Question: Please read case study. Assignment questions are as follows: 1. Critically analyze the strategic position of Kunapipi Gardens. 2. What are the pros and cons

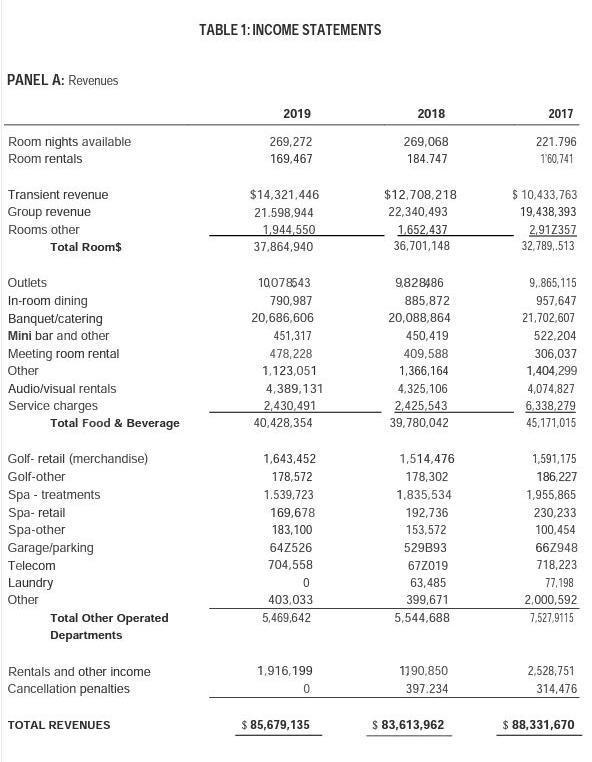

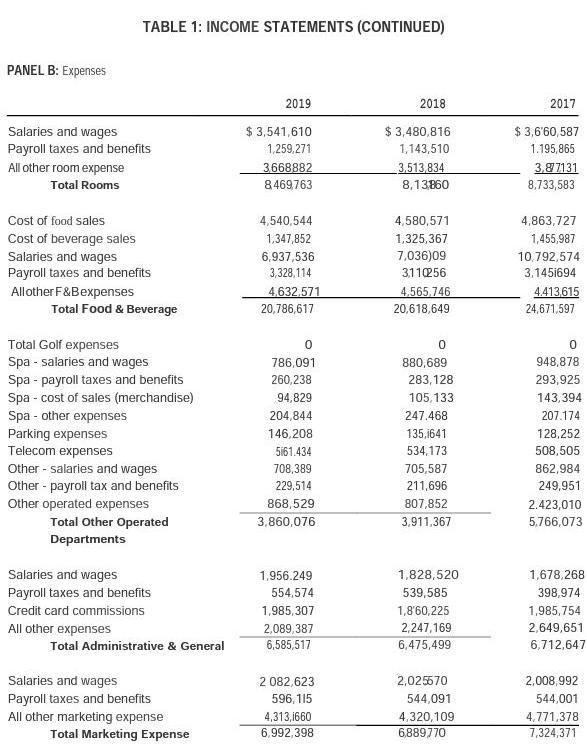

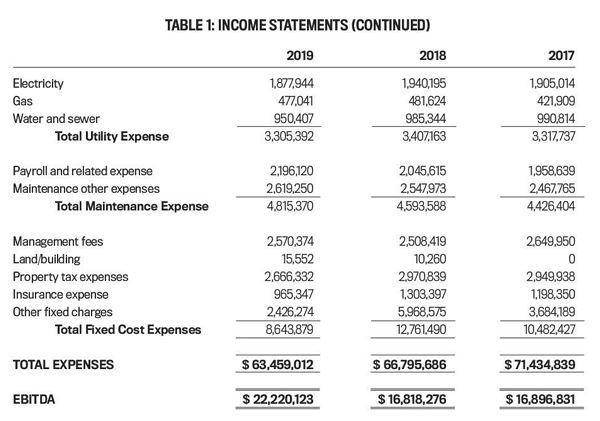

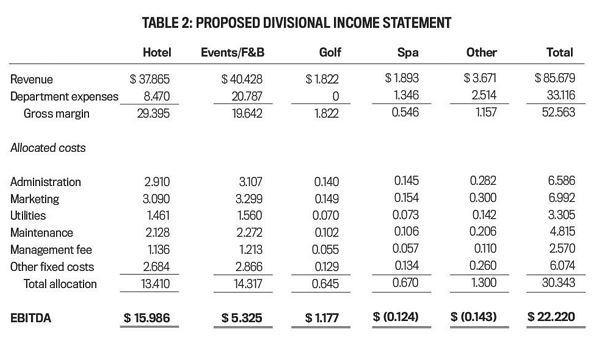

Please read case study. Assignment questions are as follows: 1. Critically analyze the strategic position of Kunapipi Gardens. 2. What are the pros and cons of the current system (income statement) described in Table 1? 3. To what extent does the system in Table 2 solve these issues or create new problems? 4. Based on your analysis so far, please suggest an "ideal" performance measurement system. Feel free to make appropriate and reasonable assumptions and to discuss alternative designs. No additional information is available.

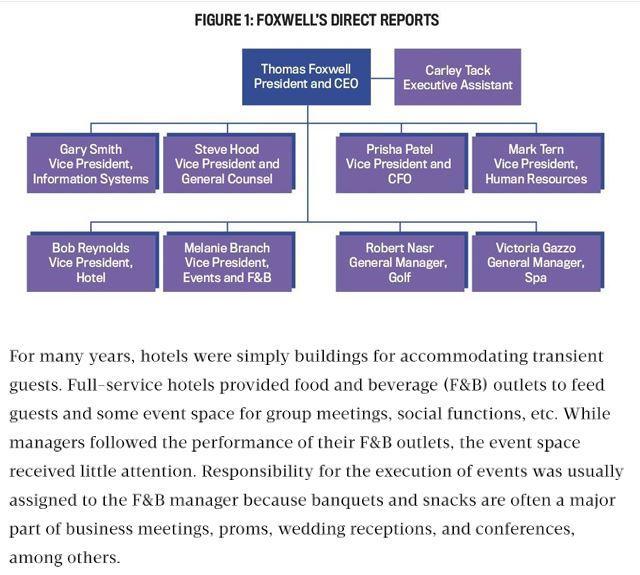

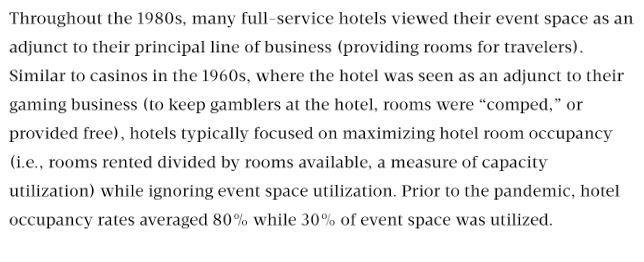

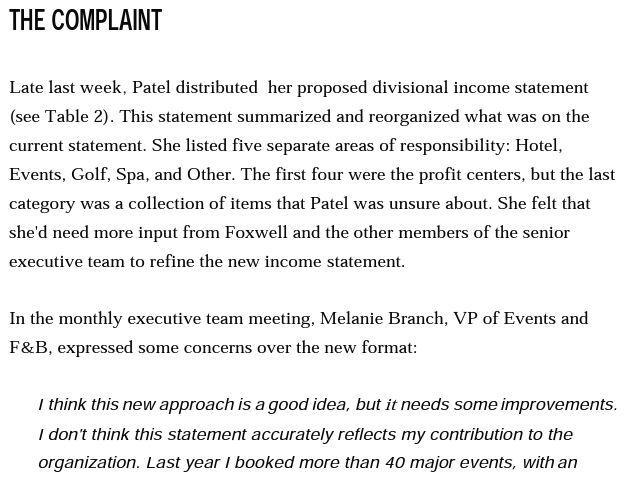

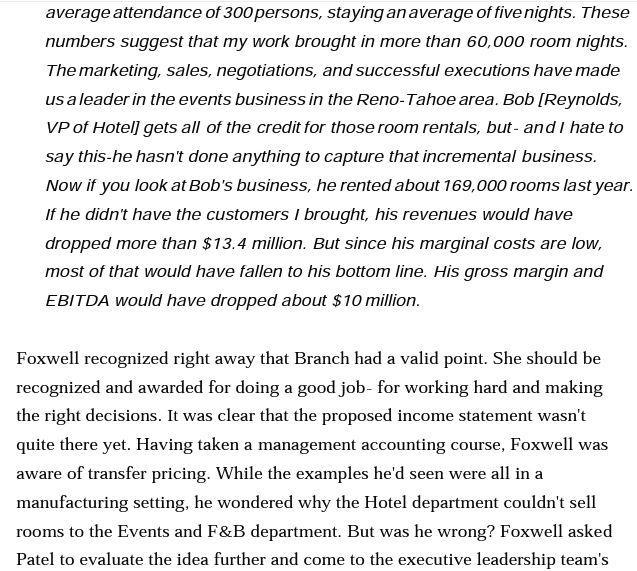

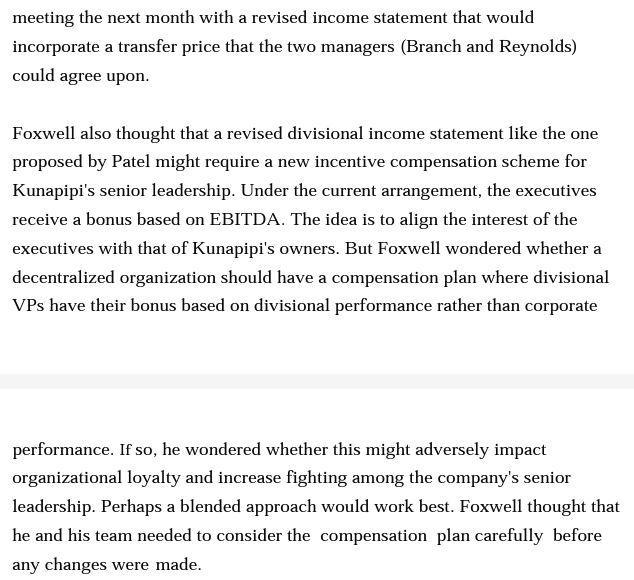

About a month ago, Thomas Foxwell, president and CEO of Kunapipi Gardens, a 738 - room resort hotel, met with CFO Prisha Patel to discuss the company's performance. Foxwell has been CEO of Kunapipi Gardens for the past four years after the prior CEO was fired after the company's earnings before interest, taxes, depreciation, and amortization (EBITDA) had fallen nearly 50%. During his tenure, Foxwell hasn't seen much growth in revenues, but EBITDA has increased 29%. The board of directors has been placing increased pressure on Foxwell to get back to the record revenues and EBITDA of a decade ago. As Foxwell and Patel looked over the reports together in one of the hotel's restaurants, Foxwell summarized the situation: We started out as a midsize hotel in Lake Tahoe, steadily expanding to where we are today The problem I have is that our annual income statements are an outgrowth of what we used more than 40 years ago. Back then, we were a 180-room hotel. Over the years, we added two new buildings for hotel rooms, added an event center 20 years ago, and, more recently, added a golf course and spa. Our income statement treats the organization as a hotel with multiple departments, but I think of us as a

Step by Step Solution

There are 3 Steps involved in it

Certainly Here are the answers to the assignment questions based on the information provided in the case study 1 Critically analyze the strategic position of ... View full answer

Get step-by-step solutions from verified subject matter experts