Question: Please read both but only solve the modified problem!!! Also, include a graph comparing the accounts. (10) Mr. Valdez has $10,000 to invest at time

Please read both but only solve the modified problem!!! Also, include a graph comparing the accounts.

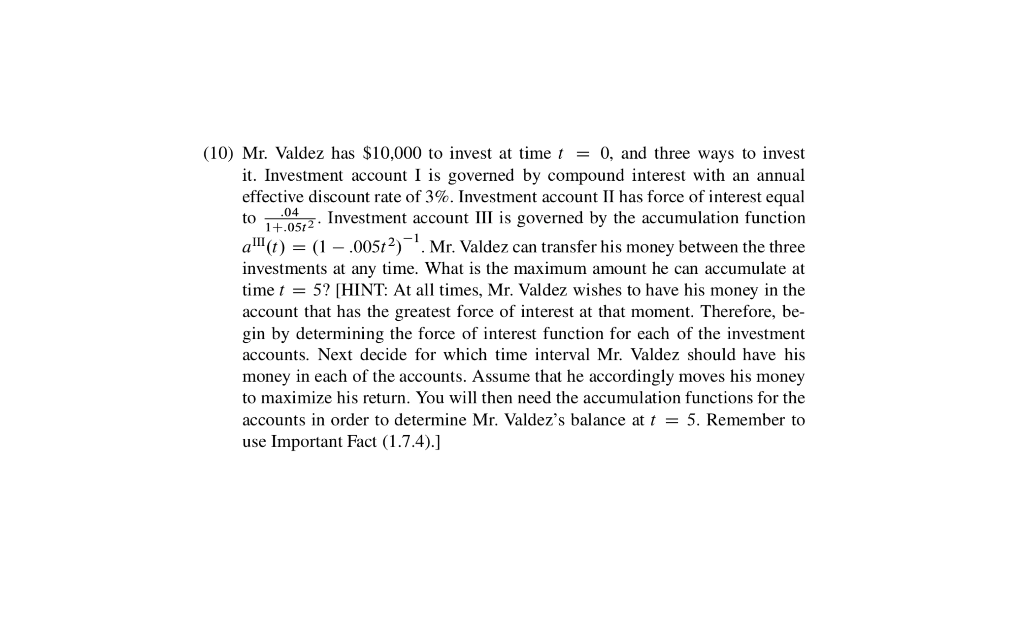

(10) Mr. Valdez has $10,000 to invest at time t = 0, and three ways to invest it. Investment account I is governed by compound interest with an annual effective discount rate of 3%. Investment account II has force of interest equal to .04 1+0512. Investment account III is governed by the accumulation function q"(t) = (1 - 00512)-7. Mr. Valdez can transfer his money between the three investments at any time. What is the maximum amount he can accumulate at time t = 5? [HINT: At all times, Mr. Valdez wishes to have his money in the account that has the greatest force of interest at that moment. Therefore, be- gin by determining the force of interest function for each of the investment accounts. Next decide for which time interval Mr. Valdez should have his money in each of the accounts. Assume that he accordingly moves his money to maximize his return. You will then need the accumulation functions for the accounts in order to determine Mr. Valdez's balance at t = 5. Remember to use Important Fact (1.7.4).] *Modified version of 1.12 #10 The original problem asks you to determine the maximum amount Mr. Valdez can accumulate for t=5. Instead, just describe how Mr. Valdez should invest his money to maximize his account value at t=5 by stating exactly which account he should keep his money in for each time interval. Since Mr. Valdez is investing money, he would desire the highest interest rate and hence the highest force of interest at any given time. On the other hand, if Mr. Valdez were to borrow money, he would desire the lowest interest rate at any given time. The problem can be solved as originally written, but that would make your solution fairly long. Even with this modification, it's still long, but much shorter than as originally stated.) (10) Mr. Valdez has $10,000 to invest at time t = 0, and three ways to invest it. Investment account I is governed by compound interest with an annual effective discount rate of 3%. Investment account II has force of interest equal to .04 1+0512. Investment account III is governed by the accumulation function q"(t) = (1 - 00512)-7. Mr. Valdez can transfer his money between the three investments at any time. What is the maximum amount he can accumulate at time t = 5? [HINT: At all times, Mr. Valdez wishes to have his money in the account that has the greatest force of interest at that moment. Therefore, be- gin by determining the force of interest function for each of the investment accounts. Next decide for which time interval Mr. Valdez should have his money in each of the accounts. Assume that he accordingly moves his money to maximize his return. You will then need the accumulation functions for the accounts in order to determine Mr. Valdez's balance at t = 5. Remember to use Important Fact (1.7.4).] *Modified version of 1.12 #10 The original problem asks you to determine the maximum amount Mr. Valdez can accumulate for t=5. Instead, just describe how Mr. Valdez should invest his money to maximize his account value at t=5 by stating exactly which account he should keep his money in for each time interval. Since Mr. Valdez is investing money, he would desire the highest interest rate and hence the highest force of interest at any given time. On the other hand, if Mr. Valdez were to borrow money, he would desire the lowest interest rate at any given time. The problem can be solved as originally written, but that would make your solution fairly long. Even with this modification, it's still long, but much shorter than as originally stated.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts