Question: Please read and complete case questions. Thanks! *develop an analysis* In January 2019, Brandon Wilson, procurement specialist for Global Technology Corporation, Jessup, Georgia, and three

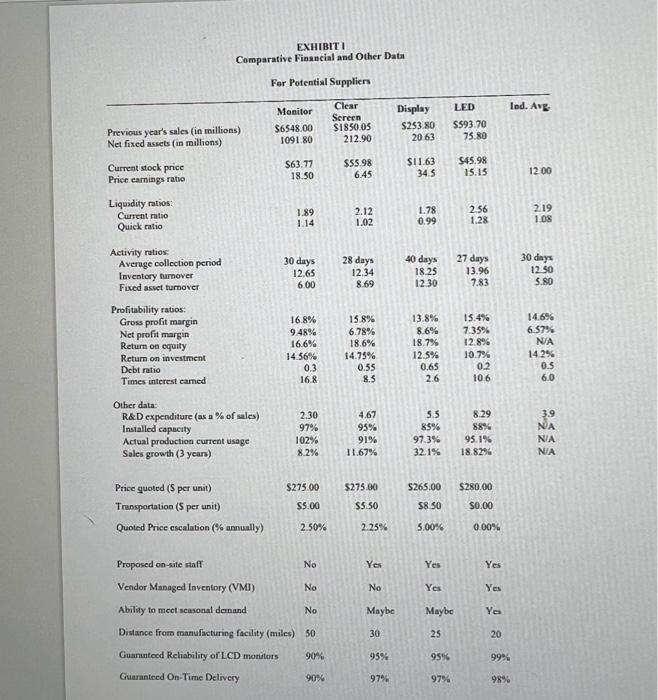

In January 2019, Brandon Wilson, procurement specialist for Global Technology Corporation, Jessup, Georgia, and three teammates were responsible for recommending which of four (4) potential suppliers should roceive a purchase order for the next year's requirement of 12 -inch touch-sereen color LCD pancls/monitors. The panels/monitors were expected to be of exeeptional quality, with extra high resolution. Globsl Technology Corporation was recognized as a leading manufacturer of several lines of handheld tablet style computers. The touch-sereen capability enables a wser to work with the computer without a mouse or keyboard. The latest in this line of produets was the PT 1000, a high-quality computer with a 10 -gigahertz processor, 500 megabyte hard-drive, and an optional removable DVD writer. The PT 1000 was designed for industry use in harsh climates and operating environments. In its nearly three years of operation, Global Technology Corporation had grown from a single product manufacturer with annual sales of around $250,000 to a melti-product $5 billion global firm. The company has always had a reputation for highequality. Funding has never been compromised where research and development is concerned especially with qualified suppliers. Global Technology Corporation intends to buy the touch-screen panels/monitors from one of the four potential suppliers. It estimates that the demand for next year would be 1.0 million monitors. Forecasts indicated that this demand was expected to grow at an annual rate of 10 pereent over the next three years. In order to maintain a uniform quality, the company policy was to use a single source of supply, if possible, to ensure quality and assurance of delivery. In deternining the supplier for the touch-sereen panelvmonitors, Brandon was assisted by the following co-workers, who brought a varied line of expertise to the sourcing team: - Courtncy MeCaffrey, the senior engineer, had been with the company for fourteen years and currently was its R\&D chief whom he believes is critical. She held an engineering degree from a Midwest university and an M.B.A. from the University of San Diego. - Jordon Willians, financial analyst, had recently joined Global Technology Corporation after moving from Los Angeles, where he worked for three years with Pasadena Financial Corporation. He held an M.B.A. from UCLA. - Tyra Smith, quality assurance, had been with the company for eight years. She had an engineering degree from MIT and had a reputation for being a very tough penon when quality was in question. Quality must be number one according to Tyre. The responsibilities of the team included: 1. Identifying potential suppliers. 2. Preparing a bricf comparative statement of the key suppliers' financial and operational metries plus industry metrics. 3. Developing a brief analysis of each potential supplicr. 4. Recommending the supplier with whom the order should be placed. This recommendation was to be made to a senior executive corporate-level review board (CEO COO After a preliminary review, incloding visits to all potential suppliers and a detailed review of their facilities, equipment, management systems, and supply departments, the team had narrowed the list of potential suppliers to four suppliers/manufacturers: 1. Mega Monitor Corporation, the largest manufachurer of LCD pancls under consideration, with annual sales of about $6.5 billion, had been in existence since 1984 and was the industry price leader. Recently management changed policy that the comeany would not be interested in any order of less than $500 million per annum. This decision was made after competitors had put in a bid for the Global Technology Corporation contract. Mega Monitor's proposed LCD unit price is $275 per unit plus $5.00 per unit for transportation. The proposed LCD base unit price will escalate 2.5% annusilly. 2. LED Manufacturing had recently entered the market with a new range of touch-sereen panels/monitors. In its short life of four years, LED Manufacturing had cstablished a reputation for quality and innovation. LED Manufacturing maintained that its success was largely based on heavy. RRD expenditures. LED quoted a LCD price of $280 per unit which includes transportation. The proposed LCD base unit price will remain the same annually over the life of the coatract. 3. Display Industries, the smallest of the four potential suppliers, looked attractive since it quoted an aggressive LCD unit price of $265 plus $8.50 per unit for transportation, which was about 4 pereent lower than Mega Monitor or LED and about 6 pereent below that of Clear Sereen Corporation. If selected, Display Industrics would devote almost 100% of its production capacity to the Global Technology Corporation contrnct. Industry experts viewed the company as one of the most aggressive new corporations in the industry after its first year in business but are watching its sustainability. The proposed LCD base unit price will escalate 5.0% annually. 4. Clear Screen Corporation was a large and highly renowned manufacturer of computer equipment, including LCD panelsimonitors. With sales of nearly $2 billion, more than half of which were through the sale of menitors, the firm was the second largeat of its kind in the area. Its LCD unit price is $275 plus $5.50 per unit for transportation. The proposed LCD base unit price will cicalate 2.25% annually. Since the estimated contract was for approximately $275 million the 1"t year and over $900 million at the end of the three-ycar term, Brandon was aware of the critical nature of the decision over the next three yean. He had to present to the team's recommendation within a week. Case Questions: 1. Analyze the financial, non-financial and operational data provided in Exhibit I for each of the four potential suppliers. What are the financial, non-financial and openting metrics indicating about each supplirr? (Compare the figures between suppliers and with industry averages where necessary.) 2. On the basis of your analysis of the information contained in Exhibit 1, which potential supplier(s) looks most attractive? Why? Explain the rationale for aclecting the most attractive supplierf) EXHIBIT Comparative Financial and Other Data For Potential Supplicrs Activity mies: Average collection period Inventory tamover Fixed asvet tumover 30days12.656.0028days12.348.6940days18.25123027days13.967.8330days12.505.80 Profitability ratios: Gross profit margin Net profit margin Return on equity Return on investment Debt ratio Times interest eamed 16.8%9.48%16.6%14.56%0.316.815.8%6.78%18.6%14.75%0.558.513.8%8.6%18.7%12.5%0.652.615.4%7.35%12.8%10.7%0.210.614.6%6.57%N/A14.2%0.56.0 Other data: R&Dexpenditure(asa%ofales)InstalledcapacityActualprodoctioncurrentusageSalesgrowth(3years)2.3097%102%8.2%4.6795%91%11.67%5.585%97.3%32.1%8.2988%95.1%618.82%63.9NN/AN/A \begin{tabular}{lrrrrr} Price quoted (\$ per unit) & $275.00 & $275.00 & $265.00 & $280.00 \\ \hline Trmspartation (\$ per unit) & $5.00 & $5.50 & $8.50 & $0.00 \\ \hline Quoted Price escalation ($ annually) & 2.50% & 2.25% & 5.00% & 0.00% \end{tabular} Proposed on-site staff No Yes Yes Yes Vendor Managed Inventory (VMI) No No No Yes Yes Ability to mect seasonal dernand No Naybe Maybe Yes \begin{tabular}{|l|l|l|l|l} Distance from manufacturing facility (miles) & 50 & 30 & 25 & 20 \end{tabular} Guaranteed On-Time Delivery 90897%97%98%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts