Question: Please put the answer in a similar format ill be sure to thumbs up PART 1 Reconstruct the journal entry for cash receipts from customers,

Please put the answer in a similar format ill be sure to thumbs up

PART 1

- Reconstruct the journal entry for cash receipts from customers, incorporating the change in the related balance sheet account(s), if any.

- Reconstruct the journal entry for cash payments for inventory, incorporating the change in the related balance sheet account(s), if any.

- Reconstruct the journal entry for depreciation expense, incorporating the change in the related balance sheet account(s), if any.

- Reconstruct the journal entry for cash paid for operating expenses, incorporating the change in the related balance sheet account(s), if any.

- Reconstruct the journal entry for the sale of equipment at a gain, incorporating the change in the related balance sheet account(s), if any.

- Reconstruct the journal entry for income taxes expense, incorporating the change in the related balance sheet account(s), if any.

- Reconstruct the entry to record the retirement of the $32,000 note payable at its $32,000 carrying (book) value in exchange for cash.

- Reconstruct the entry for the purchase of new equipment.

- Reconstruct the entry for the issuance of common stock.

- Close all revenue and gain accounts to income summary.

- Close all expense accounts to income summary.

- Close Income Summary to Retained Earnings.

- Reconstruct the journal entry for cash dividends paid.

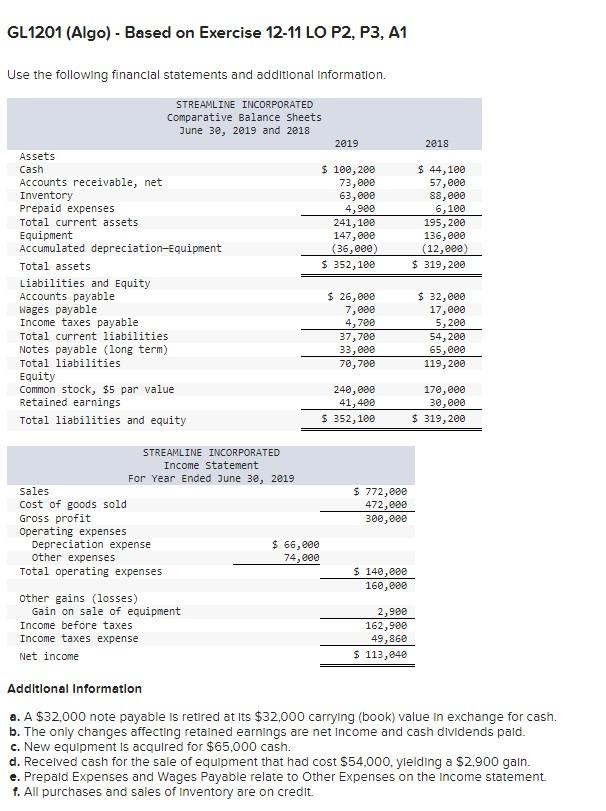

GL1201 (Algo) - Based on Exercise 12-11 LO P2, P3, A1 - Use the following financial statements and additional Information. STREAMLINE INCORPORATED Comparative Balance sheets June 30, 2019 and 2018 2019 2018 $ 100,200 73, eee 63,000 4,988 241,108 147,600 (36,000) $ 352,100 $ 44,100 57,000 88,000 6,100 195, 200 136,000 (12,000) $ 319,200 Assets Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long term) Total liabilities Equity Common stock, $5 par value Retained earnings Total liabilities and equity $ 26,000 7,888 4,700 37,788 33,680 70, 700 $ 32,000 17,000 5,200 54,200 65,000 119,200 240,00 41,400 $ 352,100 170,000 30,000 $ 319,200 STREAMLINE INCORPORATED Income Statement For Year Ended June 30, 2019 sales cost of goods sold Gross profit Operating expenses Depreciation expense $ 66, eee Other expenses 74, eee Total operating expenses $ 772,000 472,880 300,000 $ 140,000 160,880 other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense Net income 2,982 162,900 49,860 $ 113,840 Additional Information a. A $32,000 note payable is retired at its $32,000 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net Income and cash dividends pald. c. New equipment is acquired for $65,000 cash. d. Received cash for the sale of equipment that had cost $54,000, ylelding a $2,900 gain. e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement f. All purchases and sales of Inventory are on credit Note: Enter debits before credits. Account Title Debit Credit Date June 30 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts