Question: please read the case and answer asap!! Thank you Wells Fargo's Unauthorized Customer Accounts At its September 20, 2016, hearing the Senate Banking Committee relentlessly

please read the case and answer asap!! Thank you

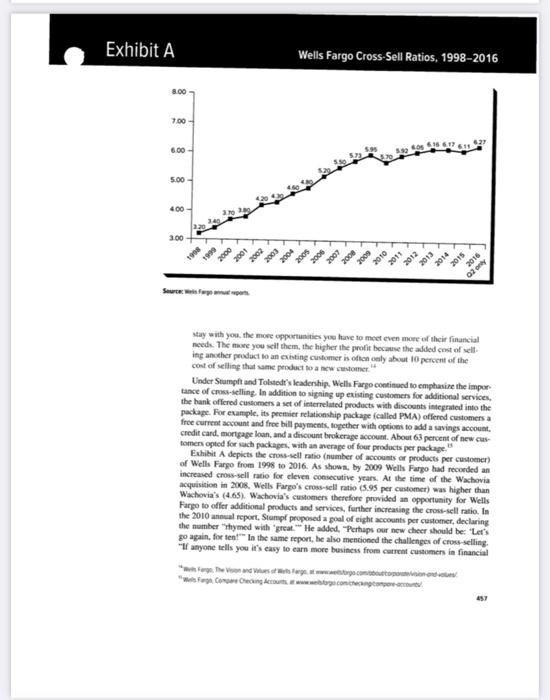

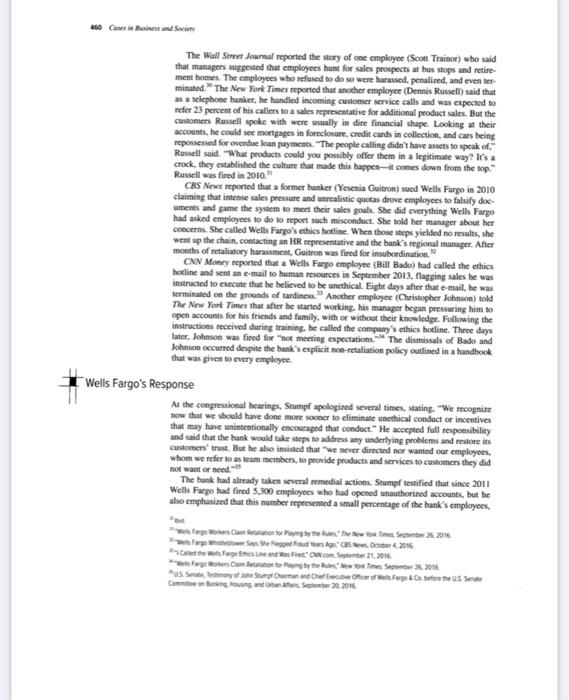

Wells Fargo's Unauthorized Customer Accounts At its September 20, 2016, hearing the Senate Banking Committee relentlessly grilled John Stumpf, chairman and CEO of Wells Fargo, about charges that the bank had fraudu lently opened unauthorized accounts for millions of customers. Senator Elizabeth Warren (D-Mass.) began with the question. "Have you returned one single nickel of the millions of dollars you were paid while the scam was going on As Stumpf fumbled in response she concluded, So you haven't resigned. You haven't returned a single nickel of your per sonal carnings. You haven't fired a single senior executive. Instead, evidently, your defini tion of accountable is to push the blame to your low-level employees who don't have the money for a fancy PR firm to defend themselves. It's gutless leadership. A few days later, on September 29, congressional members at a hearing of the House Financial Services Committee echoed the views expressed in the Senate Congressman Gregory Meeks (D. New York) said to Stumpf. "I can't believe what I'm hearing here. You're going to tell me there's not a problem with the bank's culture Patrick McHenry (R-North Carolina) accused Stumpf of being tone dear for not grasping the scandal's impact on society's trust in the banking system The two congressional hearings followed shortly after the imposition of fines on Wells Fargo by the Consumer Financial Protection Bureau (5100 million), the Los Angeles City Attorney (550 million and the Office of the Comptroller of the Currency (535 million). The reason for these fines was that the bank had opened more than two million unauthorized checking and credit card accounts without the consent of its customers between May 2011 and July 2015. Wells Fargo settled with these regulatory agencies without admitting or deny ing the alleged misconduct. These fines were not the bank's only problems. Other lawsuits against Wells Fargo-from customers, former employees, and shareholders-had started pil- ing up. Shareholders had filed a class action lawsuit alleging that the bank had misled inves- tors about its financial performance and the success of its sales practices. The price of Wells Fargo's stock had fallen more than 10 percent since September 8, when it reached the Sommer, der i denne typy 2017 by Crochenende energed by Door to the complete the Cow Research Journal Song 2017, sage: Schuing Agan. The red by the autos for the serving or connettered to the hecter etter ceso Chet of Guess Law Times See 20,2016 Postforeningens fuge Over Soestches the weet umet Se 16.2016 154 Cars leies and Society settlement with regulator, wiping out more than 525 illice of market capitalization Stumpf and his leadership team faced a major crisis Wells Fargo and Company Henry Wells and William Furgo founded Wells Fargo and Company on March 18, 1852. The company bean by offering bunking and express services in California, and soon afterwards, formed an overland mail service, becoming indelibly linked with the image of a sapecoach drawn by si thundering stations. The bank survived the Great Depression as well as the difficult period of World War I. The prosperity of the 1960s saw the bank emerge as a major regional bank in the western part of the United States. By the 1980s, when it started its online banking service, Wells Fargo had become one of the top ten U.S. bunk The bank weathered the financial crisis of 2007-2008 relatively scathed. In fact, Wells Fargo use it as an opportunity to grow by acquiring Wachovia a bank weakened by the mortgage crisis in 2008. Wachovia's culsive real work in the eastern United States, which complemented Wells Fargo's enabled the bank to double both its number of branches and total deposits. By the end of 2015. Wells Fargo had become a diversified banking and financial services company with its of over $1.8 trillion and approximately 265.000 employees, serving one in the US household In 2015. Wells Fargo was organized into the majorelatively segments These were community banking, wholesale banking and wealth and manage ment. The community banking division offered a complete wit of divenified financial products and services to consumers and small business listo products included lines of credit, automobile inventory financing, equity line pent , ocation loans residential mortgage loans and credit cards. Com.mer and basin deposit products included checking accounts, savings account, money market Individual Retire ment Accounts and time deposits The wholesale banking division provided financial solutions to businesses with annual sales exceeding milion le provided a complete line of business banking, commercial corporate Capital market cash management and real estate banking products and services. Finally, the wealth and investment management divi sion provided a full range of personalised wealth Management investment and retirement products and services to high net worth and ultra-high worth individuals and families Between 2010 and 2015. Wells Fargo's wets grow by 6 percent and net income by more than 5 percent. By carty 2015. it had posted 18 consecutive quarters of profit growth. Wells Fargo performed better than its competitions during most of these years, the bank's return on assets and return on equity were higher than those of Bank of America J.P. Morgan Chase, and Goldman Sachs les efficiency to the cost incurred to prerate a dollar of revenge) was low relative to that of its competitions of Wells Fargo's three major segments of business community banking contributed the most. In 2015, the community hanking division contributed 57 percent of revenues 99 percent of operating income and net income, and 51 percent of sales Wells Fargo's financial performance was reflected in the increase inick price. In July 2015, with market capitalization of $300 i Wells Fargo became the most valuable bank in the words and performed the made henchmark.consisting of about points 15 Cantan Pentiness and Society resources committee of the board considered the bank's financial performance (including comparison with peers, progress on strategic priorities, strong and effective leadership, business line performance for business line leaders proactive assessment and manage ment of risks, and an independent compensation consultan's advice. " in 2015. Stumpf and Tolstedt received total compensation of $19.3 million and 9.1 million, respectively Wells Fargo's Values and Code of Ethics Wells Fargo described its primary values as follows First, we value and support our people as a competitive advantage and strive to act develop retain and motivate the most talented people we can find Second we strive for the highest ethical standards with our team members, our customers our communities and our shareholders. Third, with respect to our customers, we strive to hacer decisions and act what is right for them in everything we do Fourth for cam members we strive to build and sustain a diverse and inclusive culture where they feel valued and respected for who they are as well as for the skills and experiences they bring to our company, Fifth, we who look to each of our cam members to be leaders in establishing, huring and communicating or vi Wells Fargo's Code of Ethics and Business Conduct both described the importance of ethical behavior and emphasized employees responsibility to protect the reputation and integrity of Wells Fargo. The bank also recommended a process for employees to follow when faced with an ethical dilemma they were instructed to contact their manager, HR advisor or Office of Global Ethics and Integrity for help. Employees could also report any concern regarding accounting, internal accounting controls, and auditing matters directly to the audit and examinations committee of the board or could call the bank's ethics hotline (called "EthicsLine") if they saw or suspected illegal or unethical behavior." The King of Cross-Selling" Many analysts attributed Wells Fargo's financial success in large part to its prowess in cross-selling. Cross-selling referred to the practice of marketing related or complementary products to an ceganization's existing customers cus contrasted with attracting new cus tomers). Cross-selling had several benefits. It increased a customer's reliance on the firm and decreased the likelihood he or she would switch to a competitor allowed a firm to extract the maximum revenue potential from each customer Servicing one account rather than several was also more efficient in 2006. Richard Kovacevich. Stumpfs predecessor as CEO, explained Wells Fargo's rationale for cross-selling this way Crosselling or what we called here selling is our most importants egy Why? Because it is an increasing returns business model. I like thehet work effect of commerce. It multiplies opportunities poometrically. The more you all customers, the more you know about them. The more you know them, the easier it is to sell them more products. The more products castomers have with you the better value they receive and the more loyal they are. The longer they Exhibit A Wells Fargo Cross-Sell Ratios, 1998-2016 8.00 700- 6.00 382 618 662 5.00 400 3.00 6661 2001 tie SOC 2015 2014 2013 2016 02 stay with you, the more opportunities you have to meet even more of their financial needs. The more you sell them, the higher the profit because the added cost of sell ing and the product to an existing customer is often only about 10 percent of the cost of selling that me product to a new stomer Under Stumpft and Tolstedt's Leadership. Wells Fargo continued to emphasise the impor tance of cross-selling. In addition to signing up existing customers for additional services, the bank offered customers a set of interrelated products with discounts integrated into the package. For example, its premier relationship package (called PMA) offered customers a free current account and free bill payments, topether with options to add a savings account credit card, mortgage loan and a discount brokerage account About 63 percent of new cu tomers opted for such packages, with an average of four products per package. Exhibit A depicts the cross-sell ratio (number of accounts of products per customer) of Wells Fargo from 1998 to 2016. As shown by 2009 Wells Fargo had recorded an increased cross-sell ratio for eleven consecutive years. At the time of the Wachovia acquisition in 2008, Wells Fargo's cross-sell ratio 395 per customer) was higher than Wachovia's (465). Wachovias customers therefore provided an opportunity for Wells Farge to offer additional products and services, further increasing the cross-sell ratio. In the 2010 annual report, Stumpf proposed a goal of eight accounts per customer, declaring the numbermed with great. He added. "Perhaps our new cheer should be 'Let's go again, for tentIn the same report, he also mentioned the challenges of cross-selling "If anyone tells you it's easy to earn more business from current customers in financial 497 services, don't believe them. We should know. We've been in almost a quarter centary We've been called true or not the king of cross-sell. Wells Fargo was not alone in using cross-selling as a marketing tool. Several other large and regional banks, including Bank of America. Citizens Bank PNC Bank. Sun Trust Bank, and Fifth Third Bank, also used this strategy. However, Wells Fargo's success in cross-selling was unparalleled. In the second quarter of 2016, the cross-sell ratio (number of products or accounts per customer) for US banks in 2016 averaged 2.71: Wells Fargo's To improve its cross-sell ratio, Wells Fargo developed a system of incentives for its employees. Employees who cross-sold successfully were rewarded with cura compensa tion Branch employees who hit sales targets could earn bouses of $500 to $2.000 per quarter on top of base salaries of about $25,000 to $30.000 a year." District managers could earn bonuses of $10,000 to $20.000 a year. In addition to providing bonuses, the bank mandated quotes for the number and types of products to be sold by employees. One employee remarked, "If we did not make the sales quotas, we had to stay for what felt like after school detention, or report to a call session on Saturdays. **Employees reported that branch managers routinely monitored their progress toward meeting their sales goals sometimes hourly, and sales numbers at the branch level were reported to higher-ranking managers as many as seven times a day. If an employee did not meet their quota he or she was reportedly chastised by the community banking president in front of other staff. Unauthorized Accounts While most Wells Fargo employees tried to sell the right products to the right customers some responded to the intense pressure to meet sales targets by opening accounts that customers had not authorized. An internal investigation later revealed that bank employ ces had opened as many as 1.534.280 unauthorized deposit accounts and another 565,443 unauthorized credit card accounts between 2011 and 2015. How had they done this without the customers' knowledge in some cases, employees had created phony PIN numbers and fake e-mail addresses to enroll existing customers for "Net Banking services and had forged client signatures on paperwork. Some of the questionable accounts had been created by moving a small amount of money from an existing account to open a new one for a customer. Shortly thereafter, the employees would close the new account and move the money back to the original account, thereby earning credit toward their quotes Sometimes, customers were told by phone that Wells Fargo planned to send them a new credit card as a "thank you for their business. If a customer didn't want the card, he or she was told to cut up the card when it arrived in the mail. However, most customers were unaware that issuing a new card required a credit check, which could potentially lower their credit scores 2010 shared Ownergy fonction hefugo Dutbox Doc.12.2017 Cer? Wells Fargo's Cramer Account 459 in many cases.customers did not know that a new account had been opened in their name until they received a congratulatory letter. Sometimes, when the customers complained about unwanted credit cards, the branch manager would Hame a computer glitch or say the card had been requested by someone with a similar name on several occasions, upon receiving the customer complaint. Wells Fargo refunded the amount charged to the customer. How cer, such refund would not restore any deterioration in the creditworthiness of the customer who might face higher interest rates or be denied access to credit in the future. Opening unauthorized accounts clearly violated the bank's rules. A 2007 internal docu- mentitled Sales Quality Manual stated that customer consent for each specific solution or service was required every time including for each product in a package). The document also stated that splitting a customer deposit and opening multiple accounts for the purpose of increasing potential Incentive Compensation (IC) is considered a sales integrity viola tion. When the Senate Banking Committee questioned Stumpf about the unauthorized accounts, he repeatedly stated that the vast majority of employees did the right thing, and whenever an internal investigation had found that an employee had created an account and funded it on behalf of the customer without that customer's permission, the employee was terminated. He said employees who had opened unauthorized accounts had "violated the company's code of ethics were dishonest and did not honor our culture." Wells Fargo's external auditors, KPMG, did not raise any red flags in their audit reports or in their reports on the effectiveness of internal controls at the bank during the period covered by the settlements. However, top managers knew about the problem as early as 2011, when the bank fired 1.000 employees for opening authorized accounts. The board was informed of these terminations in December 2013. the Los Angeles Times published an investigative article under the title. "Wells Fargo's Pressure Cooker Sales Culture Comes at a cost based on interviews with employees and a review of bank doc uments and court records, putting the issue in the public eye." At both the 2014 and 2015 annual meetings, employees had delivered petitions with over 10.000 signatures, urging the board to recognize the link between high-pressure sales quotes and the fraudulent opening of accounts without customer permission In August 2015. Wells Fargo hired PricewaterhouseCoopers LLP (PwC) to carry out a detailed analysis of the sales practices pertaining to all of the 82 million deposit accounts and nearly 11 million credit card accounts that had been opened between 2011 and 2015, to quan tify the remediation needed to compensate customers who had suffered because of accounts fraudulently opened in their names. About a dozen PwC employees worked on the assign ment for about a year and confirmed the prevalence of fraudulent sales practices at the bank Employees Speak Out In the wake of the congressional hearing and fines tested against Wells Fargo, dores of employees spoke to the media about their experiences wees meer.. See 2.2016 USS Summit Chefwagt. See Cangan See 20.2016. www.bong TOOBER SECURSOFT052015 shrew Store Comes Ties December 2013 D. CS 2015 Heroes Coche Sole Sette 1.20 Case inicio The Wall Street Journal reported the story of one employee (Scott Trainor) who said that managers suggested that employees hunt for sales prospects at bus stops and retire ment homes. The employees who refused to do so were harassed, penalized, and eventer minated. The New York Times reported that another employee (Dennis Russell) said that as a telephone bunker, he handled incoming customer service calls and was expected to refer 23 percent of his callers to a sales representative for additional product sales. But the customers Russell spoke with were usually in dire financial shape. Looking at their accounts, he could see mortgages in foreclosure, credit cards in collection, and cars being repossessed for overdue loan payments. The people calling didn't have assets to speak of." Rosell said. "What products could you possibly offer them in a legitimate way? It's a crock, they established the culture that made this happen it comes down from the top." Russell was fired in 2010." CBS News reported that a former bunker (Yesenia Guitron) sued Wells Fargo in 2010 claiming that intense sales pressure and unrealistic quotas drove employees to falsify doc uments and game the system to meet their sales goals. She did everything Wells Fargo had asked employees to do to report such misconduct. She told her manager about her concerns. She called Wells Fargo's ethics hotline. When those steps yielded no results, she went up the chain, contacting an HR representative and the bank's regional manager. After months of retaliatory harassment, Guitron was fired for insubordination CNN Money reported that a Wells Fargo employee Bill Bado) had called the ethics hotline and sent an e-mail to human resources in September 2013. flagging sales he was instructed to execute that he believed to be unethical. Eight days after that e-mail, he was terminated on the grounds of tardiness. Another employee (Christopher Johnson) told The New York Times that after he started working, his manager began pressuring him to open accounts for his friends and family, with or without their knowledge. Following the instructions received during training, he called the company's ethics hotline. Three days later. Johnson was fired for not meeting expectations. The dismissals of Bado and Johnson occurred despite the bank's explicit non-retaliation policy outlined in a handbook that was given to every employee. Wells Fargo's Response At the congressional hearings, Stumpf apologized several times, stating. "We recognize now that we should have done more sooner to eliminate unethical conductor incentives that may have unintentionally encouraged that conduct." He accepted full responsibility and said that the bank would take steps to address any underlying problems and restoreits customers' trust. But he also insisted that we never directed nor wanted our employees, whom we refer to as team members, to provide products and services to customers they did not want or need. The bank had already taken several remedial actions Stumpf testified that since 2011 Wells Fargo had fired 5.300 employees who had opened unauthorized accounts, but he also emphasized that this number represented a small percentage of the bank's employees, desagtestes. Se 21, 2016 geometrystywis Stone 2016 Museum Oude ces reus See Cong. Mange 2016 most of whom had done nothing wrong. The bank had refunded to customers 52.6 million of wrongfully charged fees Sample Revealed that he had commended that Wells Fargo's board rescindunvested cards of 541 million to him and $19 million to Car Tic Tolstedt, who led the bank's commity banking division where the wrongful sales practices had occurred. He said that the bank would liminate sales goals cotas for cross-selling, but would not back way from rolling completely. He also noted that although the elements involved conduct that began in 2011, the banks investigation was going back to 2009 and 2010, when Wachawi was being absorbed to determine whether misconduct was taking place thes But Stumpf's statements did line to appease the members of Congress. Many Senators and congressional members demanded prestaties and the clawback of his com penuation of about $200 million during the years of conduct. They also demanded a clow hack from Toled, who was to the end of 2016 with a $134 million paycheck mix of shares options and restricted and you have broken long-standing ethical sta dards inside the company Congressman Pick McHenry R-North Carolina). "How can you build trust most of whom had done nothing wrong. The bank had refunded to customers 52.6 million of wrongfully charged fees Sample Revealed that he had commended that Wells Fargo's board rescindunvested cards of 541 million to him and $19 million to Car Tic Tolstedt, who led the bank's commity banking division where the wrongful sales practices had occurred. He said that the bank would liminate sales goals cotas for cross-selling, but would not back way from rolling completely. He also noted that although the elements involved conduct that began in 2011, the banks investigation was going back to 2009 and 2010, when Wachawi was being absorbed to determine whether misconduct was taking place thes But Stumpf's statements did line to appease the members of Congress. Many Senators and congressional members demanded prestaties and the clawback of his com penuation of about $200 million during the years of conduct. They also demanded a clow hack from Toled, who was to the end of 2016 with a $134 million paycheck mix of shares options and restricted and you have broken long-standing ethical sta dards inside the company Congressman Pick McHenry R-North Carolina). "How can you build trust 1. Immediate Issue(s) or Problem(s): Define the immediate problem(s) or identify the decision(s) that must be made. State a time frame; how long do you have to make the decision? 2. Basic Issue(s) or Associated Issue(s): List any other issue that might influence your decision. These can be higher level strategic issues. 3. Issue(s) Analysis or Information Summary: Summarize the important or major pieces of information from the case. Identify which are the facts, opinions and assumptions. State your assumptions clearly. Analyze any financial information made available in the case; financial analysis is an essential part of your analysis. Identify any long term issues. 4. Alternatife Solutions or Options: The most important part! List the various options available to resolve the problem. Discuss each option and state the advantages (pro) and disadvantages (cons) of each option. Refer to quantitative and/or qualitative information as needed in order to demonstrate the points raised. This is the major part of the case and demonstrates that you clearly understand the issue(s) and the various possible outcomes. There are usually at least three good options in a case and often many more. Identify each option clearly and always show the pros and cons of each. 5. Recommendation(s) and Implementation: Based on the analysis of the options, state what you would do to correct the problem(recommendation) and how you would do this implementation). Your recommendation is usually a restatement of the best option. This is not the time to analyze new options. The implementation plan should list the steps and include a time frame or target date 6. Monitor and Control: State the method(s) you will use to determine if your recommendation and i implementation plan are working. Some examples are use of budgets, regularly scheduled meetings or scheduled reviews. The approach you use will depend on the nature of the recommendation ed States Focus BENIN Wells Fargo's Unauthorized Customer Accounts At its September 20, 2016, hearing the Senate Banking Committee relentlessly grilled John Stumpf, chairman and CEO of Wells Fargo, about charges that the bank had fraudu lently opened unauthorized accounts for millions of customers. Senator Elizabeth Warren (D-Mass.) began with the question. "Have you returned one single nickel of the millions of dollars you were paid while the scam was going on As Stumpf fumbled in response she concluded, So you haven't resigned. You haven't returned a single nickel of your per sonal carnings. You haven't fired a single senior executive. Instead, evidently, your defini tion of accountable is to push the blame to your low-level employees who don't have the money for a fancy PR firm to defend themselves. It's gutless leadership. A few days later, on September 29, congressional members at a hearing of the House Financial Services Committee echoed the views expressed in the Senate Congressman Gregory Meeks (D. New York) said to Stumpf. "I can't believe what I'm hearing here. You're going to tell me there's not a problem with the bank's culture Patrick McHenry (R-North Carolina) accused Stumpf of being tone dear for not grasping the scandal's impact on society's trust in the banking system The two congressional hearings followed shortly after the imposition of fines on Wells Fargo by the Consumer Financial Protection Bureau (5100 million), the Los Angeles City Attorney (550 million and the Office of the Comptroller of the Currency (535 million). The reason for these fines was that the bank had opened more than two million unauthorized checking and credit card accounts without the consent of its customers between May 2011 and July 2015. Wells Fargo settled with these regulatory agencies without admitting or deny ing the alleged misconduct. These fines were not the bank's only problems. Other lawsuits against Wells Fargo-from customers, former employees, and shareholders-had started pil- ing up. Shareholders had filed a class action lawsuit alleging that the bank had misled inves- tors about its financial performance and the success of its sales practices. The price of Wells Fargo's stock had fallen more than 10 percent since September 8, when it reached the Sommer, der i denne typy 2017 by Crochenende energed by Door to the complete the Cow Research Journal Song 2017, sage: Schuing Agan. The red by the autos for the serving or connettered to the hecter etter ceso Chet of Guess Law Times See 20,2016 Postforeningens fuge Over Soestches the weet umet Se 16.2016 154 Cars leies and Society settlement with regulator, wiping out more than 525 illice of market capitalization Stumpf and his leadership team faced a major crisis Wells Fargo and Company Henry Wells and William Furgo founded Wells Fargo and Company on March 18, 1852. The company bean by offering bunking and express services in California, and soon afterwards, formed an overland mail service, becoming indelibly linked with the image of a sapecoach drawn by si thundering stations. The bank survived the Great Depression as well as the difficult period of World War I. The prosperity of the 1960s saw the bank emerge as a major regional bank in the western part of the United States. By the 1980s, when it started its online banking service, Wells Fargo had become one of the top ten U.S. bunk The bank weathered the financial crisis of 2007-2008 relatively scathed. In fact, Wells Fargo use it as an opportunity to grow by acquiring Wachovia a bank weakened by the mortgage crisis in 2008. Wachovia's culsive real work in the eastern United States, which complemented Wells Fargo's enabled the bank to double both its number of branches and total deposits. By the end of 2015. Wells Fargo had become a diversified banking and financial services company with its of over $1.8 trillion and approximately 265.000 employees, serving one in the US household In 2015. Wells Fargo was organized into the majorelatively segments These were community banking, wholesale banking and wealth and manage ment. The community banking division offered a complete wit of divenified financial products and services to consumers and small business listo products included lines of credit, automobile inventory financing, equity line pent , ocation loans residential mortgage loans and credit cards. Com.mer and basin deposit products included checking accounts, savings account, money market Individual Retire ment Accounts and time deposits The wholesale banking division provided financial solutions to businesses with annual sales exceeding milion le provided a complete line of business banking, commercial corporate Capital market cash management and real estate banking products and services. Finally, the wealth and investment management divi sion provided a full range of personalised wealth Management investment and retirement products and services to high net worth and ultra-high worth individuals and families Between 2010 and 2015. Wells Fargo's wets grow by 6 percent and net income by more than 5 percent. By carty 2015. it had posted 18 consecutive quarters of profit growth. Wells Fargo performed better than its competitions during most of these years, the bank's return on assets and return on equity were higher than those of Bank of America J.P. Morgan Chase, and Goldman Sachs les efficiency to the cost incurred to prerate a dollar of revenge) was low relative to that of its competitions of Wells Fargo's three major segments of business community banking contributed the most. In 2015, the community hanking division contributed 57 percent of revenues 99 percent of operating income and net income, and 51 percent of sales Wells Fargo's financial performance was reflected in the increase inick price. In July 2015, with market capitalization of $300 i Wells Fargo became the most valuable bank in the words and performed the made henchmark.consisting of about points 15 Cantan Pentiness and Society resources committee of the board considered the bank's financial performance (including comparison with peers, progress on strategic priorities, strong and effective leadership, business line performance for business line leaders proactive assessment and manage ment of risks, and an independent compensation consultan's advice. " in 2015. Stumpf and Tolstedt received total compensation of $19.3 million and 9.1 million, respectively Wells Fargo's Values and Code of Ethics Wells Fargo described its primary values as follows First, we value and support our people as a competitive advantage and strive to act develop retain and motivate the most talented people we can find Second we strive for the highest ethical standards with our team members, our customers our communities and our shareholders. Third, with respect to our customers, we strive to hacer decisions and act what is right for them in everything we do Fourth for cam members we strive to build and sustain a diverse and inclusive culture where they feel valued and respected for who they are as well as for the skills and experiences they bring to our company, Fifth, we who look to each of our cam members to be leaders in establishing, huring and communicating or vi Wells Fargo's Code of Ethics and Business Conduct both described the importance of ethical behavior and emphasized employees responsibility to protect the reputation and integrity of Wells Fargo. The bank also recommended a process for employees to follow when faced with an ethical dilemma they were instructed to contact their manager, HR advisor or Office of Global Ethics and Integrity for help. Employees could also report any concern regarding accounting, internal accounting controls, and auditing matters directly to the audit and examinations committee of the board or could call the bank's ethics hotline (called "EthicsLine") if they saw or suspected illegal or unethical behavior." The King of Cross-Selling" Many analysts attributed Wells Fargo's financial success in large part to its prowess in cross-selling. Cross-selling referred to the practice of marketing related or complementary products to an ceganization's existing customers cus contrasted with attracting new cus tomers). Cross-selling had several benefits. It increased a customer's reliance on the firm and decreased the likelihood he or she would switch to a competitor allowed a firm to extract the maximum revenue potential from each customer Servicing one account rather than several was also more efficient in 2006. Richard Kovacevich. Stumpfs predecessor as CEO, explained Wells Fargo's rationale for cross-selling this way Crosselling or what we called here selling is our most importants egy Why? Because it is an increasing returns business model. I like thehet work effect of commerce. It multiplies opportunities poometrically. The more you all customers, the more you know about them. The more you know them, the easier it is to sell them more products. The more products castomers have with you the better value they receive and the more loyal they are. The longer they Exhibit A Wells Fargo Cross-Sell Ratios, 1998-2016 8.00 700- 6.00 382 618 662 5.00 400 3.00 6661 2001 tie SOC 2015 2014 2013 2016 02 stay with you, the more opportunities you have to meet even more of their financial needs. The more you sell them, the higher the profit because the added cost of sell ing and the product to an existing customer is often only about 10 percent of the cost of selling that me product to a new stomer Under Stumpft and Tolstedt's Leadership. Wells Fargo continued to emphasise the impor tance of cross-selling. In addition to signing up existing customers for additional services, the bank offered customers a set of interrelated products with discounts integrated into the package. For example, its premier relationship package (called PMA) offered customers a free current account and free bill payments, topether with options to add a savings account credit card, mortgage loan and a discount brokerage account About 63 percent of new cu tomers opted for such packages, with an average of four products per package. Exhibit A depicts the cross-sell ratio (number of accounts of products per customer) of Wells Fargo from 1998 to 2016. As shown by 2009 Wells Fargo had recorded an increased cross-sell ratio for eleven consecutive years. At the time of the Wachovia acquisition in 2008, Wells Fargo's cross-sell ratio 395 per customer) was higher than Wachovia's (465). Wachovias customers therefore provided an opportunity for Wells Farge to offer additional products and services, further increasing the cross-sell ratio. In the 2010 annual report, Stumpf proposed a goal of eight accounts per customer, declaring the numbermed with great. He added. "Perhaps our new cheer should be 'Let's go again, for tentIn the same report, he also mentioned the challenges of cross-selling "If anyone tells you it's easy to earn more business from current customers in financial 497 services, don't believe them. We should know. We've been in almost a quarter centary We've been called true or not the king of cross-sell. Wells Fargo was not alone in using cross-selling as a marketing tool. Several other large and regional banks, including Bank of America. Citizens Bank PNC Bank. Sun Trust Bank, and Fifth Third Bank, also used this strategy. However, Wells Fargo's success in cross-selling was unparalleled. In the second quarter of 2016, the cross-sell ratio (number of products or accounts per customer) for US banks in 2016 averaged 2.71: Wells Fargo's To improve its cross-sell ratio, Wells Fargo developed a system of incentives for its employees. Employees who cross-sold successfully were rewarded with cura compensa tion Branch employees who hit sales targets could earn bouses of $500 to $2.000 per quarter on top of base salaries of about $25,000 to $30.000 a year." District managers could earn bonuses of $10,000 to $20.000 a year. In addition to providing bonuses, the bank mandated quotes for the number and types of products to be sold by employees. One employee remarked, "If we did not make the sales quotas, we had to stay for what felt like after school detention, or report to a call session on Saturdays. **Employees reported that branch managers routinely monitored their progress toward meeting their sales goals sometimes hourly, and sales numbers at the branch level were reported to higher-ranking managers as many as seven times a day. If an employee did not meet their quota he or she was reportedly chastised by the community banking president in front of other staff. Unauthorized Accounts While most Wells Fargo employees tried to sell the right products to the right customers some responded to the intense pressure to meet sales targets by opening accounts that customers had not authorized. An internal investigation later revealed that bank employ ces had opened as many as 1.534.280 unauthorized deposit accounts and another 565,443 unauthorized credit card accounts between 2011 and 2015. How had they done this without the customers' knowledge in some cases, employees had created phony PIN numbers and fake e-mail addresses to enroll existing customers for "Net Banking services and had forged client signatures on paperwork. Some of the questionable accounts had been created by moving a small amount of money from an existing account to open a new one for a customer. Shortly thereafter, the employees would close the new account and move the money back to the original account, thereby earning credit toward their quotes Sometimes, customers were told by phone that Wells Fargo planned to send them a new credit card as a "thank you for their business. If a customer didn't want the card, he or she was told to cut up the card when it arrived in the mail. However, most customers were unaware that issuing a new card required a credit check, which could potentially lower their credit scores 2010 shared Ownergy fonction hefugo Dutbox Doc.12.2017 Cer? Wells Fargo's Cramer Account 459 in many cases.customers did not know that a new account had been opened in their name until they received a congratulatory letter. Sometimes, when the customers complained about unwanted credit cards, the branch manager would Hame a computer glitch or say the card had been requested by someone with a similar name on several occasions, upon receiving the customer complaint. Wells Fargo refunded the amount charged to the customer. How cer, such refund would not restore any deterioration in the creditworthiness of the customer who might face higher interest rates or be denied access to credit in the future. Opening unauthorized accounts clearly violated the bank's rules. A 2007 internal docu- mentitled Sales Quality Manual stated that customer consent for each specific solution or service was required every time including for each product in a package). The document also stated that splitting a customer deposit and opening multiple accounts for the purpose of increasing potential Incentive Compensation (IC) is considered a sales integrity viola tion. When the Senate Banking Committee questioned Stumpf about the unauthorized accounts, he repeatedly stated that the vast majority of employees did the right thing, and whenever an internal investigation had found that an employee had created an account and funded it on behalf of the customer without that customer's permission, the employee was terminated. He said employees who had opened unauthorized accounts had "violated the company's code of ethics were dishonest and did not honor our culture." Wells Fargo's external auditors, KPMG, did not raise any red flags in their audit reports or in their reports on the effectiveness of internal controls at the bank during the period covered by the settlements. However, top managers knew about the problem as early as 2011, when the bank fired 1.000 employees for opening authorized accounts. The board was informed of these terminations in December 2013. the Los Angeles Times published an investigative article under the title. "Wells Fargo's Pressure Cooker Sales Culture Comes at a cost based on interviews with employees and a review of bank doc uments and court records, putting the issue in the public eye." At both the 2014 and 2015 annual meetings, employees had delivered petitions with over 10.000 signatures, urging the board to recognize the link between high-pressure sales quotes and the fraudulent opening of accounts without customer permission In August 2015. Wells Fargo hired PricewaterhouseCoopers LLP (PwC) to carry out a detailed analysis of the sales practices pertaining to all of the 82 million deposit accounts and nearly 11 million credit card accounts that had been opened between 2011 and 2015, to quan tify the remediation needed to compensate customers who had suffered because of accounts fraudulently opened in their names. About a dozen PwC employees worked on the assign ment for about a year and confirmed the prevalence of fraudulent sales practices at the bank Employees Speak Out In the wake of the congressional hearing and fines tested against Wells Fargo, dores of employees spoke to the media about their experiences wees meer.. See 2.2016 USS Summit Chefwagt. See Cangan See 20.2016. www.bong TOOBER SECURSOFT052015 shrew Store Comes Ties December 2013 D. CS 2015 Heroes Coche Sole Sette 1.20 Case inicio The Wall Street Journal reported the story of one employee (Scott Trainor) who said that managers suggested that employees hunt for sales prospects at bus stops and retire ment homes. The employees who refused to do so were harassed, penalized, and eventer minated. The New York Times reported that another employee (Dennis Russell) said that as a telephone bunker, he handled incoming customer service calls and was expected to refer 23 percent of his callers to a sales representative for additional product sales. But the customers Russell spoke with were usually in dire financial shape. Looking at their accounts, he could see mortgages in foreclosure, credit cards in collection, and cars being repossessed for overdue loan payments. The people calling didn't have assets to speak of." Rosell said. "What products could you possibly offer them in a legitimate way? It's a crock, they established the culture that made this happen it comes down from the top." Russell was fired in 2010." CBS News reported that a former bunker (Yesenia Guitron) sued Wells Fargo in 2010 claiming that intense sales pressure and unrealistic quotas drove employees to falsify doc uments and game the system to meet their sales goals. She did everything Wells Fargo had asked employees to do to report such misconduct. She told her manager about her concerns. She called Wells Fargo's ethics hotline. When those steps yielded no results, she went up the chain, contacting an HR representative and the bank's regional manager. After months of retaliatory harassment, Guitron was fired for insubordination CNN Money reported that a Wells Fargo employee Bill Bado) had called the ethics hotline and sent an e-mail to human resources in September 2013. flagging sales he was instructed to execute that he believed to be unethical. Eight days after that e-mail, he was terminated on the grounds of tardiness. Another employee (Christopher Johnson) told The New York Times that after he started working, his manager began pressuring him to open accounts for his friends and family, with or without their knowledge. Following the instructions received during training, he called the company's ethics hotline. Three days later. Johnson was fired for not meeting expectations. The dismissals of Bado and Johnson occurred despite the bank's explicit non-retaliation policy outlined in a handbook that was given to every employee. Wells Fargo's Response At the congressional hearings, Stumpf apologized several times, stating. "We recognize now that we should have done more sooner to eliminate unethical conductor incentives that may have unintentionally encouraged that conduct." He accepted full responsibility and said that the bank would take steps to address any underlying problems and restoreits customers' trust. But he also insisted that we never directed nor wanted our employees, whom we refer to as team members, to provide products and services to customers they did not want or need. The bank had already taken several remedial actions Stumpf testified that since 2011 Wells Fargo had fired 5.300 employees who had opened unauthorized accounts, but he also emphasized that this number represented a small percentage of the bank's employees, desagtestes. Se 21, 2016 geometrystywis Stone 2016 Museum Oude ces reus See Cong. Mange 2016 most of whom had done nothing wrong. The bank had refunded to customers 52.6 million of wrongfully charged fees Sample Revealed that he had commended that Wells Fargo's board rescindunvested cards of 541 million to him and $19 million to Car Tic Tolstedt, who led the bank's commity banking division where the wrongful sales practices had occurred. He said that the bank would liminate sales goals cotas for cross-selling, but would not back way from rolling completely. He also noted that although the elements involved conduct that began in 2011, the banks investigation was going back to 2009 and 2010, when Wachawi was being absorbed to determine whether misconduct was taking place thes But Stumpf's statements did line to appease the members of Congress. Many Senators and congressional members demanded prestaties and the clawback of his com penuation of about $200 million during the years of conduct. They also demanded a clow hack from Toled, who was to the end of 2016 with a $134 million paycheck mix of shares options and restricted and you have broken long-standing ethical sta dards inside the company Congressman Pick McHenry R-North Carolina). "How can you build trust most of whom had done nothing wrong. The bank had refunded to customers 52.6 million of wrongfully charged fees Sample Revealed that he had commended that Wells Fargo's board rescindunvested cards of 541 million to him and $19 million to Car Tic Tolstedt, who led the bank's commity banking division where the wrongful sales practices had occurred. He said that the bank would liminate sales goals cotas for cross-selling, but would not back way from rolling completely. He also noted that although the elements involved conduct that began in 2011, the banks investigation was going back to 2009 and 2010, when Wachawi was being absorbed to determine whether misconduct was taking place thes But Stumpf's statements did line to appease the members of Congress. Many Senators and congressional members demanded prestaties and the clawback of his com penuation of about $200 million during the years of conduct. They also demanded a clow hack from Toled, who was to the end of 2016 with a $134 million paycheck mix of shares options and restricted and you have broken long-standing ethical sta dards inside the company Congressman Pick McHenry R-North Carolina). "How can you build trust 1. Immediate Issue(s) or Problem(s): Define the immediate problem(s) or identify the decision(s) that must be made. State a time frame; how long do you have to make the decision? 2. Basic Issue(s) or Associated Issue(s): List any other issue that might influence your decision. These can be higher level strategic issues. 3. Issue(s) Analysis or Information Summary: Summarize the important or major pieces of information from the case. Identify which are the facts, opinions and assumptions. State your assumptions clearly. Analyze any financial information made available in the case; financial analysis is an essential part of your analysis. Identify any long term issues. 4. Alternatife Solutions or Options: The most important part! List the various options available to resolve the problem. Discuss each option and state the advantages (pro) and disadvantages (cons) of each option. Refer to quantitative and/or qualitative information as needed in order to demonstrate the points raised. This is the major part of the case and demonstrates that you clearly understand the issue(s) and the various possible outcomes. There are usually at least three good options in a case and often many more. Identify each option clearly and always show the pros and cons of each. 5. Recommendation(s) and Implementation: Based on the analysis of the options, state what you would do to correct the problem(recommendation) and how you would do this implementation). Your recommendation is usually a restatement of the best option. This is not the time to analyze new options. The implementation plan should list the steps and include a time frame or target date 6. Monitor and Control: State the method(s) you will use to determine if your recommendation and i implementation plan are working. Some examples are use of budgets, regularly scheduled meetings or scheduled reviews. The approach you use will depend on the nature of the recommendation ed States Focus BENIN