Question: please read carefully show work if needed June Mayfair Co. completed the following transactions and uses a perpetual inventory system. 4 Sold $500 of merchandise

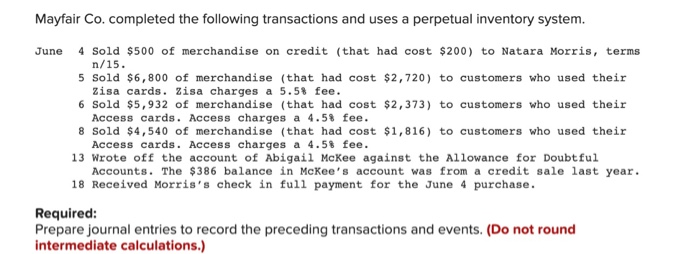

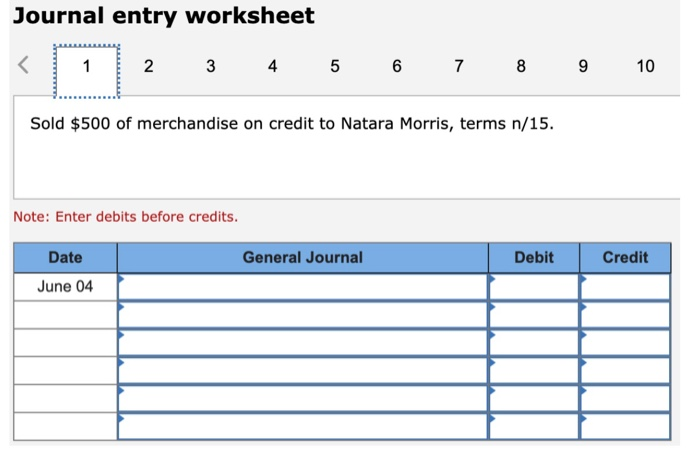

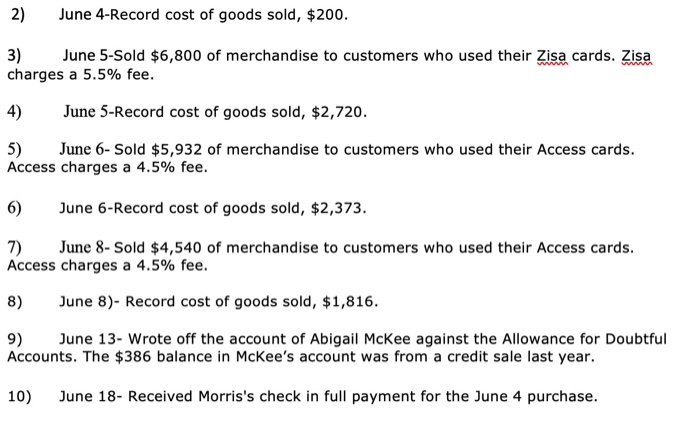

June Mayfair Co. completed the following transactions and uses a perpetual inventory system. 4 Sold $500 of merchandise on credit (that had cost $200) to Natara Morris, terms n/15. 5 Sold $6,800 of merchandise (that had cost $2,720) to customers who used their Zisa cards. Zisa charges a 5.5% fee. 6 Sold $5,932 of merchandise (that had cost $2,373) to customers who used their Access cards. Access charges a 4.5% fee. 8 Sold $4,540 of merchandise (that had cost $1,816) to customers who used their Access cards. Access charges a 4.58 fee. 13 Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $386 balance in McKee's account was from a credit sale last year. 18 Received Morris's check in full payment for the June 4 purchase. Required: Prepare journal entries to record the preceding transactions and events. (Do not round intermediate calculations.) Journal entry worksheet 1 2 3 4 5 6 7 8 9 10 Sold $500 of merchandise on credit to Natara Morris, terms n/15. Note: Enter debits before credits. General Journal Debit Credit Date June 04 2) June 4-Record cost of goods sold, $200. 3) June 5-Sold $6,800 of merchandise to customers who used their Zisa cards. Zisa charges a 5.5% fee. 4) June 5-Record cost of goods sold, $2,720. 5) June 6- Sold $5,932 of merchandise to customers who used their Access cards. Access charges a 4.5% fee. 6) June 6-Record cost of goods sold, $2,373. 7) June 8- Sold $4,540 of merchandise to customers who used their Access cards. Access charges a 4.5% fee. 8) June 8)- Record cost of goods sold, $1,816. 9) June 13- Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $386 balance in Mckee's account was from a credit sale last year. 10) June 18- Received Morris's check in full payment for the June 4 purchase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts