Question: Please put the following transactions into the General Journal. Dec 1: Purchased equipment costing $15,608 by taking out a 4-month installment note with First Bank.

Please put the following transactions into the General Journal.

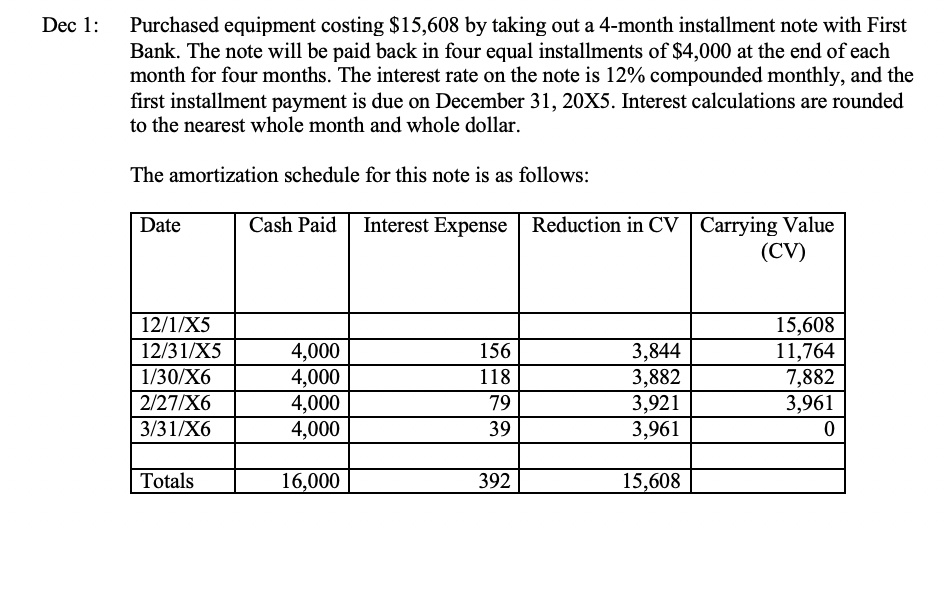

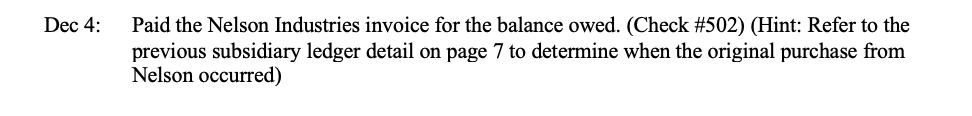

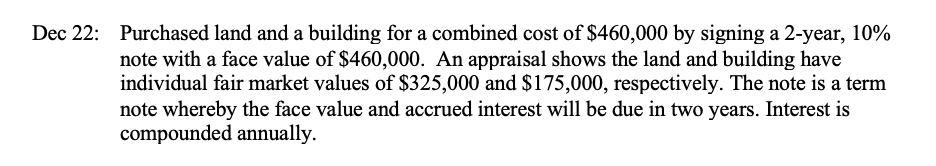

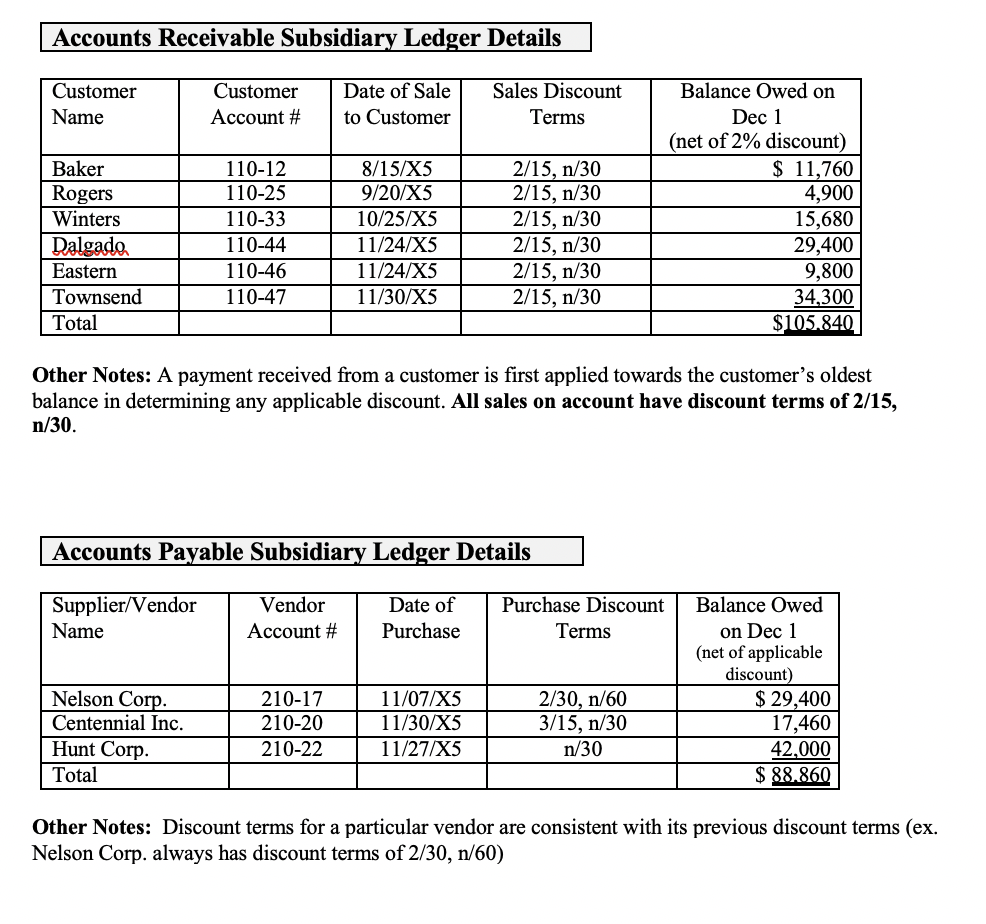

Dec 1: Purchased equipment costing $15,608 by taking out a 4-month installment note with First Bank. The note will be paid back in four equal installments of $4,000 at the end of each month for four months. The interest rate on the note is 12% compounded monthly, and the first installment payment is due on December 31, 20X5. Interest calculations are rounded to the nearest whole month and whole dollar. The amortization schedule for this note is as follows: Date Cash Paid Interest Expense Reduction in CV Carrying Value (CV) 12/1/X5 12/31/X5 1/30/X6 2/27/X6 3/31/X6 4,000 4,000 4,000 4,000 156 118 79 39 3,844 3,882 3,921 3,961 15,608 11,764 7,882 3,961 0 Totals 16,000 392 15,608 Dec 4: Paid the Nelson Industries invoice for the balance owed. (Check #502) (Hint: Refer to the previous subsidiary ledger detail on page 7 to determine when the original purchase from Nelson occurred) Dec 5: Specifically wrote off the receivable balance owed by Baker as uncollectible. Dec 7: Returned defective inventory with a gross cost of $4,000 back to Hunt Corp. Dec 14: Wilson returned an item originally purchased on Dec 12 with a gross sales price of $7,000. Dec 14: Returned inventory with a gross cost of $2,000 back to Nelson Industries. Dec 18: Bought office supplies on account for $9,000 from Staples Inc. (open a new Accounts Payable in the subsidiary ledger--Vendor # 210-30). Invoice # is OM1218. Staples Inc.'s terms are n/30. Note: Wolfpack follows the traditional approach for recording deferred expenses. Dec 19: Received the December utilities bill for the amount of $15,000. The bill will be paid in January of next year. Special note: Credit the Utilities Payable account for the balance owed. Dec 19: The annual dividend of $1.00 per share is declared for all outstanding shares. The dividend will be distributed to shareholders on January 19, 20X6. Note: 100,000 shares were outstanding before December. (Hint: To calculate the total dividend amount, take into account the treasury shares that were purchased on Dec 1) Dec 22: Purchased land and a building for a combined cost of $460,000 by signing a 2-year, 10% note with a face value of $460,000. An appraisal shows the land and building have individual fair market values of $325,000 and $175,000, respectively. The note is a term note whereby the face value and accrued interest will be due in two years. Interest is compounded annually. Accounts Receivable Subsidiary Ledger Details Customer Name Customer Account # Date of Sale to Customer Sales Discount Terms Baker Rogers Winters Dalgado Eastern Townsend Total 110-12 110-25 110-33 110-44 110-46 110-47 8/15/X5 9/20/X5 10/25/X5 11/24/X5 11/24/25 11/30/X5 2/15, n/30 2/15, n/30 2/15, n/30 2/15, n/30 2/15, n/30 2/15, n/30 Balance Owed on Dec 1 (net of 2% discount) $ 11,760 4,900 15,680 29,400 9,800 34,300 $105.840 Other Notes: A payment received from a customer is first applied towards the customer's oldest balance in determining any applicable discount. All sales on account have discount terms of 2/15, n/30. Accounts Payable Subsidiary Ledger Details Supplier/Vendor Name Vendor Account # Date of Purchase Purchase Discount Terms Nelson Corp. Centennial Inc. Hunt Corp. Total 210-17 210-20 210-22 11/07/15 11/30/X5 11/27/15 2/30, n/60 3/15, n/30 n/30 Balance Owed on Dec 1 (net of applicable discount) $ 29,400 17,460 42,000 $ 88.860 Other Notes: Discount terms for a particular vendor are consistent with its previous discount terms (ex. Nelson Corp. always has discount terms of 2/30, n/60) General Journal (GJ) Date Account Name Debit Credit A/R or A/P Subsidiary Account # (if applicable) 24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts