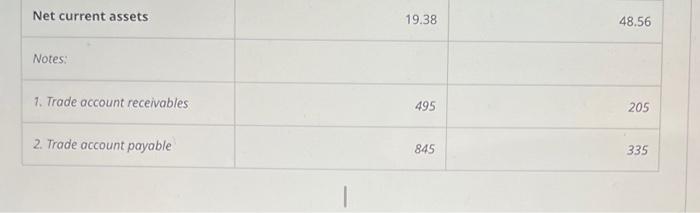

Please provide your answer through calculations to the problem, by presenting the formulas you use the calculations, the result and its interpretation Analyse if the following firm exhibits or not overtrading by interpreting the five sets of rations and the signals. Consider the Overdraft limit is $150m. Calculate Current ration, Quick ratio, Account receivables and account payable days, Inventory days and Sales to Working capital now last year Amounts are in sm 2021 2020 Sales Revenue 6000 2550 Cost of Sales (COGS) 5824 2403 Gross Profit 176 147 Net profit 150 140 Current assets Current assets Inventories 500 201 Account receivables (note 1) 498 342 Short term investment un 5 Cash at bank and in hand 50 52 1053 600 Accounts payable (failing due within 1 year) Loans and overdrafts 140 80 Corporation taxes 21.12 17.64 Dividend 22 21 Accounts payable (note2) 850.5 432.8 1033.62 551.44 Net current assets 19.38 48.56 Net current assets 19.38 48.56 Notes: 7. Trade account receivables 495 205 2. Trade account payable 845 335

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts