Question: PLEASE PUT SOLUTION IN THE SAME FORMAT AS THE IMAGE. THANK YOU! Exercise 16-11 (Algo) Determine taxable income (LO16-2, 16-3] Eight independent situations are described

PLEASE PUT SOLUTION IN THE SAME FORMAT AS THE IMAGE. THANK YOU!

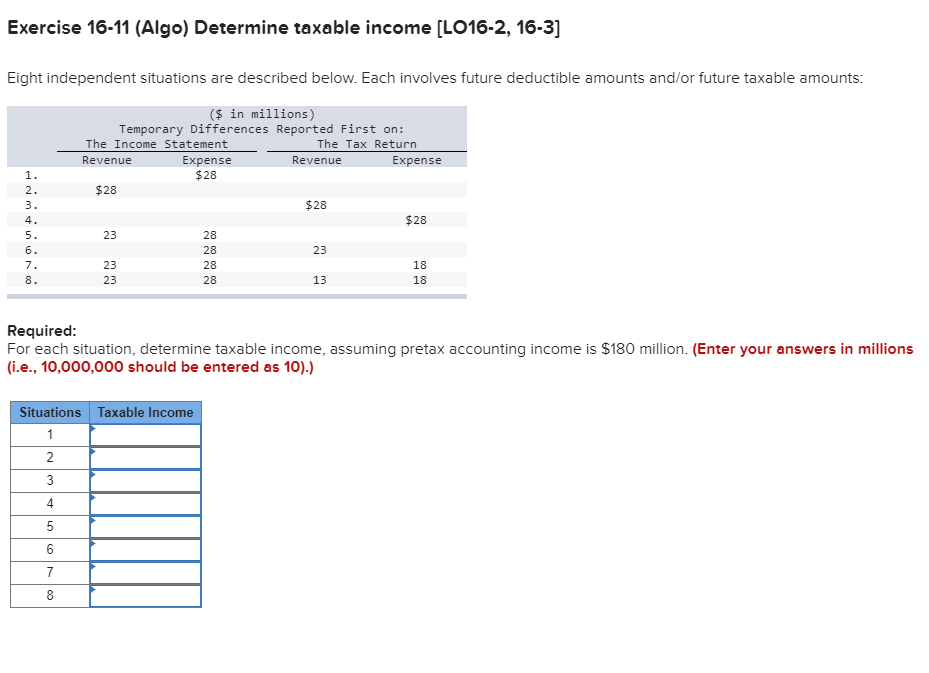

Exercise 16-11 (Algo) Determine taxable income (LO16-2, 16-3] Eight independent situations are described below. Each involves future deductible amounts and/or future taxable amounts: ($ in millions) Temporary Differences Reported First on: The Income Statement The Tax Return Revenue Expense Revenue Expens $28 $28 $28 $28 inim tnonoo Required: For each situation, determine taxable income, assuming pretax accounting income is $180 million. (Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) Situations Taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts