Question: PLEASE PUT SOLUTION IN THE SAME FORMAT AS THE IMAGE. THANK YOU! Exercise 16-6 (Algo) Temporary difference; income tax payable given (L016-3] In 2021, DFS

PLEASE PUT SOLUTION IN THE SAME FORMAT AS THE IMAGE. THANK YOU!

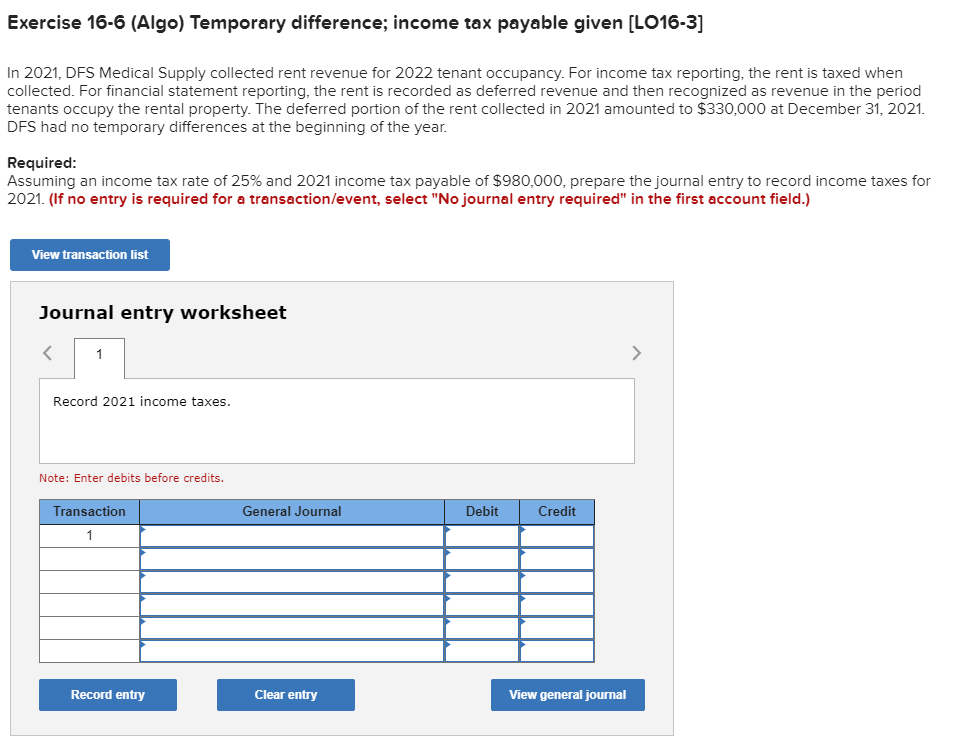

Exercise 16-6 (Algo) Temporary difference; income tax payable given (L016-3] In 2021, DFS Medical Supply collected rent revenue for 2022 tenant occupancy. For income tax reporting, the rent is taxed when collected. For financial statement reporting, the rent is recorded as deferred revenue and then recognized as revenue in the period tenants occupy the rental property. The deferred portion of the rent collected in 2021 amounted to $330,000 at December 31, 2021. DFS had no temporary differences at the beginning of the year. Required: Assuming an income tax rate of 25% and 2021 income tax payable of $980,000, prepare the journal entry to record income taxes for 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record 2021 income taxes. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts