Please read the Case Study and solve the question below please do not copy and paste this answer I want on Word and unique answer make it for each question 100 word

...

Today marks a major milestone for us as a Finance organization. I have an important announcement to share with you about a transition for our department that I believe to be a major step forward to propel us into the next phase of the company.

First, permit me to take you down memory lane.

Some of you remember (or have certainly heard the stories) just 7 short years ago when we started making our specialized organic energy bars for athletes. Our founder, Melissa Waters, used her PhD in nutrition science to develop our proprietary formula for professional athletes after years of experimentation and scientific research. Our production team worked out of Melissas kitchen and hand-crafted each batch.

We had just one grocery location, but we knew we had a unique product when world-renowned athletes started asking us to ship directly to them. The gluten-free bars combined with our patented packaging fueled our customers and fueled our growth. As demand grew and our popularity increased, we couldnt keep the bars in stock, especially when we were endorsed by Professional Triathlete Monthly. Within two years, we were in 23 grocery stores and selling boxes online. We moved into a commercial kitchen.

Much has changed in the past year alone. We have expanded into snack foods. We have begun to sell energy drinks. And with our recent acquisition of AthleteFoodCoach.com, we now provide nutrition coaching for professional and amateur athletes based on scientific research and testing.

Many of these are new and fast-growing business models in a competitive industry space. We have multiple businesses now that are all very different. We sell both products and services; we sell in brick and mortar stores and directly online. We have come under increased profitability pressures in the last year as cheaper competitors have flooded the market. It has become a price war, and while we have had to lower our prices to maintain our market share, that has come at a cost of our profits.

Our business leaders need us as a Finance team to support them with the financial knowledge and advice they need to make the right business decisions to expand the company profitably. They need detailed information on pricing strategies for current and new products, unit costs, business case analysis, and much more.

Based on conversations with our senior leaders, I have come to the conclusion that our old finance support model is inadequate for our companys needs. The old model that worked effectively when we were a single product company no longer works adequately, as we have too much complexity now for each of us to know everything about every type of business.

***

And thats all I wrote so far, Heather said.

Its a great start. I think that reflects everything we discussed to explain the rationale for the redesign, Brad said.

Heather and Brad sat at the long conference room table, reflecting on the debates they had endured during the last eight weeks. It seemed like yesterday when Heather, the Chief Financial Officer and head of the finance team, tapped Brad to lead the effort. Brad was the first financial analyst she had hired and was most knowledgeable about the organization and industry. She trusted Brads expertise and knew that he would be a good sounding board for organization design decisions. Heather had told the Chief Executive Officer a few months back that Brad was the highest potential person in the finance organization and should be her eventual successor.

I agree, and after all of this time, I think were getting close to communicating, Heather said. Im proud of the work that we did, and Im confident in our choices. Im concerned about a few points, however, and this is where I need your help before we proceed.

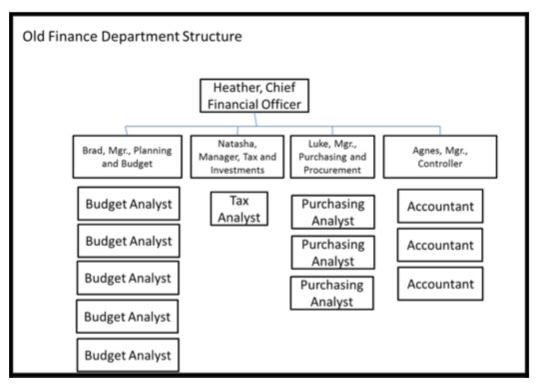

Lets walk through the whole transition again, so we can clarify what is changing, Heather began. We have a classic functional organizational structure which we have had since the beginning. Heather pulled out her organizational chart

In our division now, I have four managers and 12 financial analysts. Each group works on some area of finance expertise. In your planning and budget team you have five analysts, all responsible for the sales targets for the product areas, annual budgets, and financial reporting. Natasha has the tax and investments area. Since this is smaller, she only has one tax analyst assigned to her, although with the expansion into additional retail stores in new states with new tax regulations I know this is going to get more-thorny. Luke has purchasing and procurement, which includes our supplier contracts. Agnes is our controller and maintains our financial records and bank accounts.

One area where we have always struggled in is cross-functional collaboration, Heather continued. I have always wanted more teaming between these groups. For example, when we enter into a new retail location we need a budget plan that includes any tax implications, we need to set up purchasing agreements with the retail chain, and we need to involve Agnes team if there are new accounts needed.

Thats what we did before we acquired the new coaching business, Brad added. We pulled together an ad hoc team of the managers plus a few analysts to help us with the business case. We have typically done that informally when a question comes up where we need to coordinate. Its become much more intricate with these new businesses.

I agree, but its been a slow process to create ad hoc teams every time we need to coordinate. Everything has increased ten-fold in complexity. In the old model I relied heavily on the management team to be the focus for the business decisions that needed to get made, Heather pointed out. Now there is too much to know about any one business.

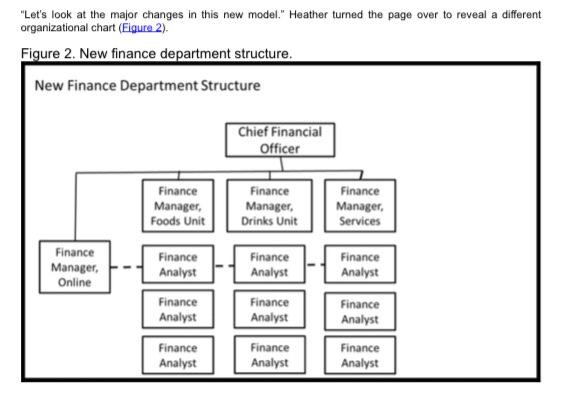

Right now, I have tried to assign two budget analysts to foods, two to drinks, and one to services, Brad admitted. But the workload on them is tremendous, and the core foods business tends to eat up most of everyones time. I want us to become more business-centric and product-centric, Heather said. We will organize the new department by the different product units that we each will work with. All financial reporting, advice, and knowledge will be contained within each finance unit, reporting to me but working closely with the different product leaders. The Foods Unit General Manager will have a finance manager who works with her on everything from planning to tax to accounts to procurement. Same thing for Drinks and Services. Our nutrition service unit is just one part of Services where we think we can grow. I want us to invest our time in helping managers of growth businesses like Drinks and Services.

From what weve heard from the General Managers when we interviewed them, Brad said, they are going to appreciate having a single team to handle all of their finance needs. They had been complaining about not knowing who to contact in each finance group, plus every time they got a report it was inconsistent, because every analyst had a preferred format and methodology for reporting.

And they complained that the analysts did not understand the business well enough, Heather added. This way we can focus the whole teams attention on the line of business and coordinate our finance services. And to emphasize how important it is to focus on the needs of the line of business, I want to institute a bonus plan for helping each product area grow as well as customer satisfaction reports from surveys of the business leaders. I also want more generalists, not finance specialists. To provide an integrated finance picture of the business means we need to present one face as a team, not isolated pockets of finance knowledge disconnected from one another.

I think that makes sense, Brad said cautiously. But I think it will be a challenge. We all have our specialty areas based on educational background and on comfort level with the established procedures that we are used to. Of course, Heather said sympathetically. We are going to need a training plan. We dont really do much training, but I am willing to invest in that. If we have any chance of growing these businesses we are going to need everyone to come together as a team, learn from one another, and dive in. Look at the current organizational chart. Almost everyone is a specialized analyst of some form, doing one narrow job without a holistic view of the organization. Whether its planning, tax, procurement, or accounting, everyone must be well-versed in every area. We need flexible and educated utility players, not specialists. If they cant learn or grow or adapt, then maybe this is not the finance team for them. Heather was starting to sound a lot less sympathetic.

Lets go back to our discussion of the finance manager role for the Online business, because that job will still be a direct report to you, but without a team to manage, Brad said.

Yes. We also heard from the stakeholder interviews of the General Managers that we should mirror the rest of the structure in the company. The Online business crosses each of the product areas. Its a key growth area for us as a company. While it has always been part of our strategy, we think we can grow 25% faster in the Online business over the next two years. I want someone on my team to focus their attention on that business area, but there must be very close coordination to the other business units. I want one financial analyst from each line of business to also be assigned dotted line to the Online division.

I guess the elephant in the room has always been the number of boxes on this chart, Brad said quietly. There are still four managers, but only nine analysts, not 12. We are going to lose three team members.

I dont have to tell you about the budget for the year, Heather reminded Brad. Profits are down and we have invested heavily in our expansion. We must tighten our belts for a while. I also have news for you as we consider this transition plan. Natasha has decided to leave the company.

What? Thats a huge blow. She is one of the smartest people I know, an excellent leader, and a sharp business professional. We are going to miss her, Brad said.

I couldnt agree more, Heather said. She didnt even know about this transition yet, but she was recruited for a perfect role. She agonized over the decision, but finally let me know yesterday.

So that means a manager opportunity would open up? Brad asked.

It certainly could, Heather agreed. I havent decided on the placement of the leadership team yet. That brings up another topic I wanted to discuss with you. Brad, I would like for you to consider the manager role for the Services unit. Its a growing area of the business where we need your expertise. I also think it would challenge you and grow you as a leader. Ive been thinking about tapping Agnes to take on the Foods Unit and Luke to take on the Online Unit.

Brad thought for a moment. Thank you, Heather. I am a little surprised because I assumed I would ask for the Foods Unit manager role. Thats been my entire career here. Can I think about it?

Yes, of course, Heather assured him.

How do you think Agnes and Luke will feel? Brad asked.

Agnes knows the Foods Unit so well, I think it would be a natural fit for her. I also know how much she loves the world of accounting, so I dont know how comfortable she is going to be with the ambiguous world of business cases and planning assumptions. Luke is a born leader and gravitates toward leading his team. I think he would learn a lot in the Online role although I think he would miss having a team reporting to him, Heather concluded.

What Brad thought, but did not say, was that he saw Natashas departure coming. Rumors had been circulating about organizational changes for weeks, and Brad knew that Natasha wanted to stay in a role that allowed her to use her tax expertise.