Question: please read questions because this is third time no body can answer i attached one of wrong answers , has gathered the following Depreciation and

please read questions because this is third time no body can answer i attached one of wrong answers

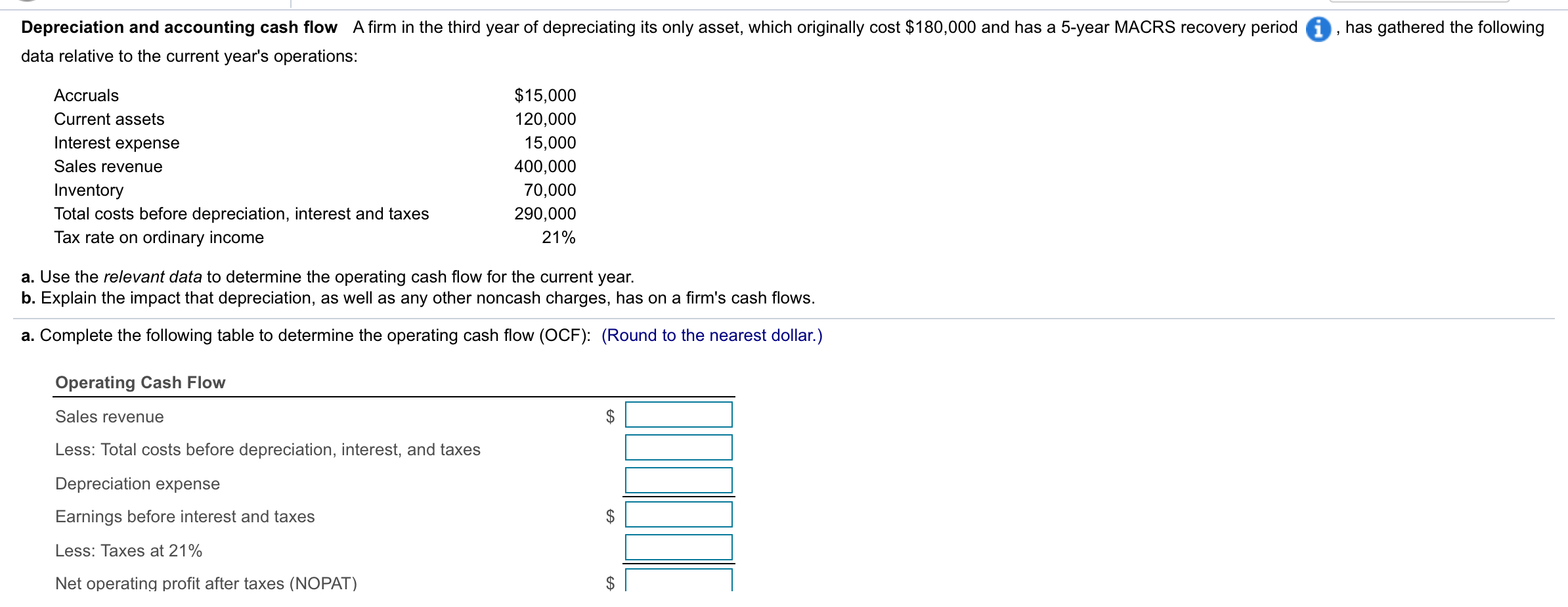

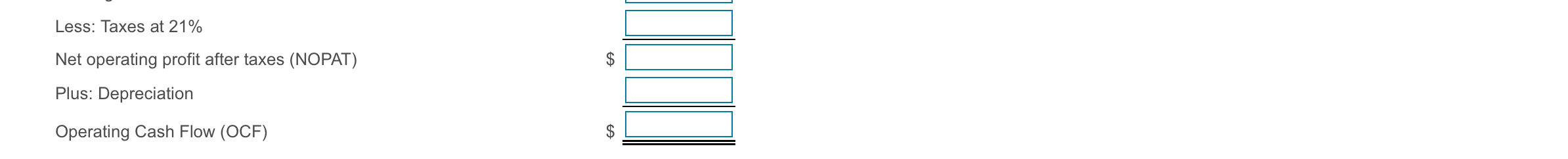

, has gathered the following Depreciation and accounting cash flow A firm in the third year of depreciating its only asset, which originally cost $180,000 and has a 5-year MACRS recovery period data relative to the current year's operations: Accruals Current assets Interest expense Sales revenue Inventory Total costs before depreciation, interest and taxes Tax rate on ordinary income $15,000 120,000 15,000 400,000 70,000 290,000 21% a. Use the relevant data to determine the operating cash flow for the current year. b. Explain the impact that depreciation, as well as any other noncash charges, has on a firm's cash flows. a. Complete the following table to determine the operating cash flow (OCF): (Round to the nearest dollar.) Operating Cash Flow Sales revenue Less: Total costs before depreciation, interest, and taxes Depreciation expense Earnings before interest and taxes Less: Taxes at 21% Net operating profit after taxes (NOPAT) Less: Taxes at 21% Net operating profit after taxes (NOPAT) Plus: Depreciation A Operating Cash Flow (OCF) A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts