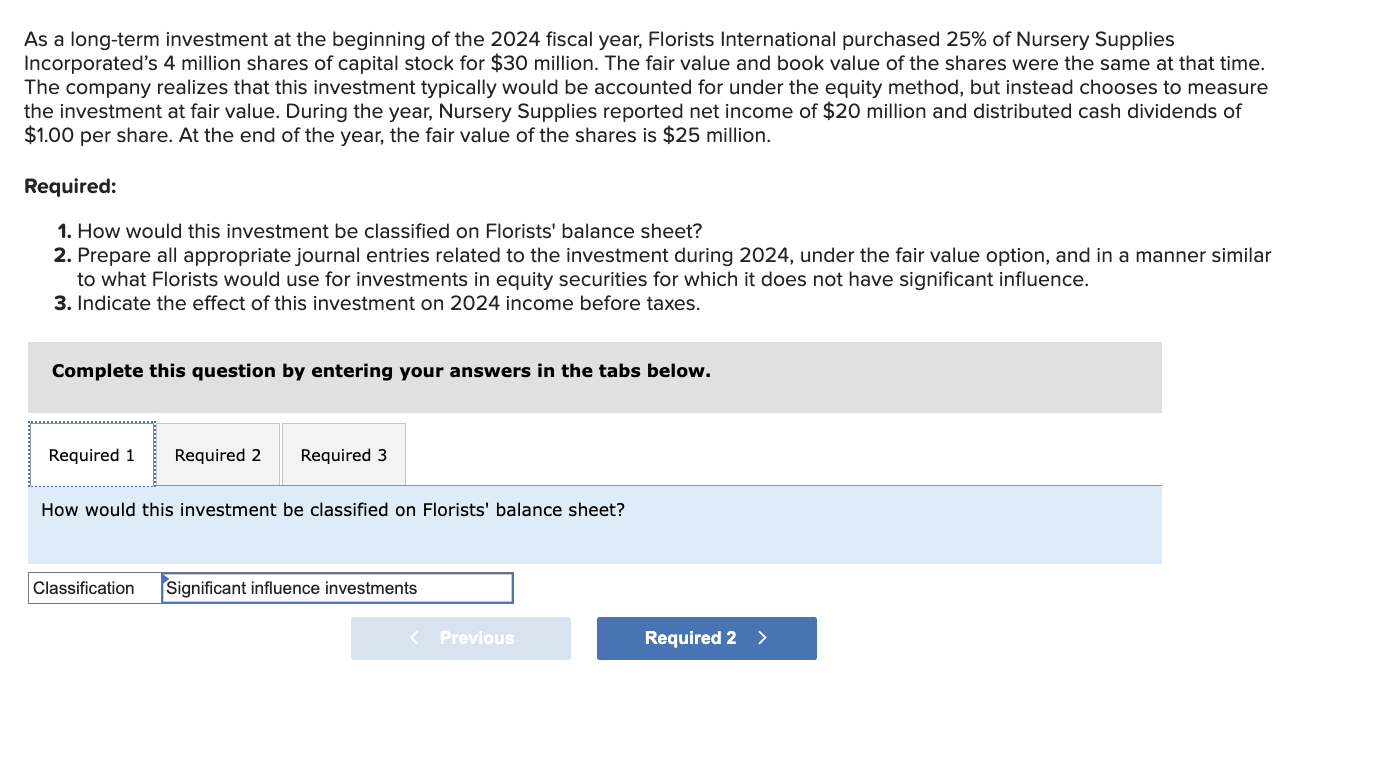

Question: please put this in a nice and easy to read table for me please and thank you! As a long - term investment at the

please put this in a nice and easy to read table for me please and thank you! As a longterm investment at the beginning of the fiscal year, Florists International purchased of Nursery Supplies

Incorporated's million shares of capital stock for $ million. The fair value and book value of the shares were the same at that time.

The company realizes that this investment typically would be accounted for under the equity method, but instead chooses to measure

the investment at fair value. During the year, Nursery Supplies reported net income of $ million and distributed cash dividends of

$ per share. At the end of the year, the fair value of the shares is $ million.

Required:

How would this investment be classified on Florists' balance sheet?

Prepare all appropriate journal entries related to the investment during under the fair value option, and in a manner similar

to what Florists would use for investments in equity securities for which it does not have significant influence.

Indicate the effect of this investment on income before taxes.

Complete this question by entering your answers in the tabs below.

How would this investment be classified on Florists' balance sheet?

Record the purchase of Nursery Supplies Incorporated

capital stock.

Record the dividends received from Nursery Supplies

Incorporated.

Record any adjusting entry needed at yearend for the

change in fair value.

View transaction list

No Transaction General Journal Debit Credit gamma Investment in equity affiliate Cash Cash Dividend revenue Loss on investments unrealized Nl Fair value adjustment

Indicate the effect of this investment on income before taxes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock