Question: Please read the attached article that reports on research using behavioral nudges to encourage people to save ( not spend ) their income tax refund.

Please read the attached article that reports on research using behavioral nudges to encourage people to save not spend their income tax refund. The article describes two field experiments. As we discussed in the BEworks case, field experiments are inherently messier and have less controls than lab experiments. Here is your chance to think critically about the pros and cons of field experiments. Please respond to the following question:

What is the causal relationship that each experiment sought to establish? In your opinion, is there enough evidence to establish this causal relationship for either of these experiments? Use what you have learned through our readings and class discussions about establishing cause and effect relationships through research to help you craft your response. A good response will include a discussion of elements required to meet criteria for a causal link, whether or not the experiment met these requirements, and how.

Article Intro: Taxfiling season can be a time of great stress, but it can also be one of the best opportunities all year for individuals to build up their shortterm savings. In of tax filers received a tax refund, averaging $ This can often be the largest single deposit many receive all year.

In the IRS introduced the Form which enables tax filers to easily split their tax refund into multiple accounts up to three thus making it possible for recipients to directly set aside a portion of their refund into a savings account.

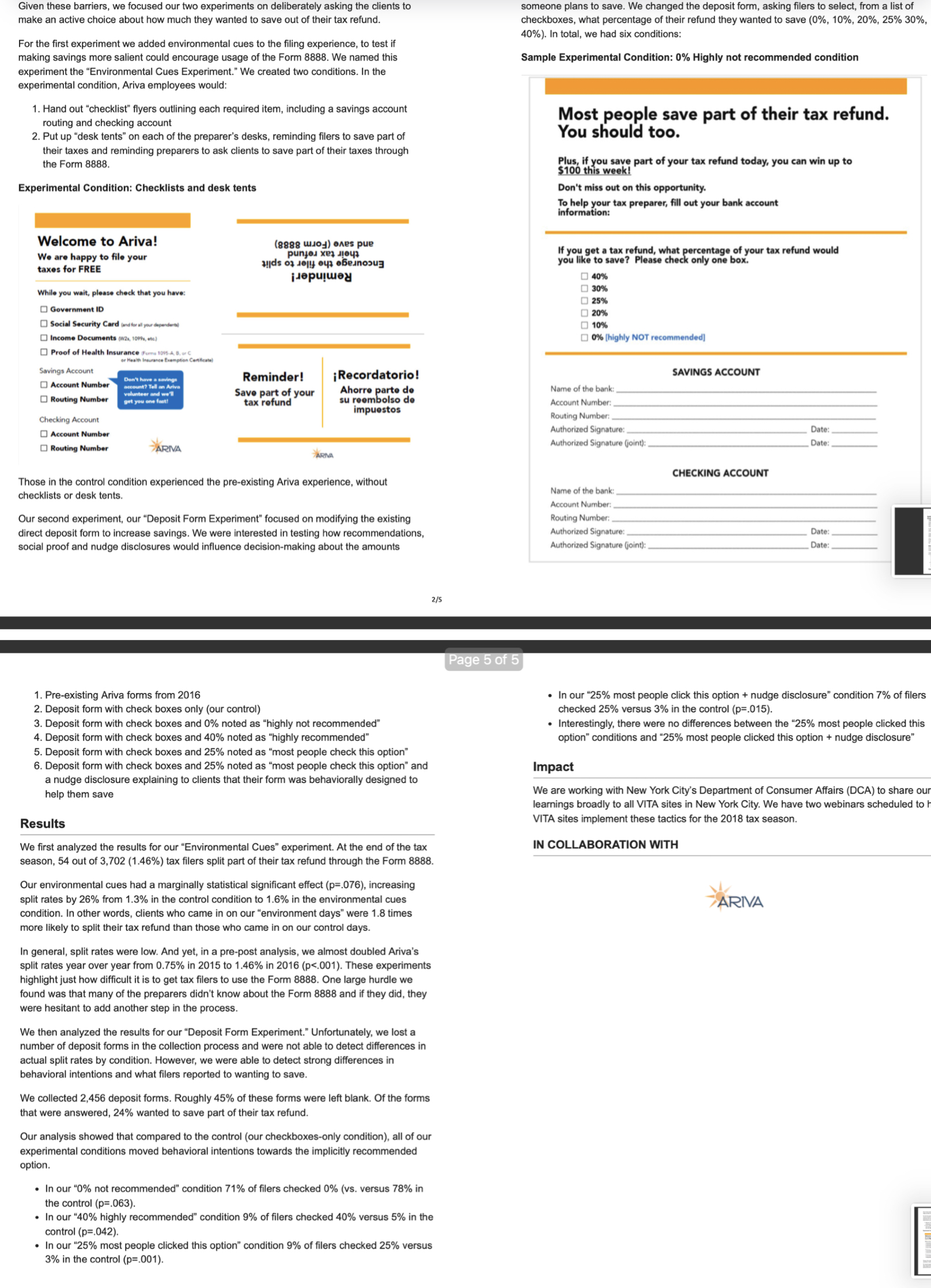

Through the Robin Hood Foundation, we partnered with Ariva to run a eld experiment testing different interventions, with the goal of increasing savings rates through Form and increasing attendance at a tax preparation site.

Ariva operates nine tax sites in the Bronx and one tax site in Manhattan, serving over tax filers each year. Their main location is in the Highbridge area of the Bronx and serves over tax filers each year. Over of the Highbridge residents live below the poverty line.

Behavioral Diagnosis and Key Insights

To understand the environment where filers are taking actions, we initiated site visits before tax season began. We conducted two full days of observation, along with ten hours of qualitative interviews with key staff members, preparers, greeters, and other volunteers.

Consolidating themes from the conversations led to these key insights on the tax preparation process:

There was a limited mention of saving. Although Ariva played a video in their waiting room subtly highlighting the Form and the importance of saving, few greeters, intake persons, or preparers actively discussed saving or the Form with the client. In addition, none of the forms explicitly asked filers if they wanted to save, and if so how much they wanted to

Their base of volunteers is inconsistent seasonal worker problems Since most preparers at a VITA site are seasonal volunteers, consistency with some processes such as where to place the deposit form, how to introduce the Form and how to assist clients in opening savings accounts can be difficult.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock