Question: Please read the case study and provide a problem with FINANCE within the company. Then provide a full justification and recommendations at a page minimum.

Please read the case study and provide a problem with FINANCE within the company. Then provide a full justification and recommendations at a page minimum.

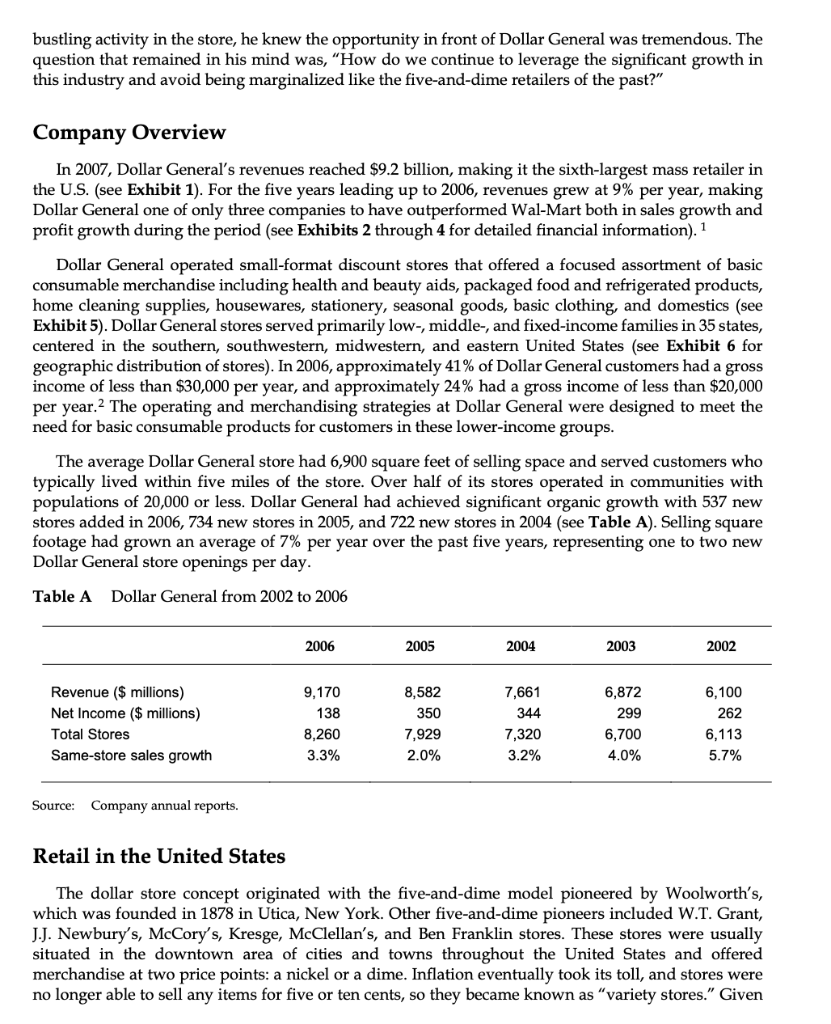

Ironically, small-box retailers like Dollar General owe their growth to the success of our big-box rivals. The dominance of big-box retail fuels the demand for a convenient alternative. - David Perdue, Chairman and CEO, Dollar General Walking through the home cleaning aisle of a Dollar General store in Nashville, Tennessee, David Perdue, CEO of Dollar General, reflected on the significant progress the dollar store industry, and Dollar General in particular, had made in the United States over the past decade. Many consumers in the U.S. still believed that the large dollar store retailers focused on low-priced knick-knacks. In 2007, however, this was far from reality. The majority of the products sold at Dollar General were household consumables priced under $10, and one-third of these products were nationally branded consumer goods including Tide, Pepsi, and Kellogg's Cereal. The dollar store industry, led by Dollar General, had been the fastest-growing retail channel throughout the United States over the past decade with the only exception being supercenters (such as Sam's Club and Costco). At the beginning of 2007, Perdue had reason to be pleased. Since he had taken leadership of the company in 2003, the company had grown from 6,273 stores to 8,260 in early 2007. Revenues had increased to $9.2 billion by the end of fiscal year 2006, representing a 9% cumulative average growth rate over the past five years. This frenetic pace of growth, while very exciting, also created some growing pains for Dollar General. During fiscal year 2006, Dollar General was forced to address a number of structural issues pertaining to its growth. The company closed over 200 low-potential stores and wrote off a significant amount of old inventory that had built up over time. Perdue knew that there remained significant growth opportunities within the U.S., but the question hanging over his head was how to achieve both sustainable and profitable growth for the long term. With 8,260 company-owned stores in the U.S., maintaining the current growth rate was going to be challenging. "Should we continue to drive growth through new store openings?" Perdue thought to himself as he stood in the store, "or should we focus more on our existing stores and look to drive growth through merchandising and in-store operational improvements?" As Perdue watched a customer add a $20 leather jacket to her shopping cart, which was already filled with grocery items including soup, bread, and soda, he once again was struck by the unique position Dollar General occupied in the marketplace. The company had evolved over the past decade to become a retailer that provided highly consumable products in addition to the traditional dollar store "treasure-hunt" items. As Perdue observed the bustling activity in the store, he knew the opportunity in front of Dollar General was tremendous. The question that remained in his mind was, "How do we continue to leverage the significant growth in this industry and avoid being marginalized like the five-and-dime retailers of the past?" Company Overview In 2007, Dollar General's revenues reached $9.2 billion, making it the sixth-largest mass retailer in the U.S. (see Exhibit 1). For the five years leading up to 2006, revenues grew at 9% per year, making Dollar General one of only three companies to have outperformed Wal-Mart both in sales growth and profit growth during the period (see Exhibits 2 through 4 for detailed financial information). 1 Dollar General operated small-format discount stores that offered a focused assortment of basic consumable merchandise including health and beauty aids, packaged food and refrigerated products, home cleaning supplies, housewares, stationery, seasonal goods, basic clothing, and domestics (see Exhibit 5). Dollar General stores served primarily low-, middle-, and fixed-income families in 35 states, centered in the southern, southwestern, midwestern, and eastern United States (see Exhibit 6 for geographic distribution of stores). In 2006, approximately 41% of Dollar General customers had a gross income of less than $30,000 per year, and approximately 24% had a gross income of less than $20,000 per year. 2 The operating and merchandising strategies at Dollar General were designed to meet the need for basic consumable products for customers in these lower-income groups. The average Dollar General store had 6,900 square feet of selling space and served customers who typically lived within five miles of the store. Over half of its stores operated in communities with populations of 20,000 or less. Dollar General had achieved significant organic growth with 537 new stores added in 2006, 734 new stores in 2005, and 722 new stores in 2004 (see Table A). Selling square footage had grown an average of 7% per year over the past five years, representing one to two new Dollar General store openings per day. Table A Dollar General from 2002 to 2006 Source: Company annual reports. Retail in the United States The dollar store concept originated with the five-and-dime model pioneered by Woolworth's, which was founded in 1878 in Utica, New York. Other five-and-dime pioneers included W.T. Grant, J.J. Newbury's, McCory's, Kresge, McClellan's, and Ben Franklin stores. These stores were usually situated in the downtown area of cities and towns throughout the United States and offered merchandise at two price points: a nickel or a dime. Inflation eventually took its toll, and stores were no longer able to sell any items for five or ten cents, so they became known as "variety stores." Given that $0.05 in 1913, adjusted for inflation, was $1.01 in 2006 dollars, the five-and-dime retailing concept had shown remarkable strength over the years. 3 Woolworth's original five-and-dime concept was widely copied during the first part of the twentieth century, and its stores were a fixture in American downtowns through the 1960s. Woolworth's was also among the pioneering group of retailers that evolved the five-and-dime concept to a larger discount store format. In 1962, Woolworth's founded a discount chain called Woolco. This was the same year that its competitors opened similar discount chains: the S.S. Kresge Co. opened Kmart, the Dayton Company opened Target, and Sam Walton opened his first Wal-Mart. Interestingly, as the larger-format discount retailers grew at a rapid pace, the five-and-dime stores remained primarily locally owned and never found the growth engine other retailers found in the 1960s and 1970s. It was not until the 1990s that the dollar store segment truly broke away from its five-and-dime roots with a shift in product mix and the industry began to achieve significant growth. Extreme-Value Retailing Dollar Stores vs. Extreme-Value Retailers While the roots of the dollar store lay with the five-and-dime stores of the past, today four distinct types of retailers fell under the dollar store umbrella. The first type was the original dollar store, which carried on the tradition of its predecessors, the five-and-dime stores. These stores were single-price-point retailers that adhered to the strict philosophy of selling every item for $1 or less. The two major retailers in the U.S. where "everything is a dollar" included 99 Cents Only and Dollar Tree. The second subcategory of the dollar store segment was the close-out retailer. These stores sold overstock, discontinued, surplus, and distressed merchandise. Big Lots and Tuesday Morning were the two companies that fell into this category in the U.S. Many items in these stores were usually available for $1, but the quality was wildly inconsistent and the selection varied dramatically from day to day. Limited assortment grocery retailers were considered a third subcategory of the dollar store segment. Save-A-Lot and Aldi were the two major U.S. firms in this category. These stores offered a small number of grocery stock-keeping units (SKUs) and primarily offered private-label products instore. Extreme-value retailers represented the fourth type of dollar store in the United States. These retailers offered everyday low prices (EDLP) in a small-box format. They had a more focused assortment of goods compared to mass retailers such as Wal-Mart but still stocked a significant number of nationally branded products. Mass retailers (e.g., Wal-Mart, Target) and supercenters (e.g., Sam's Club, Costco) competed on large assortments and price, while small-box extreme-value retailers competed on convenience and price. Many products offered at extreme-value retailers were in fact $1; however, price points could range up to $10 or $15. Dollar General and Family Dollar were the largest players in the extreme-value retail segment in the United States. (See Exhibit 7 for an overview of U.S. dollar stores and format types.) Extreme-Value Retail The extreme-value channel in the United States in 2007 was estimated to total $46 billion. (Exhibit 8 shows the breakdown by subcategory.) The growth rate in the sector had been almost twice that of the overall retail sector from 2000 to 2005 , growing at a 10.2% compound annual growth rate (CAGR) during this period compared with 5.6% for the retail sector as a whole. 4 In 2006 , Dollar General and Family Dollar combined represented approximately 40% of the overall revenue in the extreme-value retailing channel in the U.S. Beyond these two major extreme-value retailers, the industry was highly fragmented and remained regionalized. Dollar General and Family Dollar themselves were regional players, and both operated mainly in the southeastern, southwestern, and midwestern United States. In the United States in 2007 there were approximately 23,000 small-format discount retail outlets. Small-box discounters outnumbered supercenters 16 to 1 in the U.S. The growth in the sector could be attributed to two main drivers: - The new bargain-based mentality of the American consumer. Over the past three decades, Wal-Mart, Target, and Costco (among others) created a culture shift in the U.S. whereby consumers turned into bargain hunters. Some observers termed this the "hour-glass economy," where there is a bifurcation of shopping behavior. Shoppers make aspirational purchases in one channel and augment these purchases with commodity purchases in the discount channel. This channel blurring continued to lift the popularity of warehouses, supercenters, and extreme-value retailers in the U.S. In 2005, 67% of American households shopped at some type of dollar store, up from 55% in 2000.5 This was the largest household penetration increase of any bricks-andmortar retail channel over this period. - The rising percentage of U.S. households in lower-income brackets and/or on fixed incomes. In 2005, 37 million Americans had household incomes below the poverty line as defined by the U.S. Census Bureau. 6 The number of Americans living below the poverty line increased 12% from 2000 to 2005. In addition to growth in the lower-income brackets, an aging population in the U.S. contributed to a rise in the number of people on fixed incomes. The post-World War II babyboom bubble will continue to dramatically increase the ranks of the elderly over the next decade and likely drive increased demand for value discounters in the U.S. Company History Dollar General was founded in 1939 as a wholesale dry goods retailer by J.L. Turner and his son Cal Turner. The company eventually switched from wholesale to retail, and in 1955 Dollar General opened its first dollar store in Kentucky. In 1965, Cal Turner, Jr. joined his father in management of the company, and they took the company public in 1968. Cal Turner, Jr. succeeded his father as president in 1977 and as chairman in 1989, remaining in that position until 2003 when he stepped down. Dollar General remained a family business to the core for many decades. The influence of the Turner family on the company can still be felt throughout Dollar General today. As Perdue, the first nonfamily chairman and CEO, commented, "Over the years, the Turner family created a strong mission-oriented culture that is the core to our success today. Our mission of serving others is timeless, and it is the starting point of any strategic discussion." In addition to a strong family culture, Dollar General built its foundation on opportunistic buying. Cal Turner bought large quantities of liquidated merchandise and then pushed the merchandise to the stores with the hope of moving as much product as possible. The company relied on the buying prowess of the company's owners and merchants. This proved to be a successful strategy for the company for many decades. Perdue recalled, "From 1955 through to the early 1990s, Dollar General operated a close-out retail model. In the 1990s we started adding household consumables to the product mix. This began the migration from the buyer-driven company model of the past to the more customer-centric model we see at Dollar General today." The company achieved significant scale primarily through organic growth over the past five decades. From one store in 1955, Dollar General grew to over 1,300 stores in 23 states by the end of the 1980s. By the mid-1990s the company operated over 2,000 stores in 25 states, and as of February 2007, the total number of stores had reached 8,260 in 35 states. The Dollar General Mission At the heart of Dollar General was the company mission, which permeated every facet of the organization. This mission lay at the roots of the organization and had been a central focus for decades. The Dollar General mission was "To Serve Others: to provide customers a better life, shareholders a chance for a superior return, and employees respect and opportunity" (see Exhibit 9). David Bere, COO of Dollar General, commented: I truly believe our mission statement is something that makes us very distinctive in the retailing industry. The mission of serving others is embraced at all levels of the organization. Many people in the organization see the mission as a ministry itself. Dollar General makes a special effort to reach low-income consumers. There is a sense of purpose to the work that we do. Oftentimes we are the only retailer in a rural community, and we take great pride in serving that community. To carry out this mission, the company's business strategy was based on providing customers with a focused assortment of fairly priced, consumable merchandise in a convenient, small-store format. Kathleen Guion, division president of store operations, commented on the pervasiveness of the Dollar General mission: We often get letters from communities asking us to open a Dollar General in their town. The closest option these people have to get everyday consumables at low prices is Wal-Mart, which may happen to be in the next town 30-40 miles away. The convenience of having a Dollar General within five miles of your home is of tremendous value to these customers. Suddenly they don't have to think about their purchases in weekly intervals based on their trip to Wal-Mart. They can now stop by the Dollar General and pick up needed items any day of the week and avoid the cost of driving 30 miles to the nearest Wal-Mart. It is the knowledge and understanding of this customer and her needs that truly lies at the heart of Dollar General. At the corporate support center (Dollar General's term for the corporate office) and in the field, the customer was consistently referred to as she. Women represented 86% of consumers shopping in the dollar store channel, and 41% of dollar store customers earned less than $30,000 per year. As Guion stated, "Employees feel a close affinity to the customer that they serve. They know their customers well, especially in the more rural locations, and they want to provide great products and service to their customers." The Dollar General Store The average Dollar General store was 6,900 square feet and contained 4,900 SKUs. This compared with over 100,000 square feet of selling space for a Wal-Mart and 75,000-plus SKUs. Dollar General had a focused assortment of quality, consumable merchandise in a number of core categories. It did not carry every brand and size but focused its inventory on the fastest-turning SKUs in each category. Table B shows the top 10 SKU categories in the extreme-value retail segment in 2006. Source: Michael Silverstein and John Butman, Treasure Hunt: Inside the Mind of the New Consumer (Portfolio Hardcover, 2006). Dollar General emphasized even-dollar prices on most of its items. In the typical store the majority of products were priced at $10 or less, with approximately 30% of the products priced at $1 or less. Over 30% of the products offered were nationally advertised name brands, including Tide, Dawn, CoverGirl, Dove, Campbell's Soup, and Kellogg's Cereal. The remaining products came from a variety of manufacturers, including Dollar General's private-label brands: Clover Valley and DG Guarantee. Private-label products represented 12% of Dollar General's merchandise mix. Perdue commented: We are very price competitive with Wal-Mart on the products we offer in our stores. We are constantly doing research to ensure that we have price parity with Wal-Mart. In some instances we can even beat them on price. Customers are very shrewd when it comes to price. At Dollar General we have a desire to keep things simple for our customers. This includes focusing on even-dollar price points. We want to make it easy for our customers to add up their basket of goods prior to entering the checkout line. While we do have some products at prices of $0.50 or $1.50, you don't see a price point of $1.79 in our stores. This poses a challenge for us when we face inflation. Wal-Mart can increase prices in 10 cent increments. We don't typically do that. While Wal-Mart competed on price and selection, Dollar General competed on price and convenience. Beryl Buley, division president of merchandising, marketing, and supply chain, noted: The average shopper at Dollar General is in and out of our stores in 10-20 minutes. If the same shopper went into a Wal-Mart and picked up an identical basket of goods, they would spend 55 minutes in the store. Convenience is where we win. Some of our stores are literally located in the parking lot of a Wal-Mart. Consumers will shop our stores first to get basic consumables and then go into the Wal-Mart for any additional items they need. We also have many stores located on the drive path to Wal-Mart that do incredibly well. Our value proposition is clearly compelling for a certain set of consumers. In addition to allowing it to compete directly with Wal-Mart in certain communities, Dollar General's business model allowed it to enter locations that were much too small for Wal-Mart. Of the 8,260 stores in operation as of February 2007, approximately 4,750 were in communities with populations of 20,000 or less. Wal-Mart, on the other hand, required a population of 50,000-plus before going into a community. "Dollar General is one of very few retailers with an economic model that enables it to be profitable in such small communities," added Perdue. The location of Dollar General stores within a community was split between strip malls (49\%) and freestanding buildings (49%). The remaining 2% of stores were in more urban areas that generally had lower household incomes (and hence lower rents). The majority of Dollar General stores were rented on short-term leases. The company emphasized a low-cost business model that permeated all aspects of the organization. Dollar General built stores in second-tier locations to maintain relatively low real estate costs. Dollar General also had very low advertising costs (less than 1% of sales) to support its low-cost business model. (Exhibit 10 shows comparative metrics across discount retailers in the U.S.) Life in the Dollar General Store The average Dollar General store had revenues of $1 million per year and operated with one store manager, two assistant store managers, and two or three store clerks. With such limited labor, life in the store was not always easy. Guion explained: Truck day has always been the central focus of any Dollar General store. Each store receives 8001,200 boxes of merchandise per week, and these boxes must be manually unloaded from the truck into the store's back room. Almost every employee in the store is scheduled to work on truck day. If the truck is late or delayed, employees will do other tasks until it arrives. Once the truck arrives it takes two or three hours to unload with the truck driver and usually four employees 'throwing' freight. Some employees will begin stocking immediately. Working in the store is a very physical job. Back rooms at Dollar General were quite small at 600-800 square feet. They were purposely built small to force stores to get the product out onto the floor quickly. The small back rooms posed many problems for store managers, and some stores faced back rooms overflowing with product all year. The back-room problem had been exacerbated by Dollar General's pack-away strategy, which persisted until 2006. Merchandise that did not sell during a given season (e.g., Halloween) would be packed away to be sold the following year. This created additional chaos for the store manager. Not only did they have extra merchandise to try and squeeze into the back room, they also had to become merchandisers for product that was not planned for. As one store manager explained: It is easy for me and my employees to get the everyday products onto the store shelves. We know where to stock the paper towels and the soda. They each have a standard location in the store that doesn't change from week to week. But when it comes to noncore merchandise that is not planogrammed, it is much more difficult for us. I wouldn't consider myself an expert merchandiser. I am much better at unloading freight and keeping the store running. Last week I spent two hours trying to stock a carton of soccer balls and a carton of water toys. I just couldn't figure out where to put them. The water toys were too bulky to fit on the standard gondolas, and the soccer balls kept rolling off the shelf. What could I do? Eventually I left the soccer balls in a big basket on the floor and put the water toys in the back room. Maybe I'll find a spot on the shelf for water toys next week. This struggle was not uncommon for a store manager. District managers (DMs), who numbered 525 , aimed to help the individual store with these types of issues. Guion commented that there was a significant improvement in the role the DMs played in the store over the past two years: Our district managers today are more focused on training store managers and problem solving for the root cause of a problem rather than directly addressing the symptom of the problem. In the past, if a store had a back room overflowing with product, the DM would roll up his or her sleeves and help the store manager dig product out of the back room. Today, our DMs are focused on avoiding the back-room problem altogether through increased in-store training and improved labor planning. Guion emphasized that the DMs were the key link between corporate and the individual store. This link was especially important when it came to noncore merchandise, the merchandise outside of the highly consumable category. Seasonal items, basic clothing, and housewares would be considered noncore merchandise at Dollar General. While most of the items in these categories did not have a permanent home in the store, noncore merchandise was very attractive to Dollar General because the margins were often one to two times those of the products in the highly consumable category. Despite the attractiveness of the noncore merchandise to the bottom line, this merchandise caused the most headaches for store employees. The merchandise mix between highly consumable and noncore merchandise in the extreme-value channel illustrated the classic dilemma highlighted by Clayton Christensen. 7 Consumables might typically command a 20% gross margin with an 8X turn rate, while seasonals and treasure hunt items might command 40% or higher gross margins, but at a much lower turn rate. Choosing the mix, or shifting the mix, had major impacts on the business model. Dollar General: Past and Present Dollar General had gone through a significant transformation over the past decade. Many would say the company had grown up, transitioning from an infant that was an inward-focused rural dollar store to a more mature and customer-facing retailer. These changes were reflected in the evolution of the key metrics tracked by Dollar General, both at the store level and across the entire organization. (Exhibit 12 shows the metrics used by Dollar General to assess its own performance.) A number of structural changes were introduced at Dollar General over the past five years, many spurred by the significant growth of the organization. Some changes, particularly those made in 2006, were implemented to address legacy issues that remained from the earlier days of Dollar General. These changes hurt the 2006 financial performance (as seen in Exhibit 4). The most recent changes were implemented under the name "Project Alpha" and were focused on upgrading the existing store base by closing 128 low-potential stores, remodeling and/or relocating a significant number of stores, and eliminating the legacy inventory pack-away policy. The old inventory pack-away policy involved boxing up unsold merchandise from one season, storing it in the back room, and then placing it back out on the shelf the following season. In 2007, Dollar General was focused on enhancing the customer in-store experience and providing fresher and more relevant merchandise to its customers. In the spring of 2006 there was also the resumption of local circulars for the first time in over a decade. Some would argue that the company was beginning to look more and more like its big-box competitors, namely Wal-Mart and Target. Technology From 2002 to 2004 Dollar General rolled out an auto-replenishment inventory system connected to its electronic point-of-sale (POS) system. These systems significantly improved the company's in-stock percentage, moving from approximately 80% to 83%, to 95% in-stock product today. These systems helped move the organization further away from a push strategy to a pull strategy driven at the store level. These systems enabled the distribution centers and stores to better manage inventory flow and product allocation. Detailed product information was now available at the SKU level for corporate, merchants, and store managers. Access to this information transformed how many employees did their jobs. For the first time store managers had access to gross margin information by category. Merchants were now able to be held accountable for buying and sell-through at the SKU level. And finally, corporate had the ability to make better merchandising decisions including improved SKU adjacencies and private-label choices. The improvement in the in-stock percentage was substantial with the technology improvements in-store; however, there was still significant opportunity surrounding the high-velocity SKUs, which usually represented the 5% of goods that were out of stock at any given point. Other technology changes included the acceptance of debit and credit cards in substantially all stores in 2004. The movement to electronic payment allowed the company to move further away from its cash-and-carry roots. This change followed the company's introduction of card readers, which made shopping more convenient for customers who relied on government assistance and electronic benefit transfer as a means of payment. Together these changes helped contribute to increased success at the store level, with basket size increasing to $9.31 per transaction in 2006, a 3.3\% increase over that of 2005. Store Management Dollar General had transitioned from a company that hired store managers based on who could throw the most freight (literally) to one that hired store managers based on their ability to solve problems, plan, and delegate. In 2007, labor was better matched to customer demand, not freight demand. Guion commented, "Customer service moved from a distant secondary focus in the store to the primary driver of work within the store." A further move toward a more customer-centric store management included selection and testing for store manager skills. Implemented in 2006, store manager testing better matched the skills of the store manager to the needs of the Dollar General customer. Increased focus on the skill set and training of the store manager increased the "hire from within" capability of the company-a key metric Dollar General began focusing on in 2004. As of 2006, 65% of new district managers were former store managers, and turnover within the DM ranks dropped from 30% in 2005 to under 20% in 2006 . Guion commented: We feel the positive movement in these personnel metrics is a leading indicator of the improved focus we have on people management at Dollar General. The biggest productivity lever we have in the store is the goodwill of our people. By focusing on improved training and increased communication we hope to continue to build on the goodwill that helps enable Dollar General to fulfill its mission of serving others. Merchandising During the majority of Dollar General's life, the merchants had primarily worked under the philosophy that the more they bought, the more they would sell. With the shift toward everyday low prices on household consumables, merchants were forced to rethink their buying process. Merchants in the old Dollar General were only held accountable for a product's initial markup, with no accountability for sell-through or markdowns. In 2007, merchants were responsible for overall shelf profitability, and the company used gross margin return on investment (GMROI)) to evaluate overall SKU profitability relative to inventory investment. In addition to improved merchant accountability, Dollar General added coolers to most of its stores between 2002 and 2004. This enabled stores to offer a focused assortment of milk, frozen foods, ice cream, and lunch meats. Offering these types of items benefited the company in two ways. First, these items helped increase store traffic, and hence same-store sales. Second, coolers allowed Dollar General - Provide a full justification and recommendation for each finding of fact (minimum 1 page each, not including the Finding of Fact)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts