Question: PLEASE READ QUESTIONS AND RUBRIC, NEED HELP DOING/UNDERSTANDING THIS, WILL LEAVE A GOOD REVIEW AND THUMBS UP WITH ANSWERS, THANK YOU!!! Assignment Questions 1. Prepare

PLEASE READ QUESTIONS AND RUBRIC, NEED HELP DOING/UNDERSTANDING THIS, WILL LEAVE A GOOD REVIEW AND THUMBS UP WITH ANSWERS, THANK YOU!!!

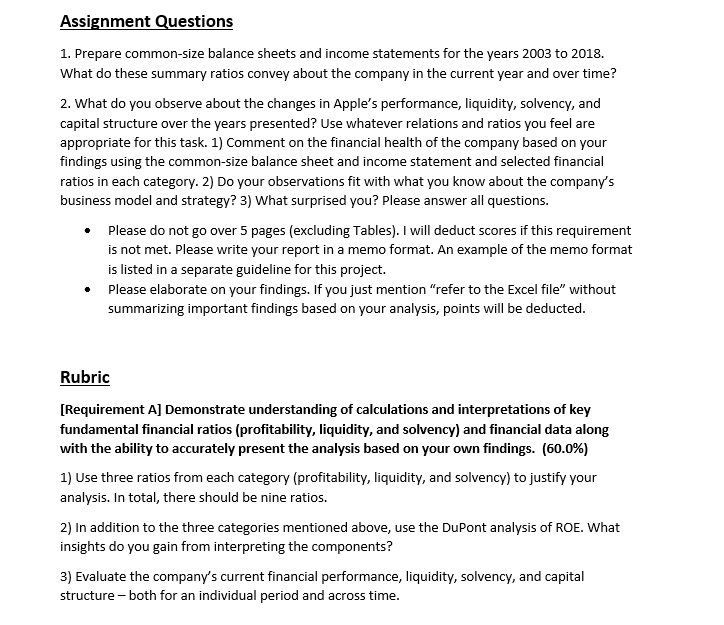

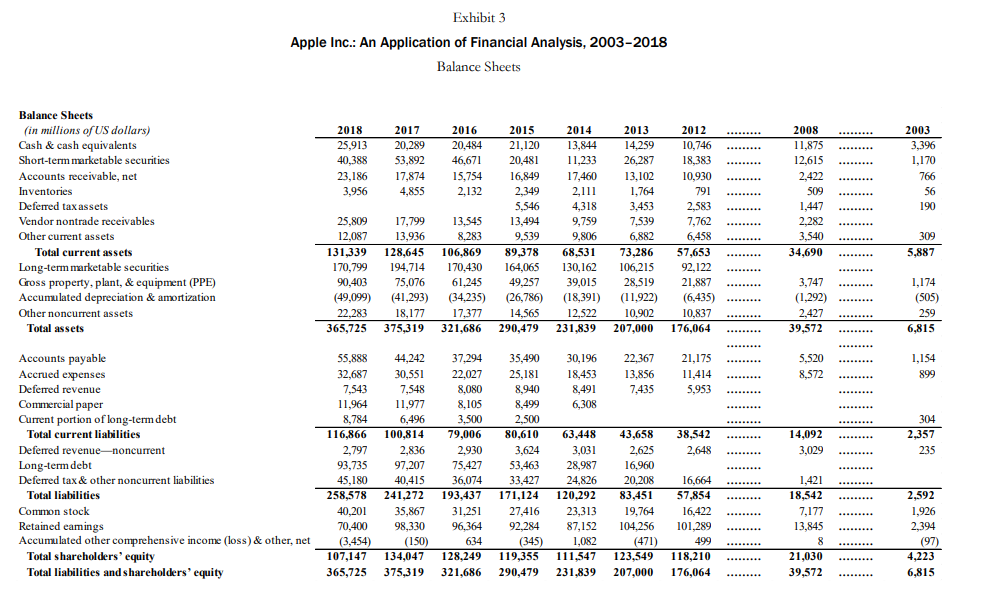

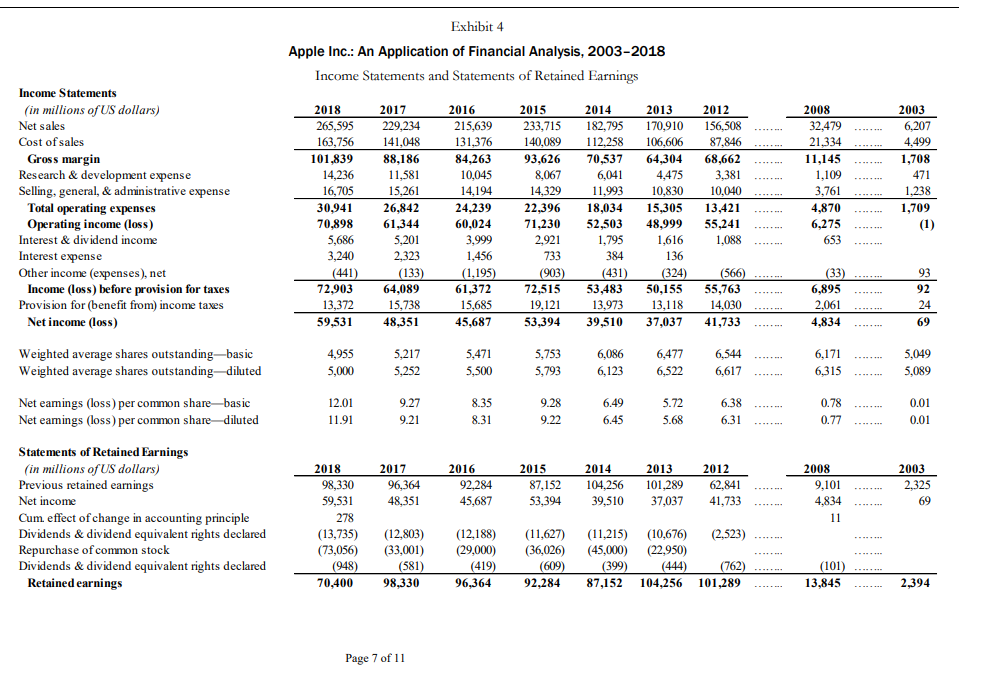

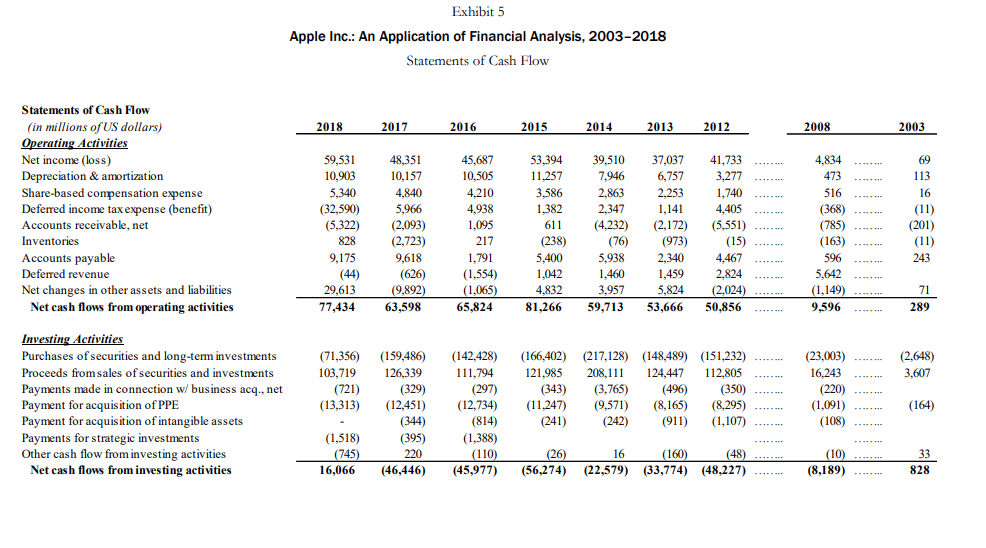

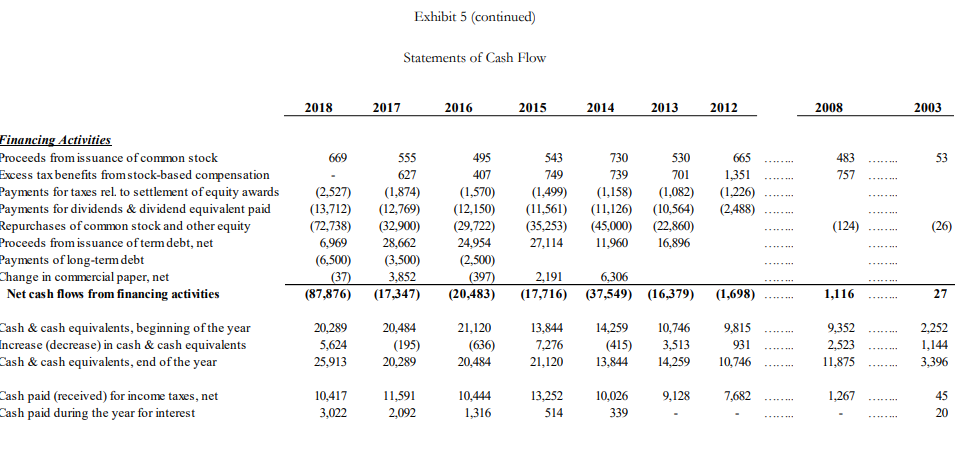

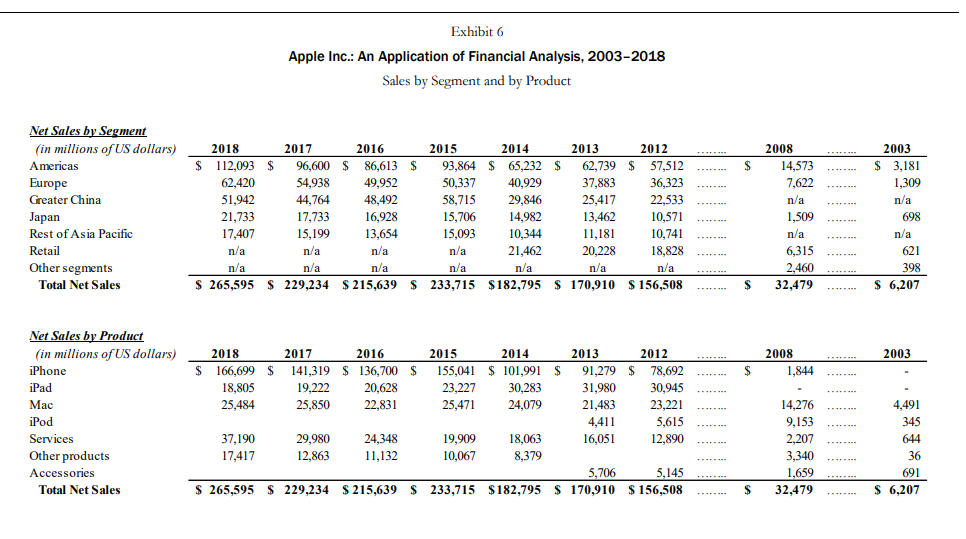

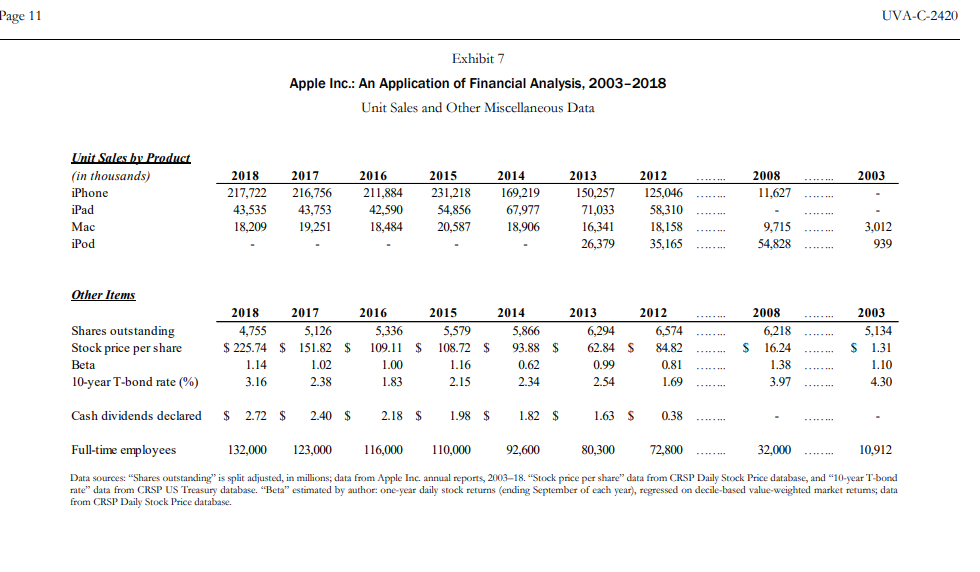

Assignment Questions 1. Prepare common-size balance sheets and income statements for the years 2003 to 2018. What do these summary ratios convey about the company in the current year and over time? 2. What do you observe about the changes in Apple's performance, liquidity, solvency, and capital structure over the years presented? Use whatever relations and ratios you feel are appropriate for this task. 1) Comment on the financial health of the company based on your findings using the common-size balance sheet and income statement and selected financial ratios in each category. 2) Do your observations fit with what you know about the company's business model and strategy? 3) What surprised you? Please answer all questions. - Please do not go over 5 pages (excluding Tables). I will deduct scores if this requirement is not met. Please write your report in a memo format. An example of the memo format is listed in a separate guideline for this project. - Please elaborate on your findings. If you just mention "refer to the Excel file" without summarizing important findings based on your analysis, points will be deducted. Rubric [Requirement A] Demonstrate understanding of calculations and interpretations of key fundamental financial ratios (profitability, liquidity, and solvency) and financial data along with the ability to accurately present the analysis based on your own findings. (60.0\%) 1) Use three ratios from each category (profitability, liquidity, and solvency) to justify your analysis. In total, there should be nine ratios. 2) In addition to the three categories mentioned above, use the DuPont analysis of ROE. What insights do you gain from interpreting the components? 3) Evaluate the company's current financial performance, liquidity, solvency, and capital structure - both for an individual period and across time. Apple Inc.: An Application of Financial Analysis, 2003-2018 Balance Sheets Apple Inc.: An Application of Financial Analysis, 2003-2018 Page 7 of 11 Apple Inc.: An Application of Financial Analysis, 2003-2018 Statements of Cash Flow Exhibit 5 (continued) Statements of Cash Flow Exhibit 6 Apple Inc.: An Application of Financial Analysis, 2003-2018 Sales by Segment and by Product Apple Inc.: An Application of Financial Analysis, 2003-2018 Unit Sales and Other Miscellaneous Data from CRSP Daily Stock Price database. Assignment Questions 1. Prepare common-size balance sheets and income statements for the years 2003 to 2018. What do these summary ratios convey about the company in the current year and over time? 2. What do you observe about the changes in Apple's performance, liquidity, solvency, and capital structure over the years presented? Use whatever relations and ratios you feel are appropriate for this task. 1) Comment on the financial health of the company based on your findings using the common-size balance sheet and income statement and selected financial ratios in each category. 2) Do your observations fit with what you know about the company's business model and strategy? 3) What surprised you? Please answer all questions. - Please do not go over 5 pages (excluding Tables). I will deduct scores if this requirement is not met. Please write your report in a memo format. An example of the memo format is listed in a separate guideline for this project. - Please elaborate on your findings. If you just mention "refer to the Excel file" without summarizing important findings based on your analysis, points will be deducted. Rubric [Requirement A] Demonstrate understanding of calculations and interpretations of key fundamental financial ratios (profitability, liquidity, and solvency) and financial data along with the ability to accurately present the analysis based on your own findings. (60.0\%) 1) Use three ratios from each category (profitability, liquidity, and solvency) to justify your analysis. In total, there should be nine ratios. 2) In addition to the three categories mentioned above, use the DuPont analysis of ROE. What insights do you gain from interpreting the components? 3) Evaluate the company's current financial performance, liquidity, solvency, and capital structure - both for an individual period and across time. Apple Inc.: An Application of Financial Analysis, 2003-2018 Balance Sheets Apple Inc.: An Application of Financial Analysis, 2003-2018 Page 7 of 11 Apple Inc.: An Application of Financial Analysis, 2003-2018 Statements of Cash Flow Exhibit 5 (continued) Statements of Cash Flow Exhibit 6 Apple Inc.: An Application of Financial Analysis, 2003-2018 Sales by Segment and by Product Apple Inc.: An Application of Financial Analysis, 2003-2018 Unit Sales and Other Miscellaneous Data from CRSP Daily Stock Price database

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts