Question: PLEASE READ EVERYTHING CORRECTLY, AND RESPOND WITH THE CORRECT ANSWERS (IN YOUR OWN GRAPH) ANSWERING EVERYTHING CORRECTLY, READ ALL DIRECTIONS Required information [The following information

PLEASE READ EVERYTHING CORRECTLY, AND RESPOND WITH THE CORRECT ANSWERS (IN YOUR OWN GRAPH) ANSWERING EVERYTHING CORRECTLY, READ ALL DIRECTIONS

![information applies to the questions displayed below.] Green Wave Company plans to](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/671622c5e2d71_941671622c591337.jpg)

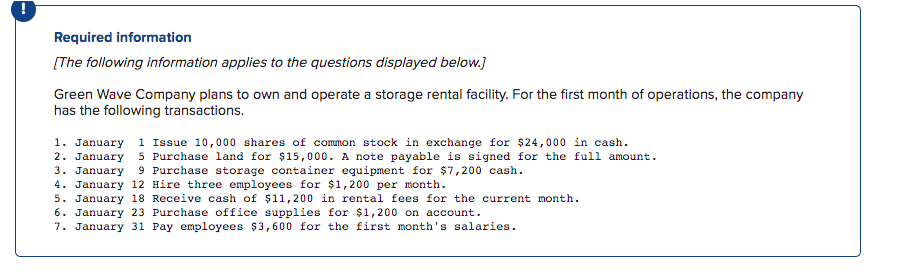

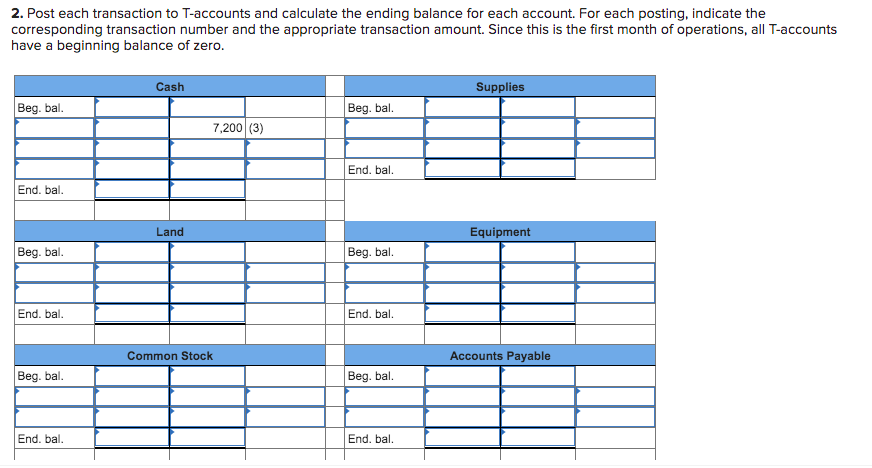

Required information [The following information applies to the questions displayed below.] Green Wave Company plans to own and operate a storage rental facility. For the first month of operations, the company has the following transactions. 1. January 1 Issue 10,000 shares of common stock in exchange for $24,000 in cash. 2. January 5 Purchase land for $15,000. A note payable is signed for the full amount. 3. January 9 Purchase storage container equipment for $7,200 cash. 4. January 12 Hire three employees for $1,200 per month. 5. January 18 Receive cash of $11,200 in rental fees for the current month. 6. January 23 Purchase office supplies for $1,200 on account. 7. January 31 Pay employees $3,600 for the first month's salaries. 2. Post each transaction to T-accounts and calculate the ending balance for each account. For each posting, indicate the corresponding transaction number and the appropriate transaction amount. Since this is the first month of operations, all T-accounts have a beginning balance of zero. Cash Supplies Beg. bal. Beg. bal. 7,200 (3) End. bal. End. bal. Equipment Beg. bal. Beg. bal. End. bal. End. bal. Accounts Payable Beg. bal. Beg. bal. End. bal. End. bal. Land Common Stock Beg. bal. End. bal. Beg. bal. End. bal. Notes Payable Salaries Expense Beg. bal. End. bal. Service Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts