Question: Please read the article and answer about questions. (I wrote about Problem 1. pelease write 2,3) Questions 1. Showing your use of the three methods

Please read the article and answer about questions. (I wrote about Problem 1. pelease write 2,3)

Questions

1. Showing your use of the three methods of valuation, what would you conclude is the fair market value of PMC?

Market value is the price an asset would fetch in the marketplace. Market value is also commonly used to refer to the market capitalization of a publicly-traded company, and is obtained by multiplying the number of its outstanding shares by the current share price. Market value is easiest to determine for exchange-traded instruments such as stocks and futures, since their market prices are widely disseminated and easily available, but is a little more challenging to ascertain for over-the-counter instruments like fixed income securities. However, the greatest difficulty in determining market value lies in estimating the value of illiquid assets like real estate and businesses, which may necessitate the use of real estate appraisers and business valuation experts respectively.

2. Once you have established your estimate of the fair market value, state what your opening offer for the business would be and state why you selected this opening offer.

3. state what the terms and conditins o your offer would be? (Terms & conditions would include items such as: the amound of the purchase price paid at closing and amount to be paid over time as a promissory note; how much of the purchase value would be compensated to the seller as payment for a non-competition of paying health insuance for the seller and/or his brothers for some period of time after the sale; would there be any consideration of writing into the purchase agreement a promise to keep the non-family employees on the payroll for some guaranteed length of time?)

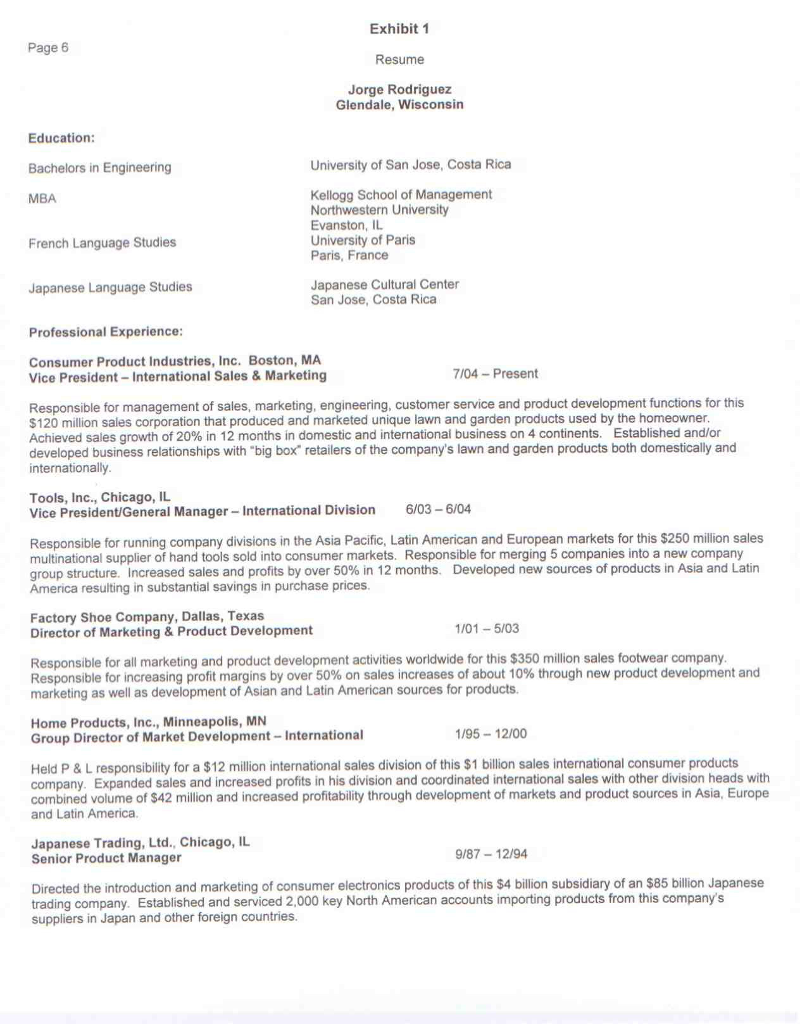

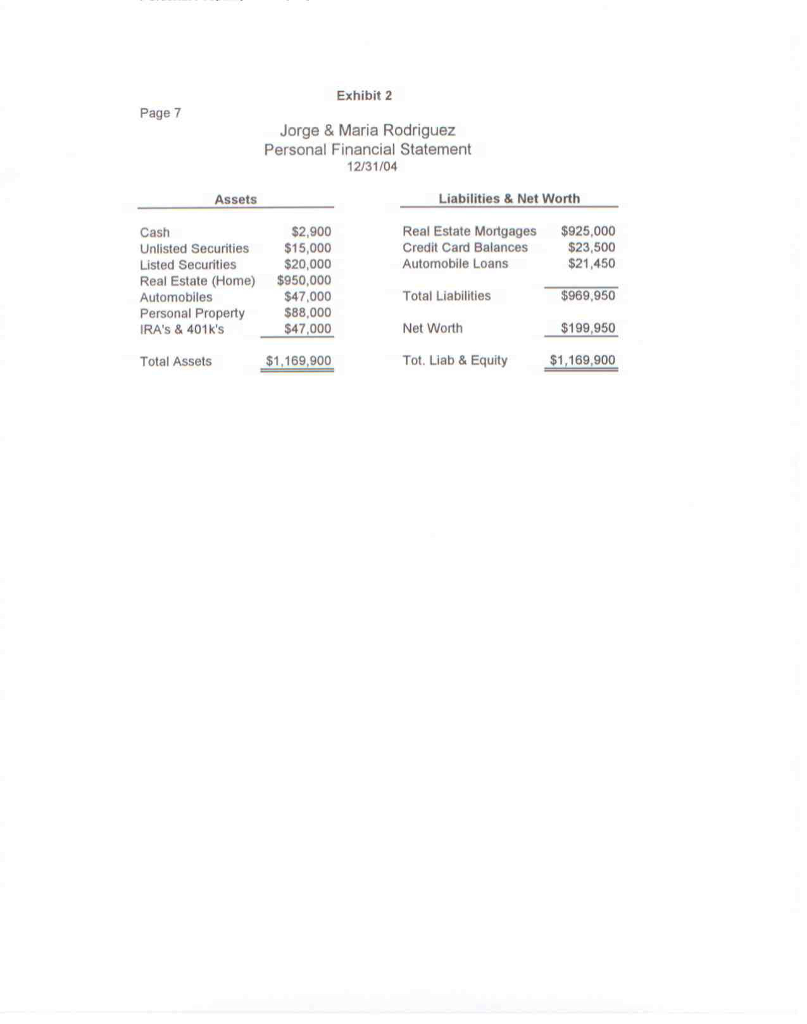

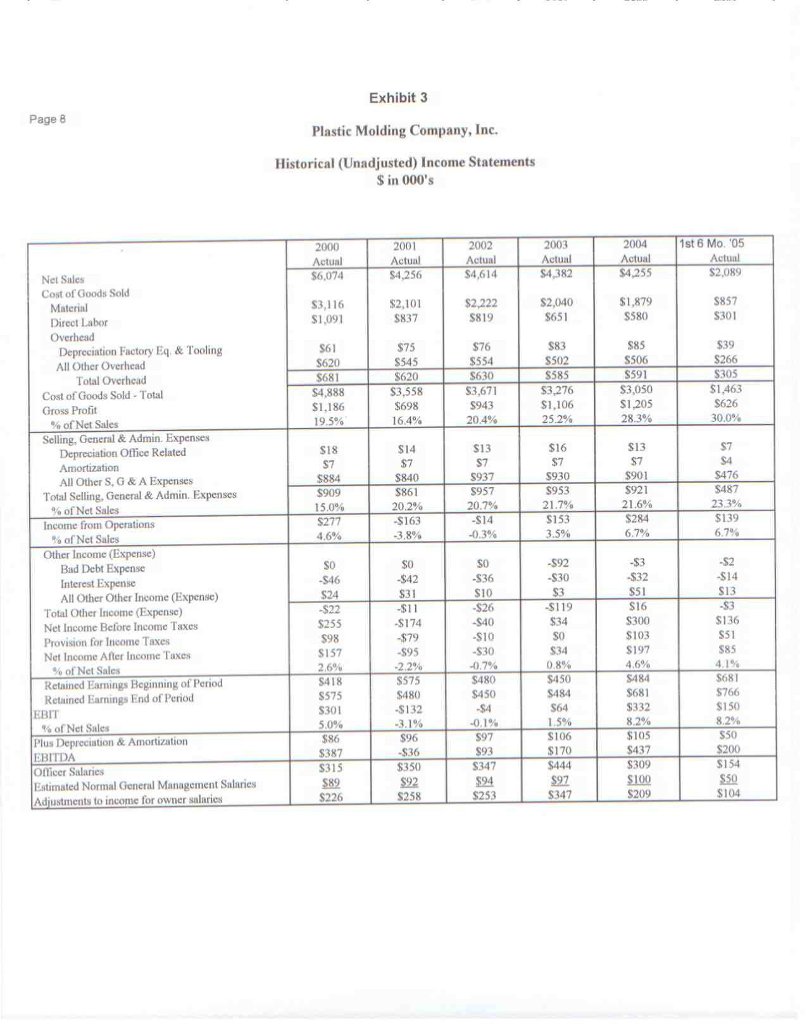

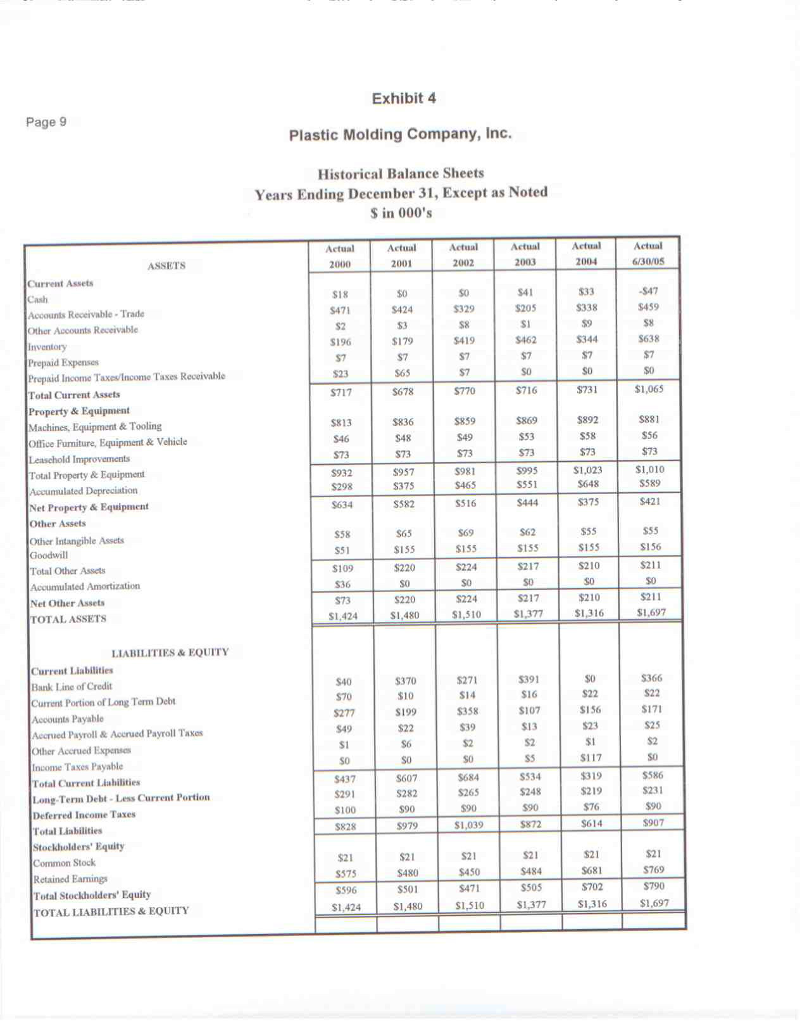

Plastic Molding Company, Inc. Page 2 Plastic Molding Company, Inc. Plastic Molding Company, Inc. (the business that was for sale) had been started in 1976 as family business engaged in molding a broad range of plastic office products. These products were manufactured to customers' specifications and were sold to office product manufacturers and distributors. The designs were prepared by the customers and Plastic Molding Company (PMC) just molded the products to the customers' designs. The founders grew the business to over $2 million in revenues and in 1996 decided to retire and sell the business to Ben Hooper who had been seeking a business to buy. Ben's desire was to find a business needing little investment in capital equipment and a company needing better efficiency in manufacturing operations. PMC was an ideal candidate since the founder had not been experienced in automation of manufacturing or in organizing production workers to operate with the greatest efficiency. A deal was struck, Ben put in about $21,000 and he borrowed the rest to make the purchase. He hired his brother, Ted, who was an expert in the manufacturing of molded plastic products and he hired his other brother, Jack, to run the sales department. The company grew from the level of about $2 million at the time Ben purchased the business to a level peaking at $6 million in 2000. At that time PMC lost its major customer who pulled production into their shop rather than subcontract the plastic molding work to PMC. Ben decided to purchase a product line that PMC had been producing for a sales and marketing company to supplement the business lost when the largest customer pulled work in. This product line, called Lawn Helper, was a unique molded plastic stool that made it easy for home gardeners to work in their flower beds and carry the needed gardening tools. Lawn Helper Distribution of the product had included sales to several "big box" home centers and hardware chains as well as small independent garden centers and hardware retailers. The product had been patented but the patent had run out prior to Ben's purchase. The product line had represented about $500,000 in business to PMC annually when they had produced it for the previous owner of Lawn Helper, but once PMC acquired the product line in 2001, they realized that the price to retailers was very attractive and on the same number of units sold, the net sales volume was now in the range of $ 1 million annually. This product line went a long way toward making up for the loss in 2000 of PMC's major customer's business. Also, once PMC was both manufacturing the product and selling it to retailers, many economies were available to PMC and they were able to cut the manufacturing cost in half. Now that the Lawn Helper product line was well incorporated into PMC's production process, the bottom line profit for the company looked better and better every year. While unprofitable in 2001 and 2002, the company produced a positive cash flow in 2002 and an outright profit from 2003 forward. (See the financial statements in Exhibits 3 & 4.) Not only had Lawn Helper enhanced the bottom line, it put PMC into the position of having a proprietary product rather than just making office products that were manufactured to office product companies' specifications. Plastic Molding Company, Inc. Page 2 Plastic Molding Company, Inc. Plastic Molding Company, Inc. (the business that was for sale) had been started in 1976 as family business engaged in molding a broad range of plastic office products. These products were manufactured to customers' specifications and were sold to office product manufacturers and distributors. The designs were prepared by the customers and Plastic Molding Company (PMC) just molded the products to the customers' designs. The founders grew the business to over $2 million in revenues and in 1996 decided to retire and sell the business to Ben Hooper who had been seeking a business to buy. Ben's desire was to find a business needing little investment in capital equipment and a company needing better efficiency in manufacturing operations. PMC was an ideal candidate since the founder had not been experienced in automation of manufacturing or in organizing production workers to operate with the greatest efficiency. A deal was struck, Ben put in about $21,000 and he borrowed the rest to make the purchase. He hired his brother, Ted, who was an expert in the manufacturing of molded plastic products and he hired his other brother, Jack, to run the sales department. The company grew from the level of about $2 million at the time Ben purchased the business to a level peaking at $6 million in 2000. At that time PMC lost its major customer who pulled production into their shop rather than subcontract the plastic molding work to PMC. Ben decided to purchase a product line that PMC had been producing for a sales and marketing company to supplement the business lost when the largest customer pulled work in. This product line, called Lawn Helper, was a unique molded plastic stool that made it easy for home gardeners to work in their flower beds and carry the needed gardening tools. Lawn Helper Distribution of the product had included sales to several "big box" home centers and hardware chains as well as small independent garden centers and hardware retailers. The product had been patented but the patent had run out prior to Ben's purchase. The product line had represented about $500,000 in business to PMC annually when they had produced it for the previous owner of Lawn Helper, but once PMC acquired the product line in 2001, they realized that the price to retailers was very attractive and on the same number of units sold, the net sales volume was now in the range of $ 1 million annually. This product line went a long way toward making up for the loss in 2000 of PMC's major customer's business. Also, once PMC was both manufacturing the product and selling it to retailers, many economies were available to PMC and they were able to cut the manufacturing cost in half. Now that the Lawn Helper product line was well incorporated into PMC's production process, the bottom line profit for the company looked better and better every year. While unprofitable in 2001 and 2002, the company produced a positive cash flow in 2002 and an outright profit from 2003 forward. (See the financial statements in Exhibits 3 & 4.) Not only had Lawn Helper enhanced the bottom line, it put PMC into the position of having a proprietary product rather than just making office products that were manufactured to office product companies' specifications

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts