Question: Please read it completely from the pictures attached and solve this problem step by step and accurately. Please don't miss any parts. Thank you .

Please read it completely from the pictures attached and solve this problem step by step and accurately. Please don't miss any parts. Thank you

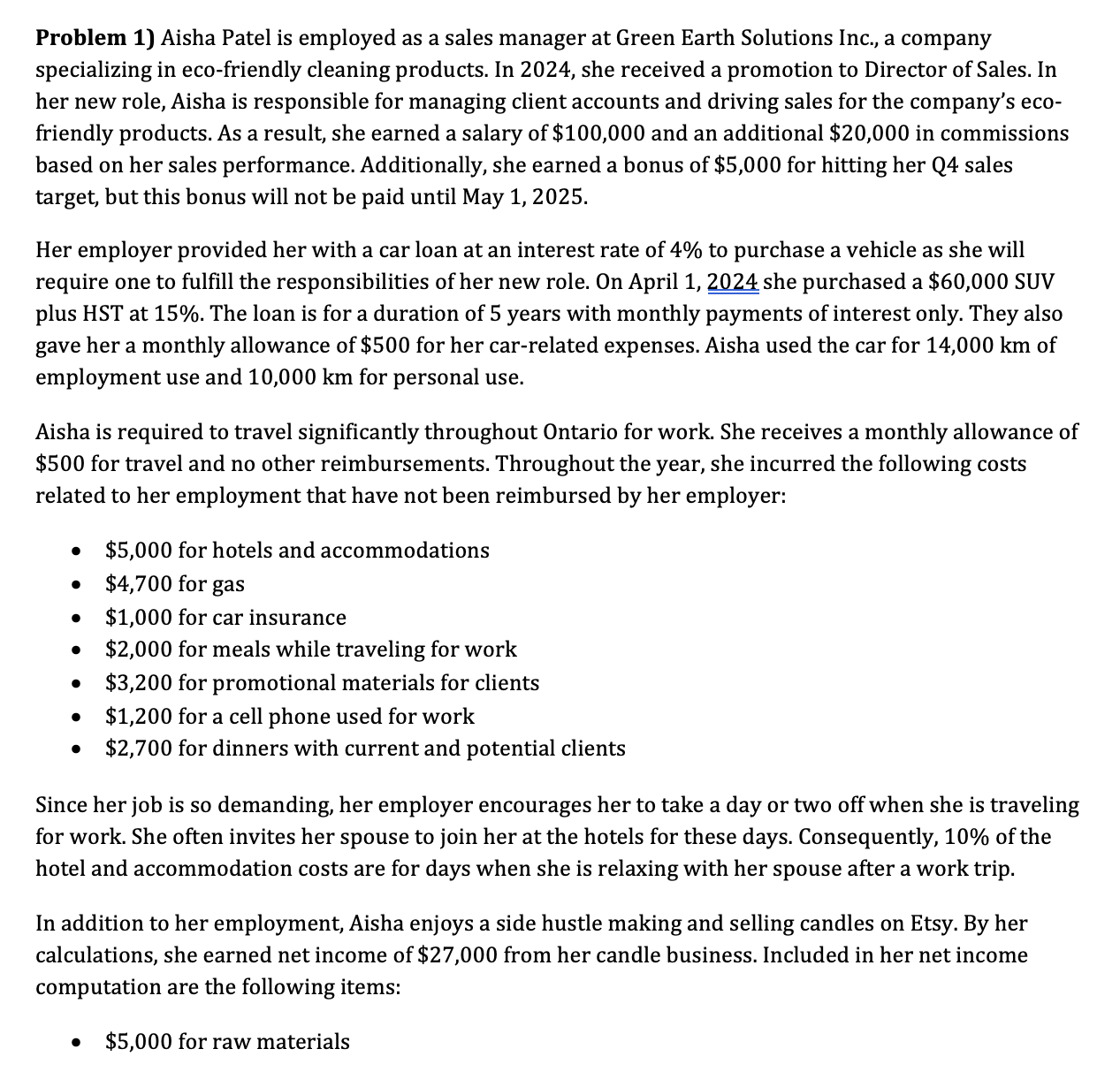

Problem Aisha Patel is employed as a sales manager at Green Earth Solutions Inc., a company

specializing in ecofriendly cleaning products. In she received a promotion to Director of Sales. In

her new role, Aisha is responsible for managing client accounts and driving sales for the company's eco

friendly products. As a result, she earned a salary of $ and an additional $ in commissions

based on her sales performance. Additionally, she earned a bonus of $ for hitting her Q sales

target, but this bonus will not be paid until May

Her employer provided her with a car loan at an interest rate of to purchase a vehicle as she will

require one to fulfill the responsibilities of her new role. On April she purchased a $ SUV

plus HST at The loan is for a duration of years with monthly payments of interest only. They also

gave her a monthly allowance of $ for her carrelated expenses. Aisha used the car for km of

employment use and km for personal use.

Aisha is required to travel significantly throughout Ontario for work. She receives a monthly allowance of

$ for travel and no other reimbursements. Throughout the year, she incurred the following costs

related to her employment that have not been reimbursed by her employer:

$ for hotels and accommodations

$ for gas

$ for car insurance

$ for meals while traveling for work

$ for promotional materials for clients

$ for a cell phone used for work

$ for dinners with current and potential clients

Since her job is so demanding, her employer encourages her to take a day or two off when she is traveling

for work. She often invites her spouse to join her at the hotels for these days. Consequently, of the

hotel and accommodation costs are for days when she is relaxing with her spouse after a work trip.

In addition to her employment, Aisha enjoys a side hustle making and selling candles on Etsy. By her

calculations, she earned net income of $ from her candle business. Included in her net income

computation are the following items:

$ for raw materials

$ for packaging & shipping

$ for miscellaneous expenses

$ for a new laptop

$ for depreciation

During a weekend trip with her spouse to Blue Mountain Resort to celebrate their anniversary, Aisha had

an informal conversation with the owner of the General Store about the possibility of selling her candles

in their store. Although nothing formal came of the discussion, she expensed the $ cost of the trip.

Aisha is dedicated to growing her candle business and plans to expand her product line in the coming

year. To support this goal, she expensed $ on tickets to the Crafting Expo in Toronto, where she aimed

to meet other suppliers and explore new equipment options.

Aisha uses a portion of her home exclusively for her candle business. This space, which is square feet,

is dedicated to activities such as production, storage, and administrative tasks. Her entire home is

square feet. She incurs various homerelated expenses annually, including $ for utilities, $ for

mortgage interest, $ for home insurance, $ for property taxes, and $ for maintenance and

repairs. Additionally, she spends $ annually on office supplies. None of these items have been

considered in computing her net income.

To increase her production capacity, Aisha purchased a new candlemaking machine for $ that will

be used in the manufacturing and processing of her candles. She also bought new furniture for her home

office, including a desk, chair, and storage cabinets, for a total cost of $ To deliver her orders to

local stores and transport goods to the post office for online sales, Aisha bought a van for $ which

is used for business purposes. Additionally, she upgraded her labeling equipment, spending $

on a printer, $ on ink, and $ on label stickers. She sold her old printer for $ which she had

purchased for $ Aisha had opening undepreciated capital cost balances as of January of $ for

Class and $ for Class

As Aisha's tax consultants, analyze the provided information to determine the tax implications and

calculate her taxable income. Consider all items mentioned. Highlight if any details are unclear or if

additional information is needed from Aisha.

Problem : On August Ms Bubkeh sold shares of Hundt Ltd a public corporation, for $

per share. Her trading history in these shares was as follows:

May purchased shares @ $ per share

$ for packaging & shipping

$ for miscellaneous expenses

$ for a new laptop

$ for depreciation

During a weekend trip with her spouse to Blue Mountain Resort to celebrate their anniversary.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock