Question: Please read below Case Study: Value in Capitation for Hospitalists?Answer the following questions in depth:1. What are the advantages & disadvantages of this offer?2. What

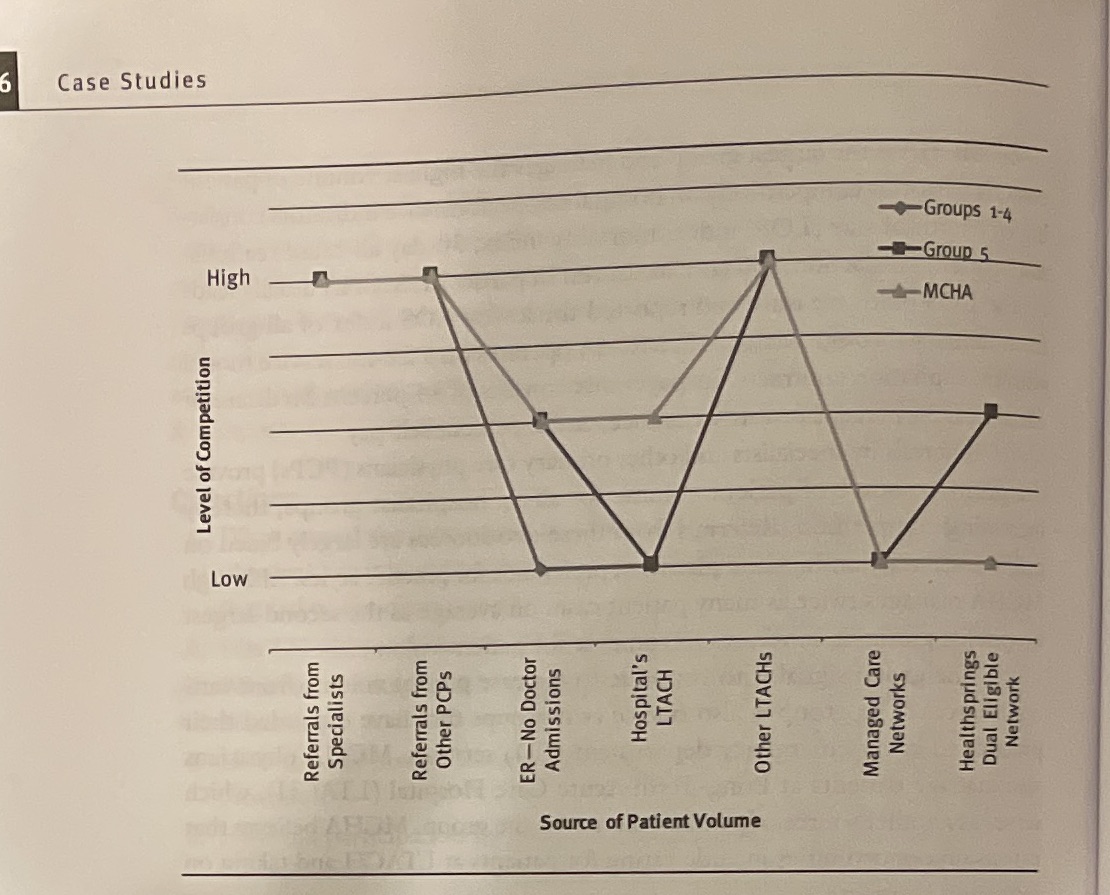

Please read below Case Study: Value in Capitation for Hospitalists?Answer the following questions in depth:1. What are the advantages & disadvantages of this offer?2. What are the specific risks MCHA will take under capitation?3. What could it do or negotiate to modify the risks?4. What would be MCHA's marginal cost & opportunity costs of this proposal?5. What other information would you want from Healthsprings?6. Given the information you have, what would you recommend to the group? A business opportunity arose for a hospitalist physician practice (MCHA) to partner with an insurance payer (Healthsprings) to manage the insurance company's dual-eligible patients admitted to the hospital where it currently treats patients. Healthsprings currently has a contract with a competing hospitalist physician group but is dissatisfied with its performance. This partnership would position MCHA to manage this patient group at the hospital exclusively. Although an exciting option, partners have questioned whether this capitation contract with Healthsprings will add value for the group of hospitalists. MCHA is a 20-physician hospitalist group practicing at a large, prestigious, teaching hospital in the Southwest with just under 900 beds. The hospital recently transitioned to a closed panel for hospital medicine physicians, which gave hospitalist groups exclusive care for all medicine patients. Currently, the hospital has contracted with six hospitalist groups that manage approximately 1,300 patient cases monthly. MCHA is the largest group and manages the highest volume of patient cases. It performs competitively on hospital key performance indicators consisting of length of stay morality, (LOS) index, morality index , 30-day all-cause dismission, patient satisfaction, and core measures. In particular, MCHA usually leads on the LOS index measure and reported the lowest LOS index of all groups from January through May 2015. ACHA operates on a fee for service model with no capitation contracts. Its payer mix consists of 44% Medicare or Medicaid, 54% private insurance, and 2% self-pay patients. Referrals by specialists and other primary care physicians (PCPs) provide the primary source of patient volume for all six hospitalist groups, thereby increasing competition. Referrals from these two sources are largely based on professional relationships and physician preference for practice styles. Although MCHA manages twice as many patient cases on average as the second-largest hospitalist group, it continues to compete for patient volume. The group's goal is to continue to increase patient volume from various sources. The group is also one of two groups that have expanded their practice to cover emergency department (ED) services. MCHA physicians also manage patients as Long-Term Acute Care Hospitals (LTACH), which serves as another source of patient volume for the group. MCHA believes that expansion opportunities include caring for their patients at LTACH and taking on capitation contracts. To understand more MCHA's director created the following figure, which displays sources of patient volume as compared to level of competition among the six hospitalist groups. The strategy canvas illustrates three hospitalist physician groupings. Four hospitalist practices (groups 1-4) together represent one category because they demonstrate the same patient volume characteristics. Group 5 constitutes the second category because it currently has the dual-eligible capitation contract with Healthsprings, and MCHA is the third category. Only group 5 and MCHA manage the ED's "no-doctor" admissions. Admitted to the hospital from the ED, these patients either do not have a PCP who has hospital privileges, have a doctor who does not want to make rounds at the hospital, or simply do not have a PCP. The hospital exclusively approached MCHA to provide patient care at the LTACH located on the west side of the city. This exclusive partnership has benefited both parties with more efficient care for the hospital and greater billings for MCHA. Although managed care and capitation payments have not yet taken hold in its metropolitan area, MCHA wants to look beyond the traditional referral sources to augment its patient volume. Because few other providers currently have managed care contracts, the business opportunity with Healthsprings provides MCHA an entry to a potential first-mover advantage. MCHA believes that with this contract it could capture another immediate source of patient volume and position itself for a future in which capitation becomes the norm. The capitation contract with health springs would also allow MCA to manage the dual eligible patient population exclusively. Given the group's ability provide quality patient care while managing LOS, the contract could yield a net profit depending on the negotiated reimbursement amount per patient case and number of patients expected from this specific payer. The additional costs could be marginal unless Healthsprings were to increase its high patient volume dramatically - given MCA current physicians and exciting capacity, it would not need to add physicians initially. While MCA feels it needs new sources of patient volume, the profitability from this new patient base remains uncertain. Medicare patients, on average, have more comorbidities and require a higher level of medical care, and they formed the majority of Healthsprings patients. Helthsprings also tends to transfer its patients form community hospitals to the teaching hospital at which MCHA practices. These patients transfer translate to Healthsprings' enrollment of sicker patients who require more specialized medical services and often prolonged treatment in the intensive care unit. As a result, Healthsprings' patients have longer LOS. Initially, the insurance company offered a capitation contract of five hundred and fifty dollars per patient per admission for an anticipated 15 patients per month period health springs also would require MCHA physicians to meet with the Healthspring's case managers twice a week. This patient volume would constitute only a small percentage of MCHA's total volume, but the longer LOS and additional meetings would result in more work per patient for MCHA physicians. The group was discussing the positives and negatives of this possible arrangement. The members did not know whether Healthsprings would provide a larger patient volume or an increase in their capitated amount. Please refer to the 6 questions listed above!

6 Case Studies Level of Competition High Low Referrals from Specialists Referrals from Other PCPs ER-No Doctor Admissions Hospital's Source of Patient Volume LTACH Other LTACHs Managed Care Networks MCHA Group 5 Groups 1-4 Healthsprings Dual Eligible Network

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts