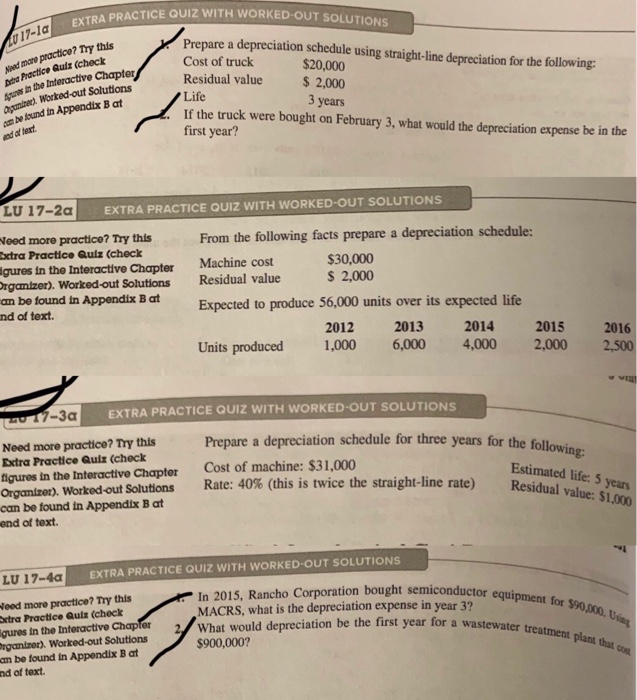

Question: Please put in excel spreadsheet and please show formula and answers. Thank you. TRA PRACTICE QUIZ WITH WORKED-OUT SOLUT IONS Prepare a depreciation schedule using

TRA PRACTICE QUIZ WITH WORKED-OUT SOLUT IONS Prepare a depreciation schedule using straight-line depreciation for the following: Cost of truck Residual value $ 2,000 Life If the truck were bought on February 3, what would the depreciation expense be in the first year? eed mare practico? Try this ptna Practice Qulz (check $20,000 unizer), Worked-out Solutions be tound in Appendix B at in the Interactive Chapter 3 years nd of teat PS EXTRA PRACTICE OUIZ WITH WORKED-OUT SOLUTIONS From the following facts prepare a depreciation schedule: Need more practice? Try this ctra Practice Quiz (check gures in the Interactive Chapter Machine cost $30,000 $ 2,000 Residual value Expected to produce 56,000 units over its expected life rganizer). Worked-out Solutions an be found in Appendix B at nd of text. 2012 2013 2014 2015 2016 Units produced 1,000 6,000 4,000 2,000 2,500 - EXTRA PRACTICE QUIZ WITH WORKED-OUT SOLUTIONS Prepare a depreciation schedule for three years for the followin Need more practice? Try this Extra Practice Quiz (check figures in the Interactive Chapter Organizer). Worked-out be found in Appendix B at end of text g: Cost of machine: $31,000 Rate: 40% (this is twice the straight-line rate) Estimated life: 5 years Residual olutions value: $1,000 LU 17-40 EXTRA PRACTICE QUIZ WITH WORKED-OUT SOLUTIONS In 2015, Rancho Corporation bought semiconductor eed more practice? Try this xtra Practice Quiz (check gures in the Interactive Chapfer ganiror). Worked-out Solutions an be found in Appendix B at nd of text equipment for $90,000. MACRS, what is the depreciation expense in year 3? What would depreciation be the first year for a wa $900,000? 2/ What wou plant that cou

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts