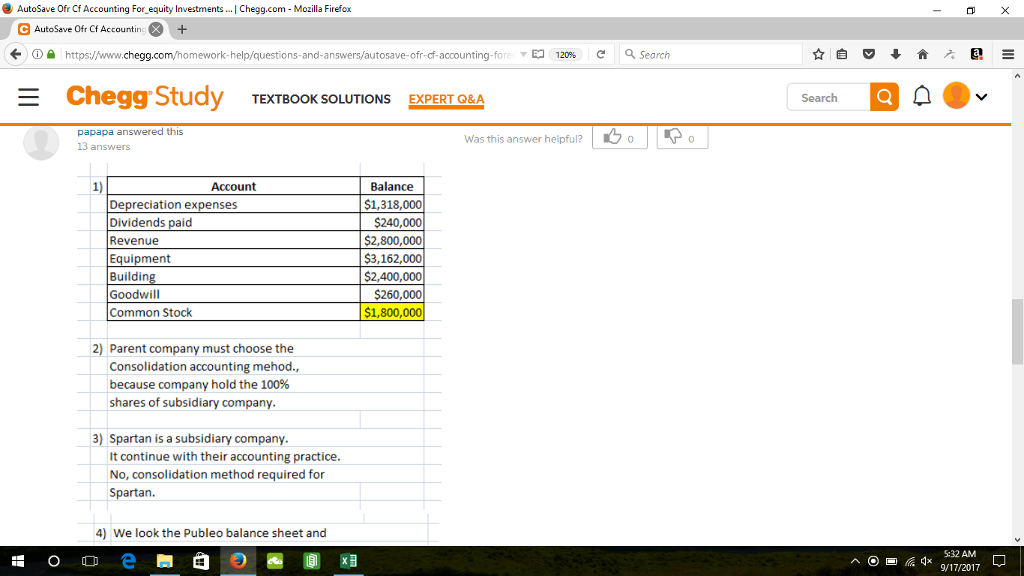

Question: Please read. I asked this question already and the response I received was wrong. Equipment and Goodwill values in question 1 are wrong and the

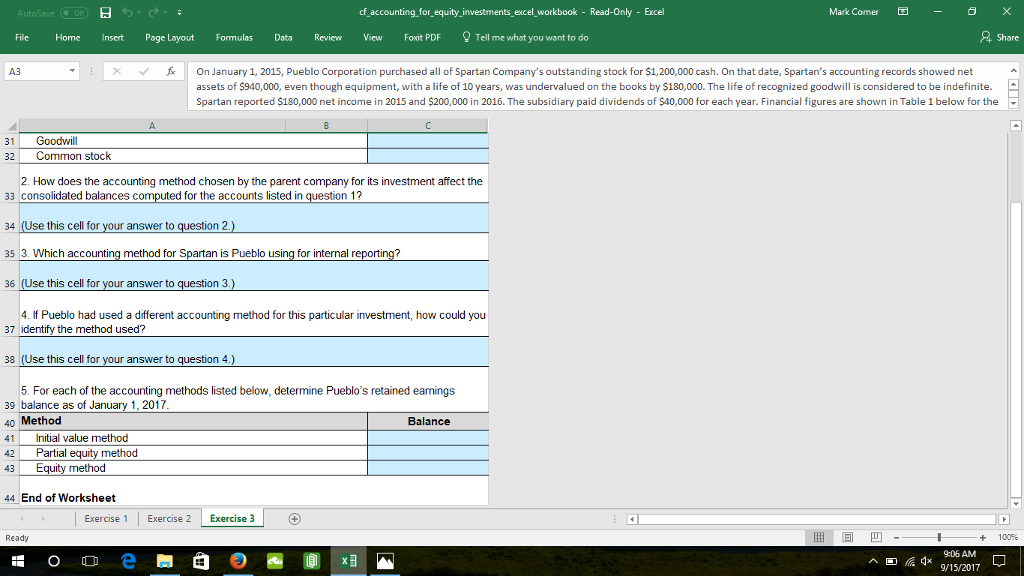

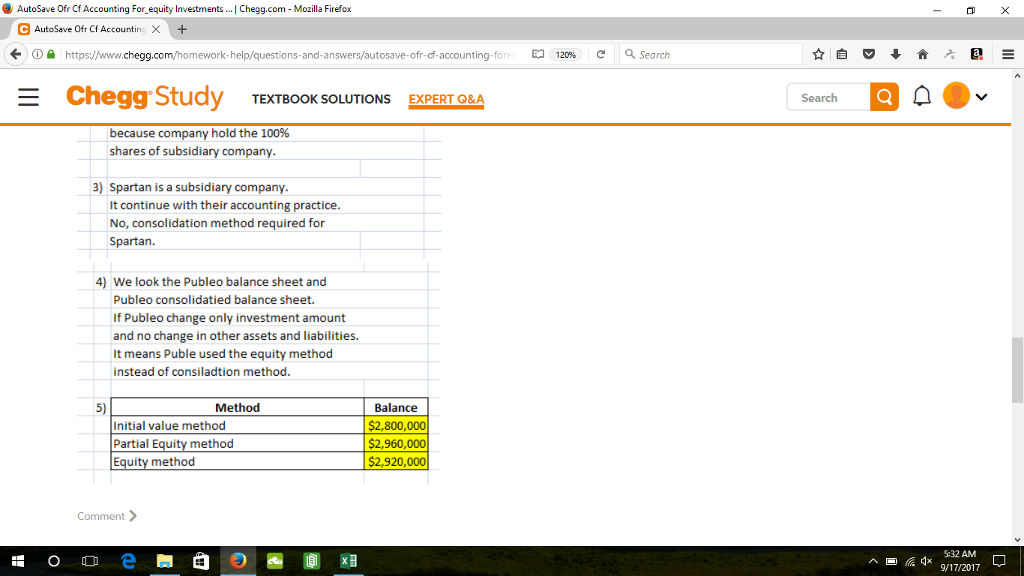

Please read. I asked this question already and the response I received was wrong. Equipment and Goodwill values in question 1 are wrong and the January 1, 2017 retained earnings balances in question 5 were also wrong. I had already gotten everything else done except for question 5. Please help me out. Thank you.

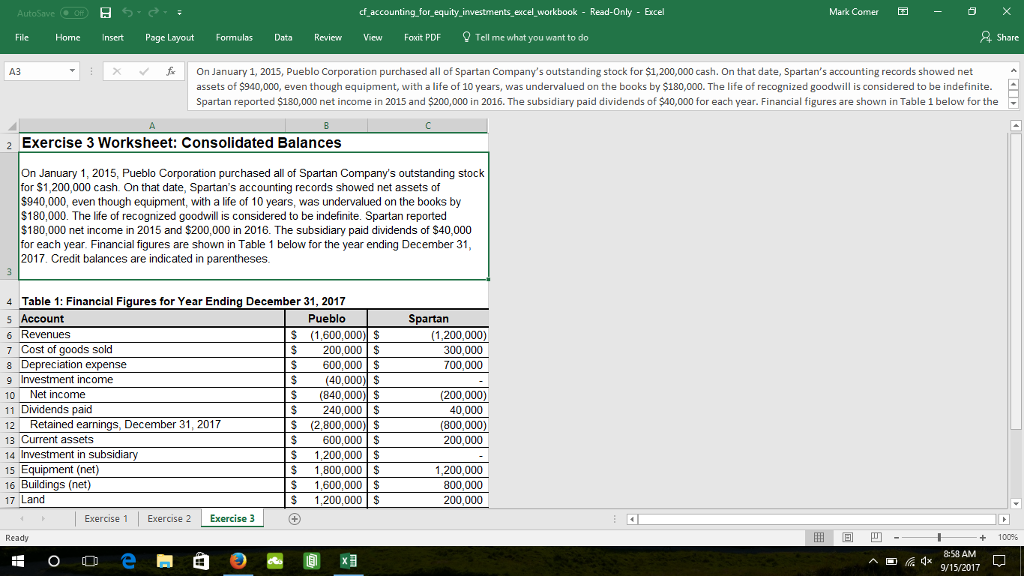

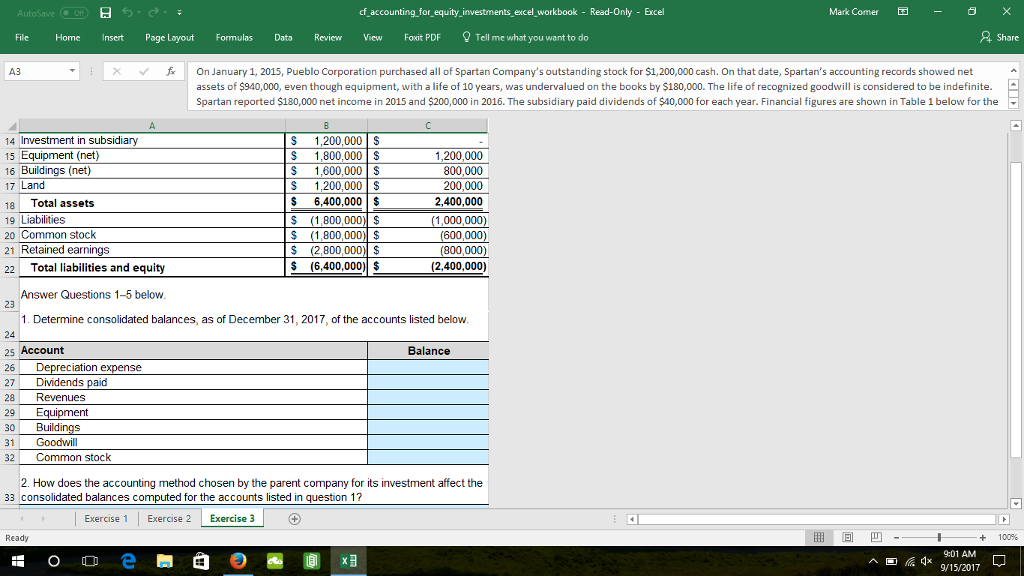

AutoSave ofr cf accounting for_equity investments excel workbook - Read-Only - Excel Mark Comer File Home Insert Page Layout Formulas Data Review View Foxit PDFTell me what you want to do Share On January 1, 2015, Pueblo Corporation purchased all of Spartan Company's outstanding stock for $1,200,000 cash. On that date, Spartan's accounting records showed net assets of $940,000, even though equipment, with a life of 10 years, was undervalued on the books by $180,000. The life of recognized goodwill is considered to be indefinite. Spartan reported $180,000 net income in 2015 and $200,000 in 2016. The subsidiary paid dividends of $40,000 for each year. Financial figures are shown in Table 1 below for the 2 Exercise 3 Worksheet: Consolidated Balances On January 1, 2015, Pueblo Corporation purchased all of Spartan Company's outstanding stock for $1,200,000 cash. On that date, Spartan's accounting records showed net assets of S940,000, even though equipment, with a life of 10 years, was undervalued on the books by $180,000. The life of recognized goodwill is considered to be indefinite. Spartan reported $180,000 net income in 2015 and $200,000 in 2016. The subsidiary paid dividends of $40,000 for each year. Financial figures are shown in Table 1 below for the year ending December 31 2017. Credit balances are indicated in parentheses. 4 Table 1: Financial Figures for Year Ending December 31, 2017 s Account 6 Revenues 7 Cost of goods sold 8 Depreciation expense 9 Investment income 10 Net income 11 Dividends paid 12 Retained earnings, December 31, 2017 13 Current assets 14 Investment in subsidia 15 Equipment (net) 16 Buildings (net) 17 Land Pueblo Spartan (1,200,000) 300,000 700,000 S (1,600,000) $ S 200,000 $ S 600,000 $ (40,000) S S (840,000)$ S 240,000 $ S (2,800,000) S S 600,000 $ S 1,200,000 $ S 1,800,000 $ S 1,600,000 $ S 1,200,000 $ (200,000) 40,000 (800,000) 200,000 1,200,000 800,000 200,000 Exercise 1 | Exercise 2 | Exercise 3 . + 100% o o e-0@@ 8:58 AM 9/15/2017 ^

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts