Question: please quickly assist me with this question 67% + e QUESTION 2 (20 marks; 30 minutes) McLane Ltd ('McLane') is a JSE listed company with

please quickly assist me with this question

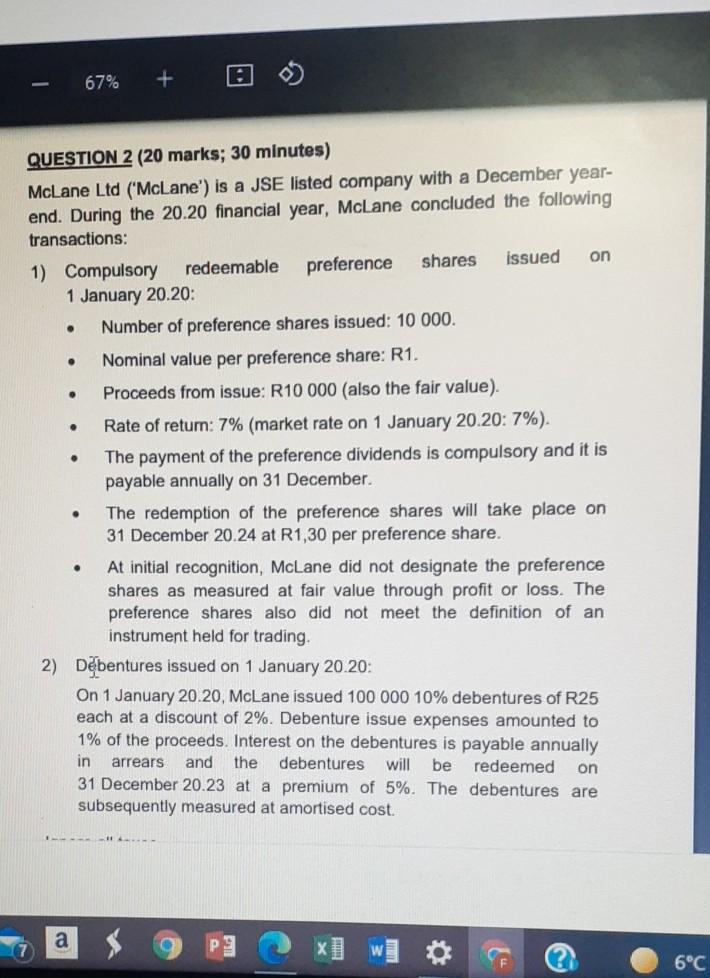

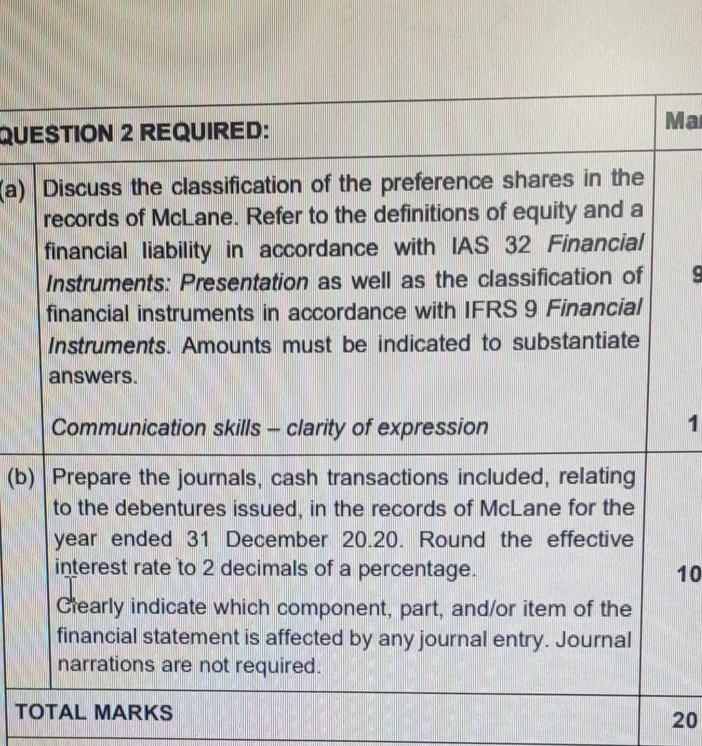

67% + e QUESTION 2 (20 marks; 30 minutes) McLane Ltd ('McLane') is a JSE listed company with a December year- end. During the 20.20 financial year, McLane concluded the following transactions: on . 1) Compulsory redeemable preference shares issued 1 January 20.20 Number of preference shares issued: 10 000. Nominal value per preference share: R1. Proceeds from issue: R10 000 (also the fair value). Rate of return: 7% (market rate on 1 January 20 20: 7%). The payment of the preference dividends is compulsory and it is payable annually on 31 December . . . . The redemption of the preference shares will take place on 31 December 20.24 at R1,30 per preference share. . At initial recognition, McLane did not designate the preference shares as measured at fair value through profit or loss. The preference shares also did not meet the definition of an instrument held for trading. 2) Debentures issued on 1 January 20 20: On 1 January 20.20. McLane issued 100 000 10% debentures of R25 each at a discount of 2%. Debenture issue expenses amounted to 1% of the proceeds. Interest on the debentures is payable annually in arrears and the debentures will be redeemed 31 December 20.23 at a premium of 5%. The debentures are subsequently measured at amortised cost. on a x] wi 6C Ma QUESTION 2 REQUIRED: a) Discuss the classification of the preference shares in the records of McLane. Refer to the definitions of equity and a financial liability in accordance with IAS 32 Financial Instruments: Presentation as well as the classification of financial instruments in accordance with IFRS 9 Financial Instruments. Amounts must be indicated to substantiate 9 answers. Communication skills clarity of expression 1 (b) Prepare the journals, cash transactions included, relating to the debentures issued, in the records of McLane for the year ended 31 December 20.20. Round the effective interest rate to 2 decimals of a percentage. Clearly indicate which component, part, and/or item of the financial statement is affected by any journal entry. Journal narrations are not required. 10 TOTAL MARKS 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts