Question: please quick solve In general, the lower (less positive and more negative) the correlation between asset returns. Select one: a. the less the potential diversification

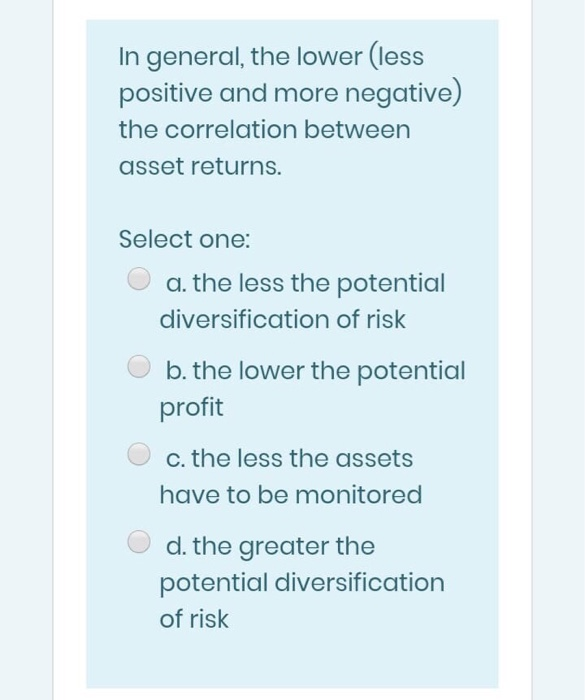

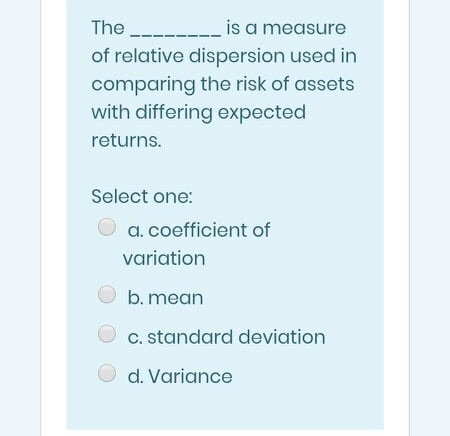

In general, the lower (less positive and more negative) the correlation between asset returns. Select one: a. the less the potential diversification of risk b. the lower the potential profit c. the less the assets have to be monitored d. the greater the potential diversification of risk The ___ is a measure of relative dispersion used in comparing the risk of assets with differing expected returns. Select one: a. coefficient of variation b.mean c. standard deviation d. Variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts