Question: please quickly help me c. 31 Estimated that bad debts expense for the year was 2% of credit sales of $420,000 and recorded that amount

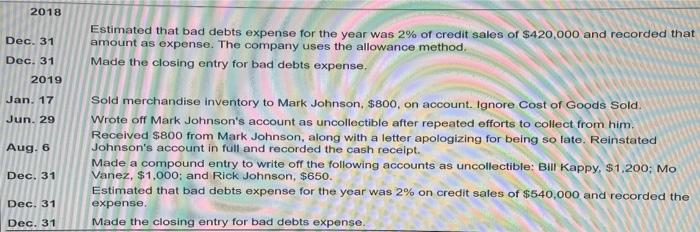

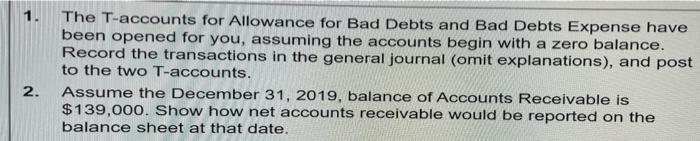

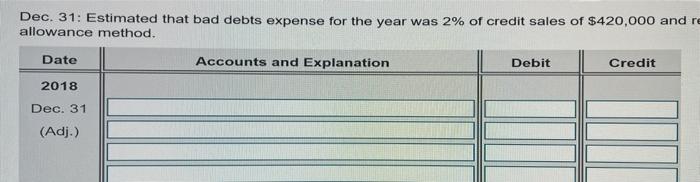

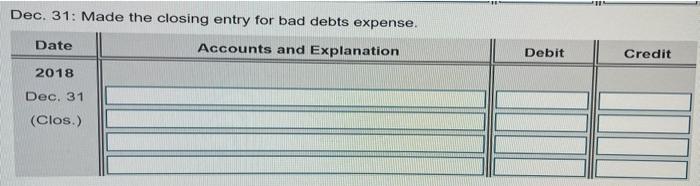

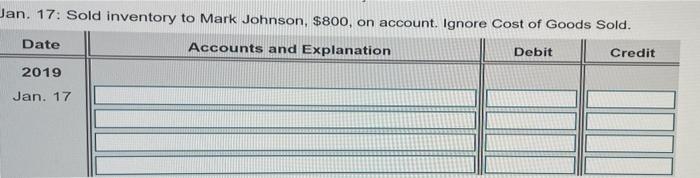

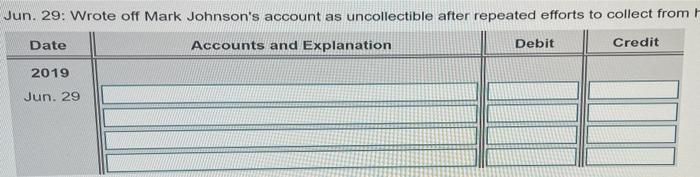

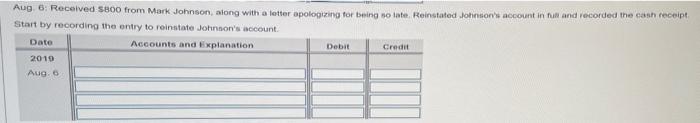

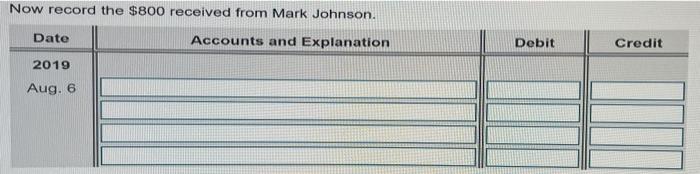

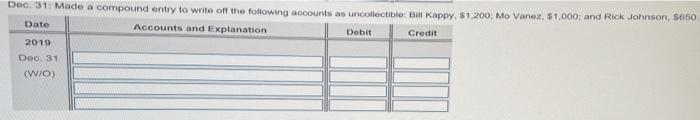

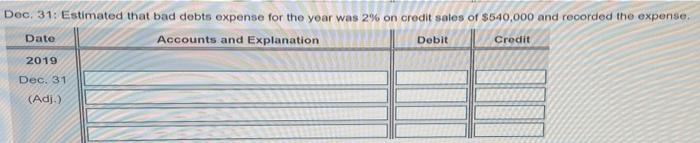

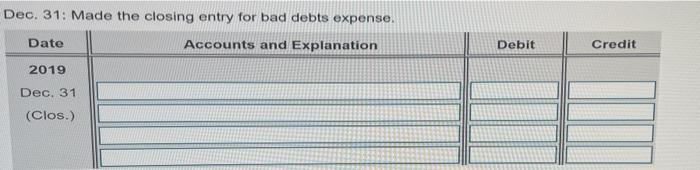

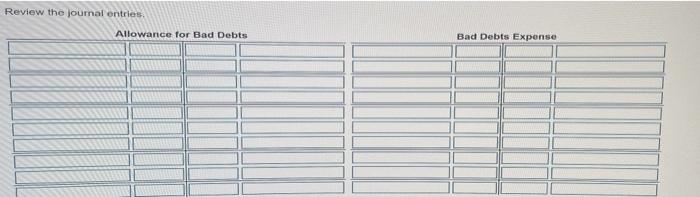

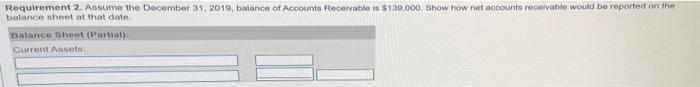

c. 31 Estimated that bad debts expense for the year was 2% of credit sales of $420,000 and recorded that amount as expense. The company uses the allowance method. c. 31 Made the closing entry for bad debts expense. 2019 17 Sold merchandise inventory to Mark Johnson, $800, on account. Ignore Cost of Goods Sold. n. 29 Wrote off Mark Johnson's account as uncollectible after repeated efforts to collect from him. Received $800 from Mark Johnson, along with a letter apologizing for being so late. Reinstated 9.6 Johnson's account in full and recorded the cash receipt. Made a compound entry to write off the following accounts as uncollectible: BIII Kappy, $1,200; Mo Vanez, \$1,000; and Rick Johnson, $650. Estimated that bad debts expense for the year was 2% on credit sales of $540,000 and recorded the expense. c. 31 Made the closing entry for bad debts expense. 1. The T-accounts for Allowance for Bad Debts and Bad Debts Expense have been opened for you, assuming the accounts begin with a zero balance. Record the transactions in the general journal (omit explanations), and post to the two T-accounts. 2. Assume the December 31,2019 , balance of Accounts Receivable is $139,000. Show how net accounts receivable would be reported on the balance sheet at that date. Dec. 31: Estimated that bad debts expense for the year was 2% of credit sales of $420,000 and allowance method. Dec. 31: Made the closing entry for bad debts expense. an. 17: Sold inventory to Mark Johnson, $800, on account. Ignore Cost of Goods Sold. Jun. 29: Wrote off Mark Johnson's account as uncollectible after repeated efforts to collect from Aug. 6: Recelved sBoo from Mark Johnson, along with a letter opologizing tor being so late. Reinstated johinion' account in full and recorded the eash receipt. Start by recording the entry to reinatate Johnsoris account. Now record the $800 received from Mark Johnson. Dee. 31: Made a compound entry to write off the folfowing aocounts as uncollectible: Bill Kappy, $1,200; Mo Vanez, s1,000; and Rick Johnson, s650 Dec. 31: Estimated that bad debts expense for the year was 2% on credit sales of $540,000 and recorded the expense. \begin{tabular}{|c||c||c||c|} \hline Date & Accounts and Explanation & Debit & Credit \\ \hline 2019 & & & \\ \hline Dec. 31 & & & \\ \hline (Adj.) & & & \\ \hline \end{tabular} Dec. 31: Made the closing entry for bad debts expense. Review the journal ontries. beatanoe sheet at that date Balaree tstueet (Paruab): Curramt Asepto

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts