Question: Please put this into a cashflow statement!! Client Information: Your clients, Tyler and Stacey Client, are both 39 years old. Tyler earns $77,000 and Stacey

Please put this into a cashflow statement!!

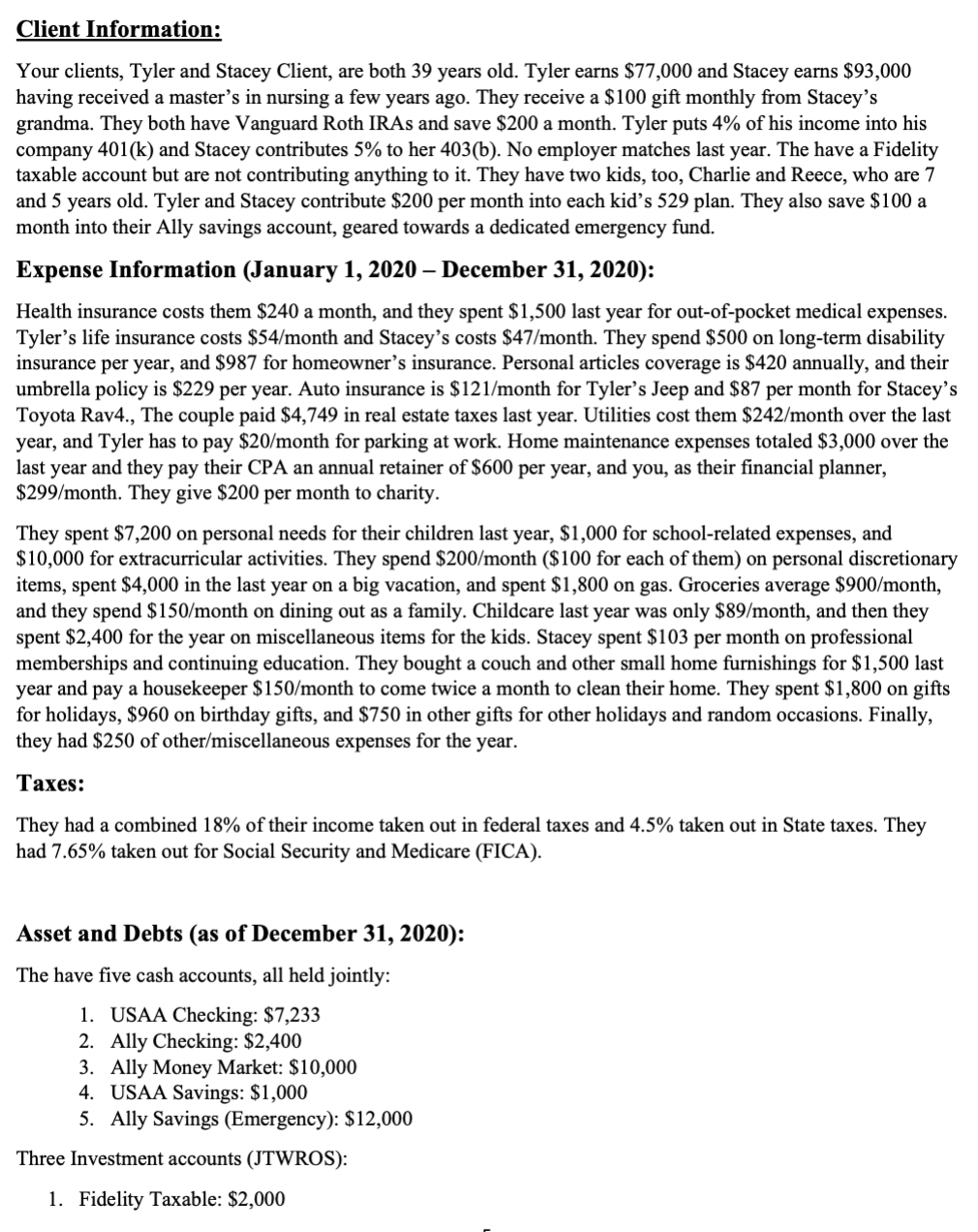

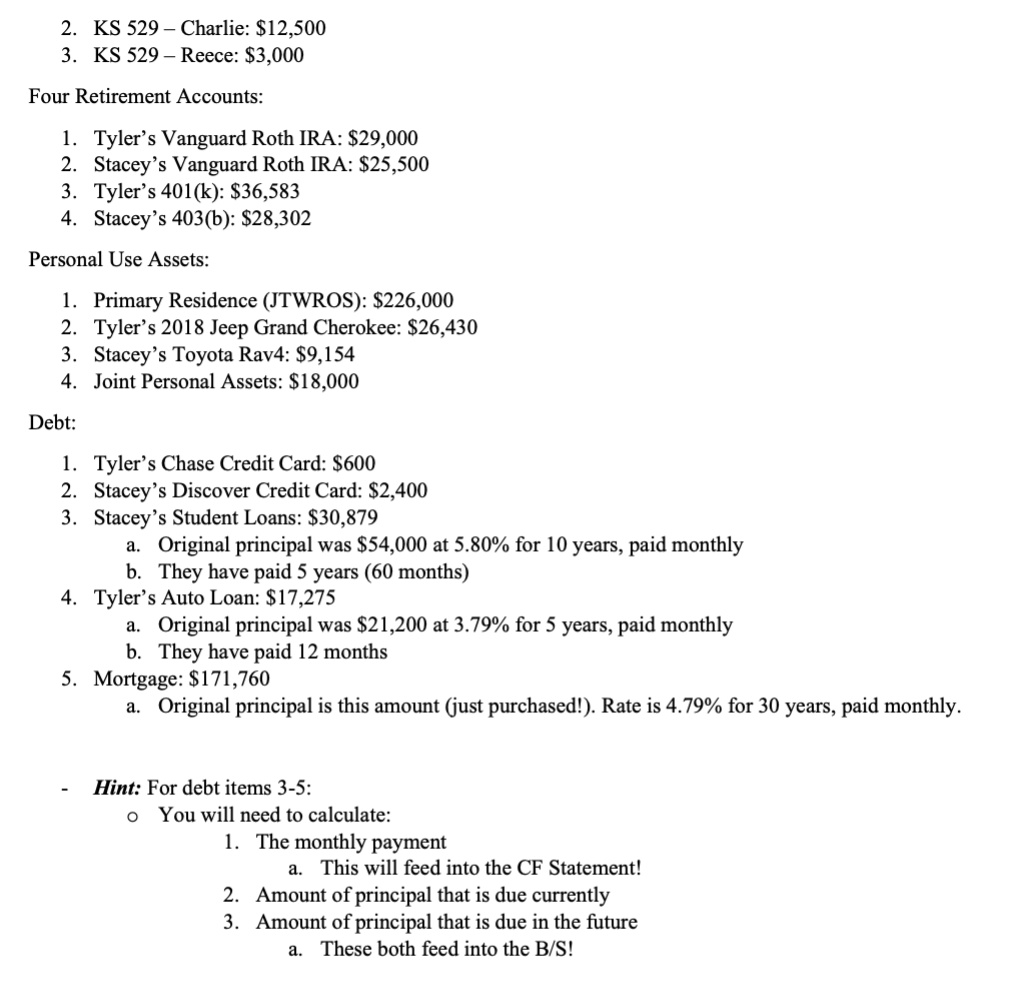

Client Information: Your clients, Tyler and Stacey Client, are both 39 years old. Tyler earns $77,000 and Stacey earns $93,000 having received a master's in nursing a few years ago. They receive a $100 gift monthly from Stacey's grandma. They both have Vanguard Roth IRAs and save $200 a month. Tyler puts 4% of his income into his company 401(k) and Stacey contributes 5% to her 403(b). No employer matches last year. The have a Fidelity taxable account but are not contributing anything to it. They have two kids, too, Charlie and Reece, who are 7 and 5 years old. Tyler and Stacey contribute $200 per month into each kid's 529 plan. They also save $100 a month into their Ally savings account, geared towards a dedicated emergency fund. Expense Information (January 1, 2020 - December 31, 2020): Health insurance costs them $240 a month, and they spent $1,500 last year for out-of-pocket medical expenses. Tyler's life insurance costs $54/ month and Stacey's costs $47 /month. They spend $500 on long-term disability insurance per year, and $987 for homeowner's insurance. Personal articles coverage is $420 annually, and their umbrella policy is $229 per year. Auto insurance is $121 /month for Tyler's Jeep and $87 per month for Stacey's Toyota Rav4., The couple paid $4,749 in real estate taxes last year. Utilities cost them $242/ month over the last year, and Tyler has to pay $20/ month for parking at work. Home maintenance expenses totaled $3,000 over the last year and they pay their CPA an annual retainer of $600 per year, and you, as their financial planner, $299/ month. They give $200 per month to charity. They spent $7,200 on personal needs for their children last year, $1,000 for school-related expenses, and $10,000 for extracurricular activities. They spend $200/ month ($100 for each of them) on personal discretionary items, spent $4,000 in the last year on a big vacation, and spent $1,800 on gas. Groceries average $900/ month, and they spend $150/ month on dining out as a family. Childcare last year was only $89/month, and then they spent $2,400 for the year on miscellaneous items for the kids. Stacey spent $103 per month on professional memberships and continuing education. They bought a couch and other small home furnishings for $1,500 last year and pay a housekeeper $150/ month to come twice a month to clean their home. They spent $1,800 on gifts for holidays, $960 on birthday gifts, and $750 in other gifts for other holidays and random occasions. Finally, they had $250 of other/miscellaneous expenses for the year. Taxes: They had a combined 18% of their income taken out in federal taxes and 4.5% taken out in State taxes. They had 7.65% taken out for Social Security and Medicare (FICA). Asset and Debts (as of December 31, 2020): The have five cash accounts, all held jointly: 1. USAA Checking: $7,233 2. Ally Checking: $2,400 3. Ally Money Market: $10,000 4. USAA Savings: $1,000 5. Ally Savings (Emergency): $12,000 Three Investment accounts (JTWROS): 1. Fidelity Taxable: $2,000 2. KS 529 -Charlie: $12,500 3. KS 529 - Reece: $3,000 Four Retirement Accounts: 1. Tyler's Vanguard Roth IRA: $29,000 2. Stacey's Vanguard Roth IRA: $25,500 3. Tyler's 401(k):$36,583 4. Stacey's 403(b): $28,302 Personal Use Assets: 1. Primary Residence (JTWROS): $226,000 2. Tyler's 2018 Jeep Grand Cherokee: $26,430 3. Stacey's Toyota Rav4: $9,154 4. Joint Personal Assets: $18,000 Debt: 1. Tyler's Chase Credit Card: $600 2. Stacey's Discover Credit Card: $2,400 3. Stacey's Student Loans: $30,879 a. Original principal was $54,000 at 5.80% for 10 years, paid monthly b. They have paid 5 years ( 60 months) 4. Tyler's Auto Loan: $17,275 a. Original principal was $21,200 at 3.79% for 5 years, paid monthly b. They have paid 12 months 5. Mortgage: $171,760 a. Original principal is this amount (just purchased!). Rate is 4.79% for 30 years, paid monthly. - Hint: For debt items 3-5: You will need to calculate: 1. The monthly payment a. This will feed into the CF Statement! 2. Amount of principal that is due currently 3. Amount of principal that is due in the future a. These both feed into the B/S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts