Question: Blossom Corporation is a publicly traded company and follows IFRS. On December 31, 2022, Blossom's financial records indicated the following information related to the company's

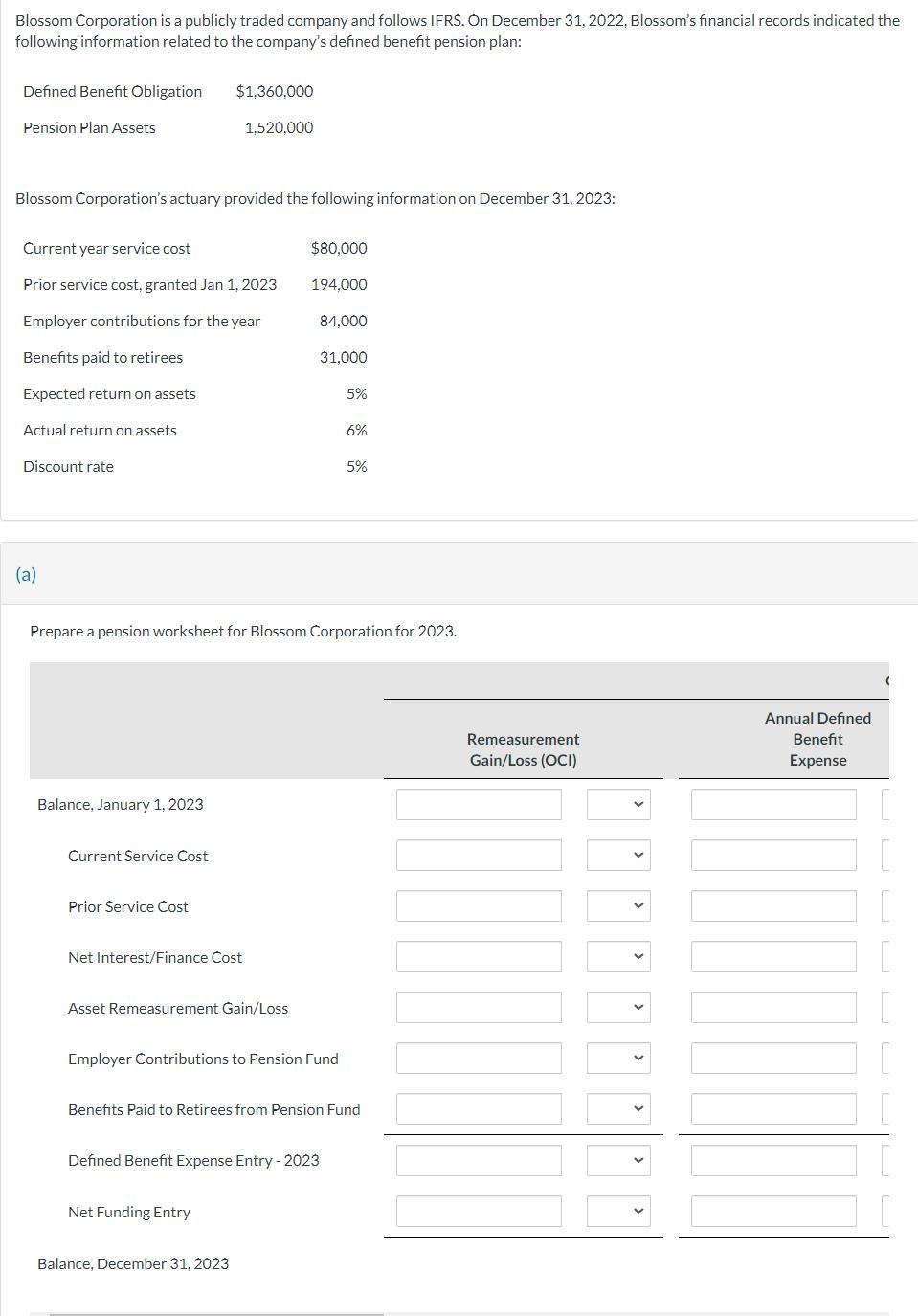

Blossom Corporation is a publicly traded company and follows IFRS. On December 31, 2022, Blossom's financial records indicated the following information related to the company's defined benefit pension plan: Defined Benefit Obligation Pension Plan Assets Blossom Corporation's actuary provided the following information on December 31, 2023: Current year service cost Prior service cost, granted Jan 1, 2023 Employer contributions for the year Benefits paid to retirees Expected return on assets Actual return on assets Discount rate (a) Balance, January 1, 2023 Current Service Cost $1,360,000 1,520.000 Prior Service Cost Net Interest/Finance Cost Asset Remeasurement Gain/Loss $80,000 Prepare a pension worksheet for Blossom Corporation for 2023. 194,000 Net Funding Entry 84,000 Balance, December 31, 2023 31,000 Employer Contributions to Pension Fund Defined Benefit Expense Entry-2023 5% 6% Benefits Paid to Retirees from Pension Fund 5% Remeasurement Gain/Loss (OCI) < Annual Defined Benefit Expense

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Answer I Step 1 i Meaning of pension expense The cost incurred by a corp... View full answer

Get step-by-step solutions from verified subject matter experts