Question: PLEASE! quick Consider a one-factor economy. Portfolio A has a beta of 1.0 on the factor and portfolio B has a beta of 2.0 on

PLEASE! quick

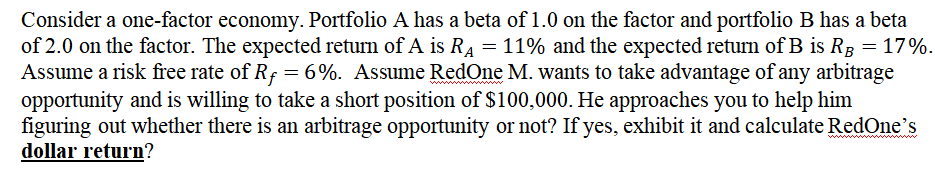

Consider a one-factor economy. Portfolio A has a beta of 1.0 on the factor and portfolio B has a beta of 2.0 on the factor. The expected return of A is RA = 11% and the expected return of B is RB = 17%. Assume a risk free rate of RF = 6%. Assume RedOne M. wants to take advantage of any arbitrage opportunity and is willing to take a short position of $100,000. He approaches you to help him figuring out whether there is an arbitrage opportunity or not? If yes, exhibit it and calculate RedOne's dollar return? Consider a one-factor economy. Portfolio A has a beta of 1.0 on the factor and portfolio B has a beta of 2.0 on the factor. The expected return of A is RA = 11% and the expected return of B is RB = 17%. Assume a risk free rate of RF = 6%. Assume RedOne M. wants to take advantage of any arbitrage opportunity and is willing to take a short position of $100,000. He approaches you to help him figuring out whether there is an arbitrage opportunity or not? If yes, exhibit it and calculate RedOne's dollar return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts