Question: please question 1,2,3 BA 507 Technology and Operations Management HOMEWORK 1 DUE DATE:03/11/2021 A Marine Parts Manufacturer has some excess production capacity and wants to

please question 1,2,3

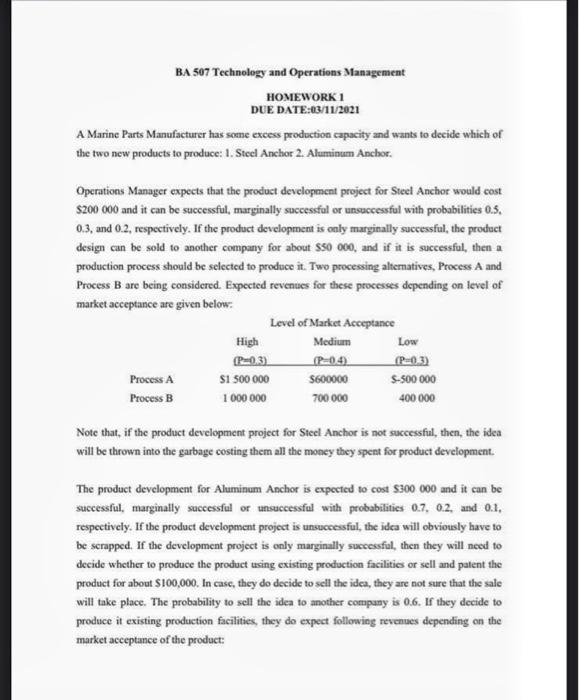

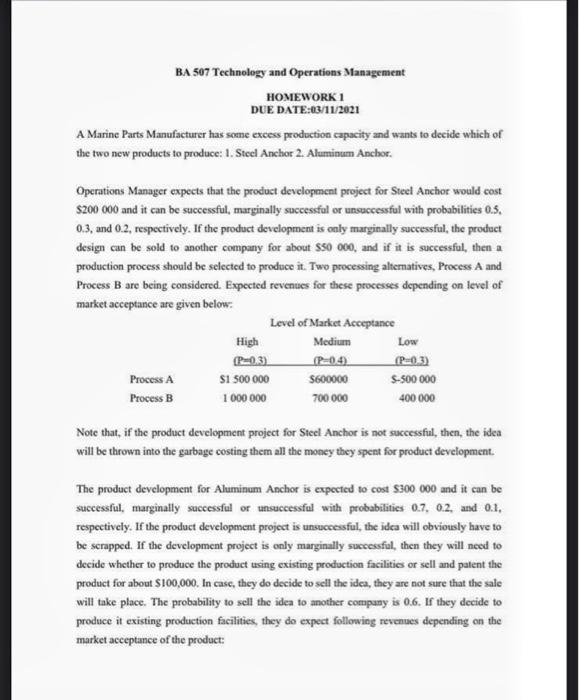

BA 507 Technology and Operations Management HOMEWORK 1 DUE DATE:03/11/2021 A Marine Parts Manufacturer has some excess production capacity and wants to decide which of the two new products to produce: 1. Steel Anchor 2. Aluminum Anchor. Operations Manager expects that the product development project for Steel Anchor would cost $200 000 and it can be successful, marginally successful or unsuccessful with probabilities 0.5. 0.3, and 0.2, respectively. If the product development is only marginally successful, the product design can be sold to another company for about S50 000, and if it is successful, then a production process should be selected to produce it. Two processing alternatives, Process A and Process B are being considered. Expected revenues for these processes depending on level of market acceptance are given below: Level of Market Acceptance High Medium P-04) (P=183) Process A S1 500 000 5600000 S-500 000 Process B 1 000 000 700000 400 000 Low Note that, if the product development project for Steel Anchor is not successful, then, the idea will be thrown into the garbage costing them all the money they spent for product development. The product development for Aluminum Anchor is expected to cost $300 000 and it can be successful, marginally successful or unsuccessful with probabilities 0.7.0.2, and 0.1. respectively. If the product development project is unsuccessful, the idea will obviously have to be scrapped. If the development project is only marginally successful, then they will need to decide whether to produce the product using existing production facilities or sell and patent the product for about $100,000. In case, they do decide to sell the idea, they are not sure that the sale will take place. The probability to sell the idea to another company is 0.6. If they decide to produce it existing production facilities, they do expect following revenues depending on the market acceptance of the product: Level of Market Acceptance Medium Low (P=0.6) S600 000 $200 000 Produce the product If the product development project for Aluminum Anchor is successful, they are first considering to spend $150 000 to modify the existing equipment, then make a decision about which process (X or Y) to use to produce it. As given below, the expected revenues from process X and Y will depend on the level of productivity of each process: Level of Productivity High Low Revenue Probability Revenue Probability Process X $800 000 0.5 $600 000 0.5 Process Y 1 100 000 0.3 400 000 0.7 1. Construct a decision tree and recommend the best decision. (80 pts) 2. What would be the range of payoffs for the recommended decision? (10 pts) 3. Which decision would you recommend if you knew that the decision maker was a risk taker? (10 pts)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock