Question: Please put some explanation for my guidance thank you Problem 4-2 (LAA) Credible Company provided the following T-account summarizing the transactions affecting the accounts receivable

Please put some explanation for my guidance thank you

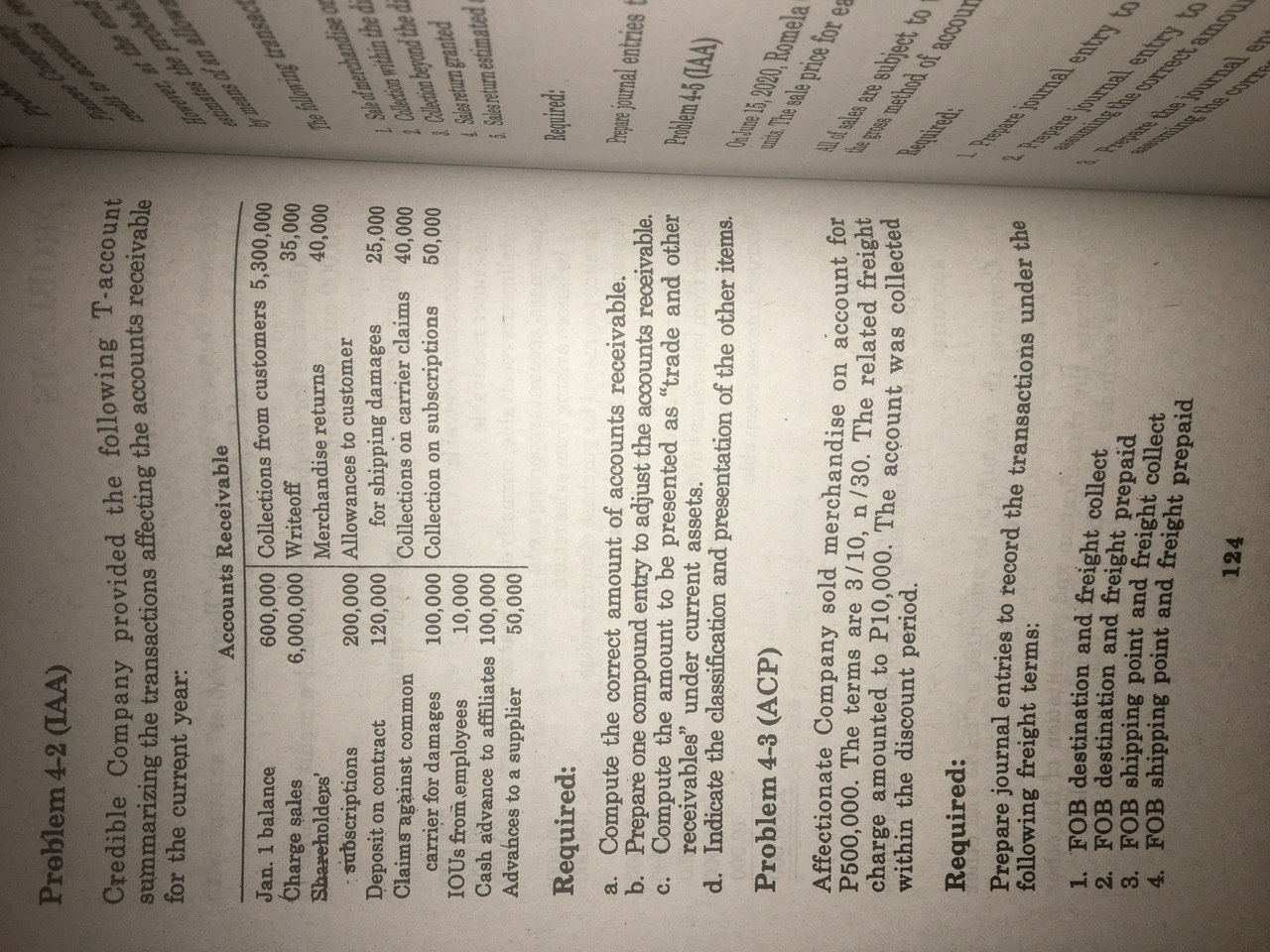

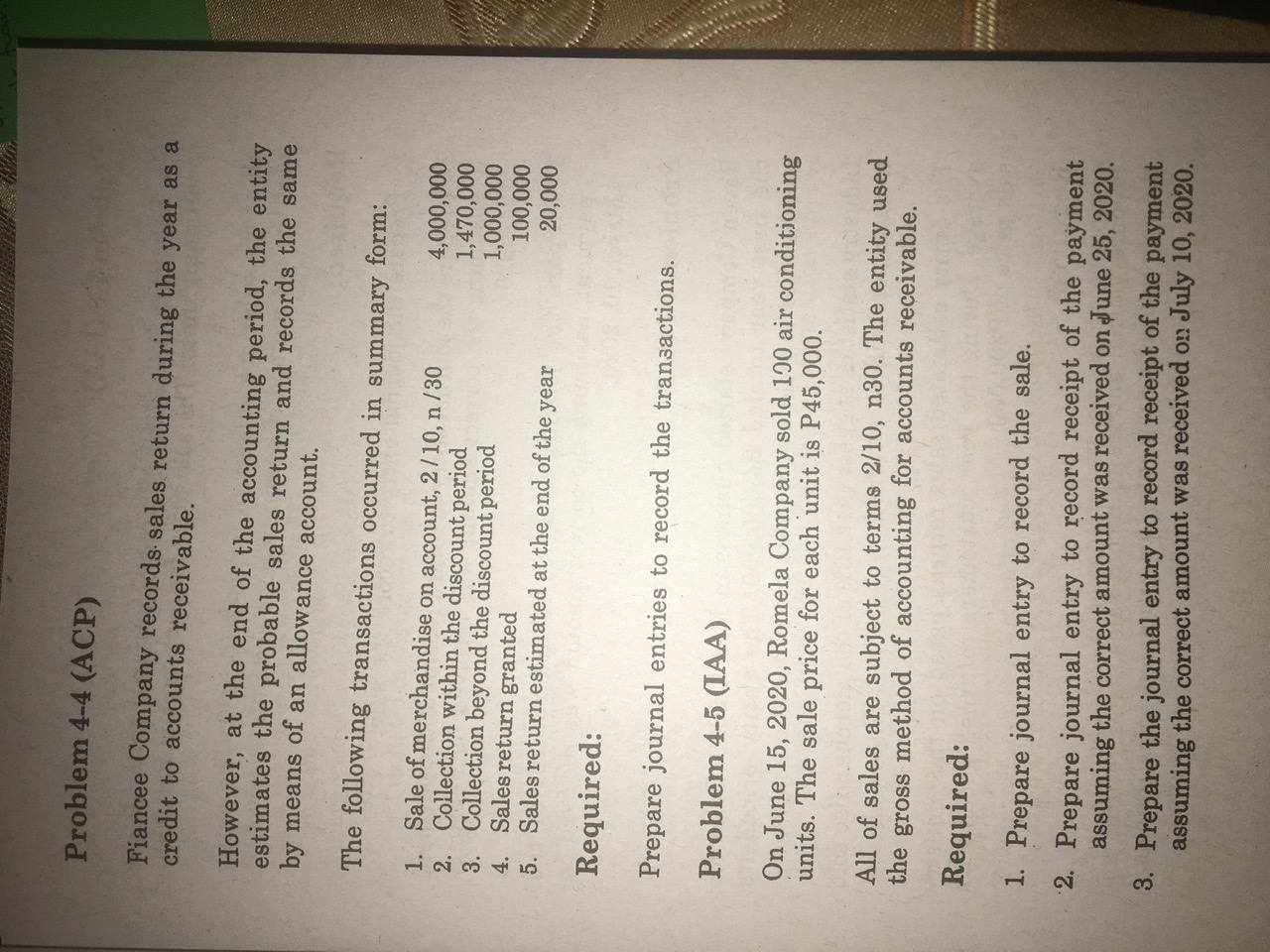

Problem 4-2 (LAA) Credible Company provided the following T-account summarizing the transactions affecting the accounts receivable for the current year: estimates the prod Accounts Receivable or means of an allo Jan. 1 balance 600,000 Collections from customers 5,300,000 The following transact Charge sales 6,000,000 Writeoff 35,000 Shareholders' Merchandise returns 40,000 . subscriptions 200,000 Allowances to customer 1. Sale of merchandise of Deposit on contract 120,000 for shipping damages 25,000 2. Collection within the di Claims against common Collections on carrier claims 40,000 &. Collection beyond the d carrier for damages 100,000 Collection on subscriptions 50,000 Sales return granted IOUs from employees 10,000 Cash advance to affiliates 100,000 5. Sales return estimated Advances to a supplier 50,000 Required: Required: Compute the correct amount of accounts receivable. Prepare journal entries . Prepare one compound entry to adjust the accounts receivable. c. Compute the amount to be presented as "trade and other receivables" under current assets Problem 4-5 (LAA) d. Indicate the classification and presentation of the other items. Problem 4-3 (ACP) On June 15, 2020, Romela units. The sale price for ea Affectionate Company sold merchandise on account for P500,000. The terms are 3/10, n /30. The related freight All of sales are subject to charge amounted to P10,000. The account was collected within the discount period. Beppi the gross method of accou Required: Prepare journal entries to record the transactions under the following freight terms: 1 Prepare journal entry to . FOB destination and freight collect 2 Prepare journal entry to FOB destination and freight prepaid FOB shipping point and freight collect assuming the correct amol 4. FOB shipping point and freight prepaid 3. Prepare the journal e 124Problem 4-4 (ACP) Fiancee Company records sales return during the year as a credit to accounts receivable. However, at the end of the accounting period, the entity estimates the probable sales return and records the same by means of an allowance account. The following transactions occurred in summary form: 1. Sale of merchandise on account, 2 / 10, n /30 4,000,000 rici co Collection within the discount period 1,470,000 Collection beyond the discount period 1,000,000 Sales return granted 100,000 5. Sales return estimated at the end of the year 20,000 Required: Prepare journal entries to record the transactions. Problem 4-5 (LAA) On June 15, 2020, Romela Company sold 190 air conditioning units. The sale price for each unit is P45,000. All of sales are subject to terms 2/10, n30. The entity used the gross method of accounting for accounts receivable. Required: 1. Prepare journal entry to record the sale. 2. Prepare journal entry to record receipt of the payment assuming the correct amount was received on June 25, 2020. 3. Prepare the journal entry to record receipt of the payment assuming the correct amount was received on July 10, 2020