Question: PLEASE PUT SOLUTION IN THE SAME FORMAT AS THE IMAGE. THANK YOU! Exercise 16-1 (Algo) Temporary difference; taxable income given (L016-1, 16-2, 16-8] Alvis Corporation

PLEASE PUT SOLUTION IN THE SAME FORMAT AS THE IMAGE. THANK YOU!

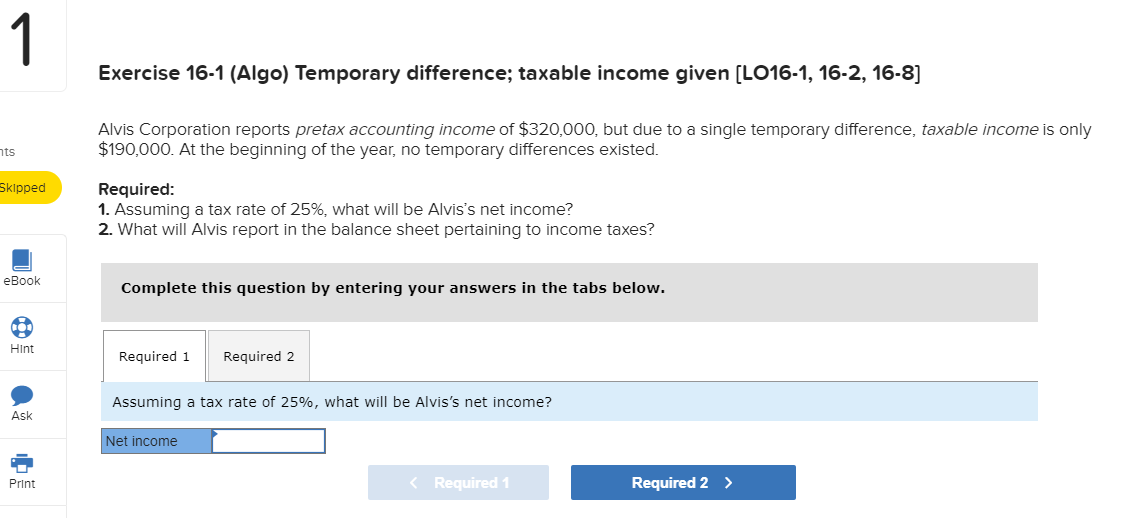

![Exercise 16-1 (Algo) Temporary difference; taxable income given (L016-1, 16-2, 16-8] Alvis](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67160e03d78ce_62767160e0377cd7.jpg)

Exercise 16-1 (Algo) Temporary difference; taxable income given (L016-1, 16-2, 16-8] Alvis Corporation reports pretax accounting income of $320,000, but due to a single temporary difference, taxable income is only $190,000. At the beginning of the year, no temporary differences existed. Skipped Required: 1. Assuming a tax rate of 25%, what will be Alvis's net income? 2. What will Alvis report in the balance sheet pertaining to income taxes? eBook Complete this question by entering your answers in the tabs below. Hint Required 1 Required 2 Assuming a tax rate of 25%, what will be Alvis's net income? Ask Net income Print Required i Required 2 What will Alvis report in the balance sheet pertaining to income taxes? Balance Sheet Account Reported Amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts