Question: please read information very carefully and answer questions five through seven You ate a junior fixcd- income analyst with 4339 Asset Management. Your supervisor, Stephanie

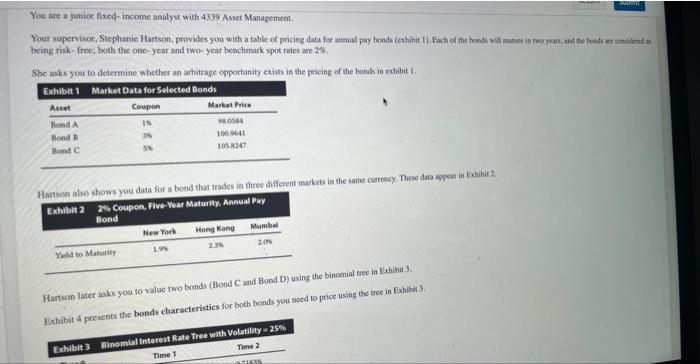

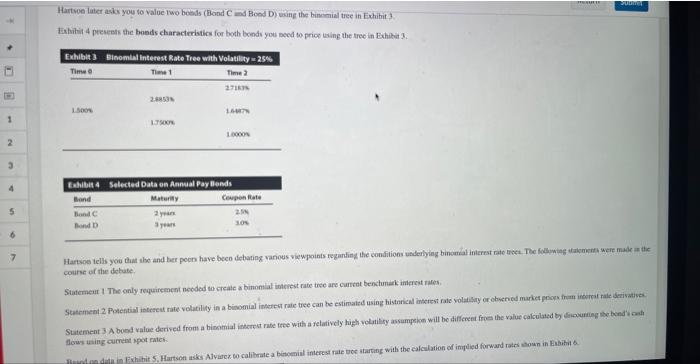

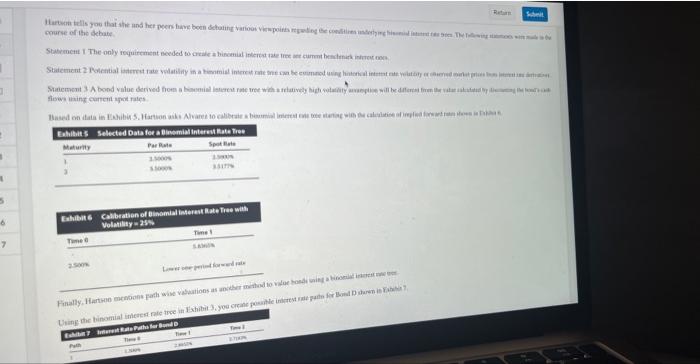

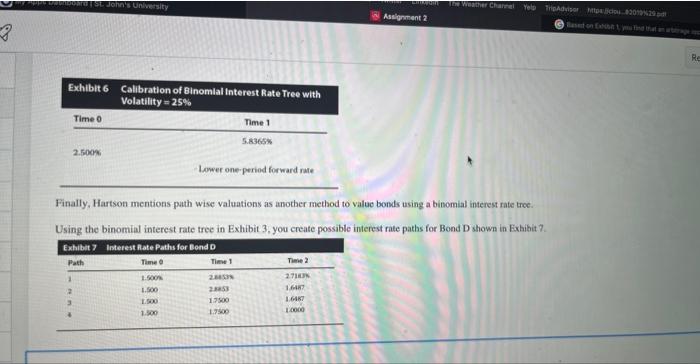

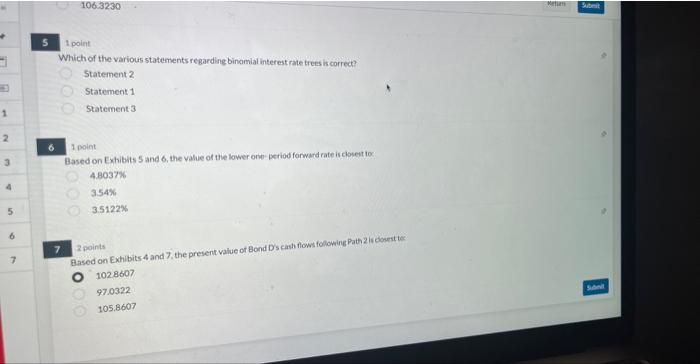

You ate a junior fixcd- income analyst with 4339 Asset Management. Your supervisor, Stephanie Hartson, provides you with a table of pricisg daba for anmal pay bonds (cthbit 1). Each of the bands ailil inanine in (wo yean. and Be tenta er eiruticred a being risk-free; bolh the obe-year and two-year benchmark spot rales aec 2%. She asks you to determine whether an arbitrage opportanity exists in the pricing of the bonds in exthitit I. Hartwon later usks you to value two bends (Bond C and Bocd D) using the bincenial tree in Exhibii 3. Hartwe later asks you to value two boests (Bond C and Bood D) wising the binomial tree in Exhithit ? Eakihit 4 presests the bonds characteristics for both bonds you peed to prioe ising the tree in Exhilit 3. course of the dehate. llows ining eurnent ypot rates: cmerse of the ekehat fiswi bins exartent sint rates Finally, Hartson mentions path wise valuations as another method to value bonds using a binomial interest rate tree. Using the binomial interest rate tree in Exhibit 3, you create possible interest rate paths for Bond D shown in Exhibit 7. 1 point Which of the various statements regarding binamial interest rate tres is corred? Statement 2 Statement 1 Statement 3 1 point Based on Exhibits 5 and 6 , the value of the lower onio period forward rate iscistet to: 4.8037%3.54%3.5122% Elased on Exhibits 4 and 7 , the present value of Bond D s cash flows folowing Path 2 is dosent te: 7 points 2 poing 102860797.0322105.8607 You ate a junior fixcd- income analyst with 4339 Asset Management. Your supervisor, Stephanie Hartson, provides you with a table of pricisg daba for anmal pay bonds (cthbit 1). Each of the bands ailil inanine in (wo yean. and Be tenta er eiruticred a being risk-free; bolh the obe-year and two-year benchmark spot rales aec 2%. She asks you to determine whether an arbitrage opportanity exists in the pricing of the bonds in exthitit I. Hartwon later usks you to value two bends (Bond C and Bocd D) using the bincenial tree in Exhibii 3. Hartwe later asks you to value two boests (Bond C and Bood D) wising the binomial tree in Exhithit ? Eakihit 4 presests the bonds characteristics for both bonds you peed to prioe ising the tree in Exhilit 3. course of the dehate. llows ining eurnent ypot rates: cmerse of the ekehat fiswi bins exartent sint rates Finally, Hartson mentions path wise valuations as another method to value bonds using a binomial interest rate tree. Using the binomial interest rate tree in Exhibit 3, you create possible interest rate paths for Bond D shown in Exhibit 7. 1 point Which of the various statements regarding binamial interest rate tres is corred? Statement 2 Statement 1 Statement 3 1 point Based on Exhibits 5 and 6 , the value of the lower onio period forward rate iscistet to: 4.8037%3.54%3.5122% Elased on Exhibits 4 and 7 , the present value of Bond D s cash flows folowing Path 2 is dosent te: 7 points 2 poing 102860797.0322105.8607

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts