Question: Please read the case in the file BCPC_CASE.pdf and answer each question using maximum 1 page per question. Question 1) Put yourself in the shoes

Please read the case in the file BCPC_CASE.pdf and answer each question using maximum 1 page per question.

Question 1) Put yourself in the shoes of the VP of Finance, Morgan Jones.

Part A) Identify and explain briefly a finance related challenge/problem in the case (You can find the finance related information on pages 4 and 5). Justify why this is a challenge.

Part B) Propose alternative courses of actions/perspectives that can be used to solve this challenge/problem. You should use the finance related information provided to answer this question.

Part C) Do you think the data provided in the case is sufficient to propose a solution to this challenge/problem, or do you need additional data? If yes, what would that data be? Specify.

Part D) Briefly discuss the implications and consequences of the solution you proposed in Part B above.

Question 2) Put yourself in the shoes of the VP of Marketing, Jan Trow.

Part A) Identify and explain briefly a marketing related challenge/problem in the case. Justify why this is a challenge.

Part B) Propose alternative courses of actions/perspectives that can be used to solve this challenge/problem.

Part C) Briefly discuss the implications and consequences of the solution you proposed in Part B above.

Question 3) Put yourself in the shoes of the director of Operations Management, Robin Rhee. Part A) Identify and explain briefly a marketing related challenge/problem in the case. Justify why this is a challenge.

Part B) Propose alternative courses of actions/perspectives that can be used to solve this challenge/problem.

Part C) Briefly discuss the implications and consequences of the solution you proposed in Part B above.

It is okay even if there not very long answers. Brief answers are okay. Thank you.

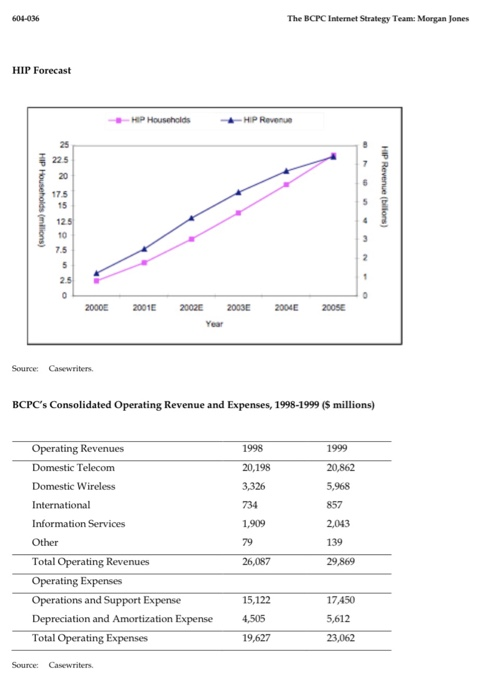

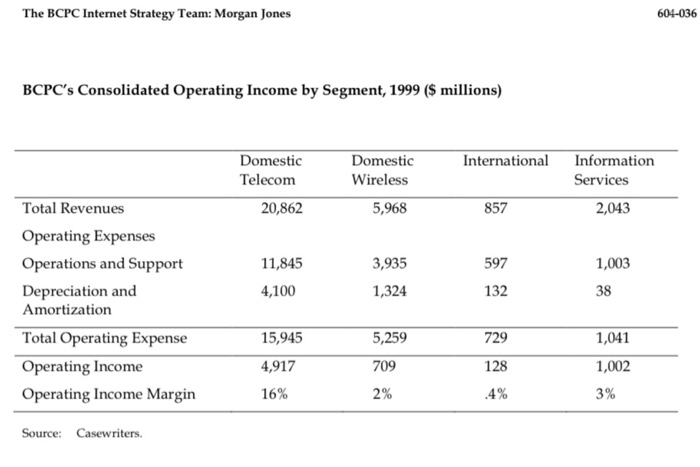

604-035 The BCPC Internet Strategy Team: An Exercise player in the wireless technology market with almost ten million subscribers. In providing Internet access, BCPC also competed with cable companies. Culture of Customer Service Service was a key value at BCPC. Top executives considered customer service to be BCPC's key differentiator in the telecommunications market and strove for only "Very good" and "Outstanding ratings in customer surveys. Research indicated a substantial drop-off in customer loyalty among people who gave BCPC "Satisfactory" ratings. To continually exceed customer expectations, BCPC ran monthly surveys of 7,500 customers in which they measured satisfaction with various types of company contact by geographic region. Results were analyzed and translated into internal business practices that addressed root causes. For example, the director of customer feedback commented, We periodically do rigorous statistical analysis of the data to determine what we call the "key drivers." We try to find the internal process measures that correspond to these two, three, or four top items. When that is finished, we communicate the information to the field groups so that they understand what's important to customers. We look at the cycle time customers have experienced and find the break point to maximize satisfaction levels. In the consumer market we find that about 24 hours is the maximum length of the tolerance for service breakdowns. Customer survey results were dispersed to the top as well as to the front lines of the organization: the CEO and other top managers received monthly reports, from which they reviewed and revised goals and objectives. Managers took these reviews very seriously; 25% of management team bonuses were tied to these results. The results were translated into precise processes and procedures that enabled customer service representatives to provide high quality service on the front lines. Human Resources With the exception of weather-related challenges, BCPC could predict the level of demand for its services, as well as how long each service encounter was likely to take, with a high degree of accuracy, facilitating accurate planning and staffing, and providing a foundation for its culture of customer service. The idea behind BCPC's intensive customer representative training process was, in the words of one BCPC trainer, that "first impressions are lasting impressions, and when a customer calls and speaks to you, you are BCPC. Furthermore, when a customer calls it may be the only contact they have with BCPC for years. So the impression you make is that much more important." BCPC was known to screen as many as 20,000 people to fill 800 positions. Once hired, the representatives were enrolled in a four-month classroom and field course that taught them the details of the job (billing, regulatory requirements, and services such as call waiting) and the high level of interpersonal skills they would need to deal with difficult customers. The representatives were allowed some leeway with respect to language and procedures but primarily followed scripts and relied on an online database of information and troubleshooting support. 2 HIP HIP was a modem technology that used existing telephone lines to transport high-bandwidth data such as multimedia and video to service subscriber personal computers (PCs). By turning a customer's existing phone line into a three-channel data delivery system, phone and internet services were available simultaneously. HIP access was six times faster than that of traditional analog modem and cost only $10 more per month than local phone service (540 instead of $30). There was a very high customer demand for the new HIP service. Both cable and phone companies could offer HIP. Under federal regulations, local regional carriers (such as BCPC) were required to make their networks available "at cost" to third-party providers. This meant that BCPC was required to be a wholesale provider of HIP service and had the option of being a service provider. Similarly, BCPC was required to sell its network capacity for local and long distance services to incumbent competitors. The HIP technology required users to have a signal splitter (to separate the phone and internet data streams), a HIP modem, and, of course, a PC that met HIP system requirements (a broad range of PC possibilities were available at that time). There were installation challenges at BCPC and customer locations that required considerable technical skill. To provide HIP service BCPC would have to integrate many vendors' technologies. Team leader Berkowitz observed: "You've got this end-to-end experience that's incredibly complicated." BCPC had just completed a successful three-month market test of 25 customers in southeastern Tennessee. While BCPC anticipated that its brand name could attract HIP users, some were concerned that supporting such a qualitatively different service might hinder BCPC's ability to provide its trademark reliable and excellent customer support. For this reason, BCPC planned to rigorously survey HIP customers to ensure that they were continuing to achieve "Very good" and "Outstanding" ratings of service quality. The Team The multi-functional team convening to discuss BCPC's internet strategy included Berkowitz from business development, and five other members: Morgan Jones, VP of Finance, Alex Wilson, VP of Marketing, Jan Trow, Senior Project Director of Information Systems, Robin Rhee, Director of Operations Management, and Terry Maneri, Director of Human Resources. Team members represented several levels of hierarchy at BCPC, creating a challenge for open communication and teamwork. Nonetheless, Chris hoped that team members would introduce themselves and start right in on their work. The questions they would have to answer before reporting back to BCPC's CEO were: (1) What do you recommend BCPC do in terms of the launch of HIP in Big City? (2) What were the key issues you considered in making this decision? Exhibit 1 provides guidelines for participating in the BCPC team decision-making exercise. 3 604-026 The BCPC Internet Strategy Team: Morgan Jones HIP Forecast HIP Households HIPS PRevenue 25 225 20 HIP Households (milions) HIP Revenue (billons) 175 15 3 125 10 7.5 5 2.5 0 2 2000E 2001E 2002 2004E 200SE 2003E Year Source: Casewriters BCPC's Consolidated Operating Revenue and Expenses, 1998-1999 (5 millions) 1998 1999 20,198 3,326 734 20,862 5,968 857 2,043 Operating Revenues Domestic Telecom Domestic Wireless International Information Services Other Total Operating Revenues Operating Expenses Operations and Support Expense Depreciation and Amortization Expense Total Operating Expenses 1,909 79 139 26,087 29,869 15,122 4,505 17,450 5,612 19,627 23,062 Source: Casewriters. The BCPC Internet Strategy Team: Morgan Jones 604-036 BCPC's Consolidated Operating Income by Segment, 1999 ($ millions) Domestic Telecom 20,862 Domestic Wireless 5,968 International Information Services 857 2,043 11,845 4,100 3,935 1,324 597 132 1,003 38 Total Revenues Operating Expenses Operations and Support Depreciation and Amortization Total Operating Expense Operating Income Operating Income Margin 729 15,945 4,917 5,259 709 128 1,041 1,002 3% 16% 2% .4% Source: Casewriters