Question: Please put your info into the graph so it is easy to understand. ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- Janson Industries purchased a metal-working lathe for $38,000. This item will

"Please put your info into the graph so it is easy to understand.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

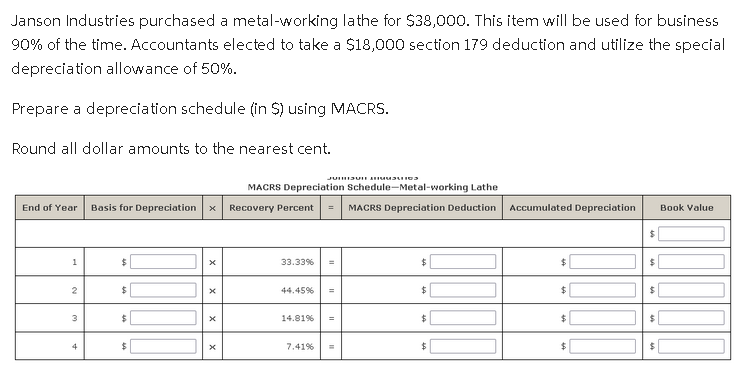

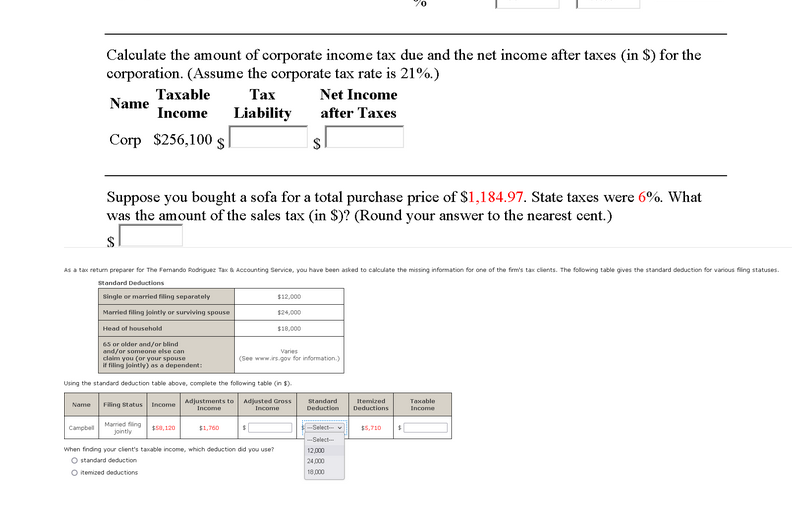

Janson Industries purchased a metal-working lathe for $38,000. This item will be used for business 90% of the time. Accountants elected to take a $18,000 section 179 deduction and utilize the special depreciation allowance of 50%. Prepare a depreciation schedule (in \$) using MACRS. Round all dollar amounts to the nearest cent. Calculate the amount of corporate income tax due and the net income after taxes (in $ ) for the corporation. (Assume the corporate tax rate is 21%.) Suppose you bought a sofa for a total purchase price of $1,184.97. State taxes were 6%. What was the amount of the sales tax (in \$)? (Round your answer to the nearest cent.) $ candaminatutions Uing the standars deduction table sbove, complete the following tatle (in 1 ). standwed desuction femized deductiond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts