Question: Please read the D'Leon INC., Part I to be able to complete D'Leon INC., Part II QUESTIONS FINANCIAL STATEMENTS AND TAXES (PART I) Donna Jamison,

Please read the D'Leon INC., Part I to be able to complete D'Leon INC., Part II QUESTIONS

FINANCIAL STATEMENTS AND TAXES (PART I)

Donna Jamison, a 2011 graduate of the University of Florida, with 4 years of banking experience, was recently brought in as assistant to the chairperson of the board of DLeon Inc., a small food producer that operates in north Florida and whose specialty is high-quality pecan and other nut products sold in the snack foods market. DLeons president, Al Watkins, decided in 2017 to undertake a major expansion and to go national in competition with Frito-Lay, Eagle, and other major snack foods companies. Watkins believed that DLeons products were of higher quality than the competitions, that this quality differential would enable it to charge a premium price, and that the end result would be greatly increased sales, profits, and stock price.

The company doubled its plant capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. DLeons results were not satisfactory, to put it mildly. Its board of directors, which consisted of its president, vice president, and major stockholders (all of whom were local businesspeople), was most upset when directors learned how the expansion was going. Unhappy suppliers were being paid late, and the bank was complaining about the deteriorating situation and threatening to cut off credit. As a result, Watkins was informed that changes would have to be madeand quickly; otherwise, he would be fired. Also, at the boards insistence, Donna Jamison was brought in and given the job of assistant to Fred Campo, a retired banker who was DLeons chairperson and largest stockholder. Campo agreed to give up a few of his golfing days and help nurse the company back to health, with Jamisons help.

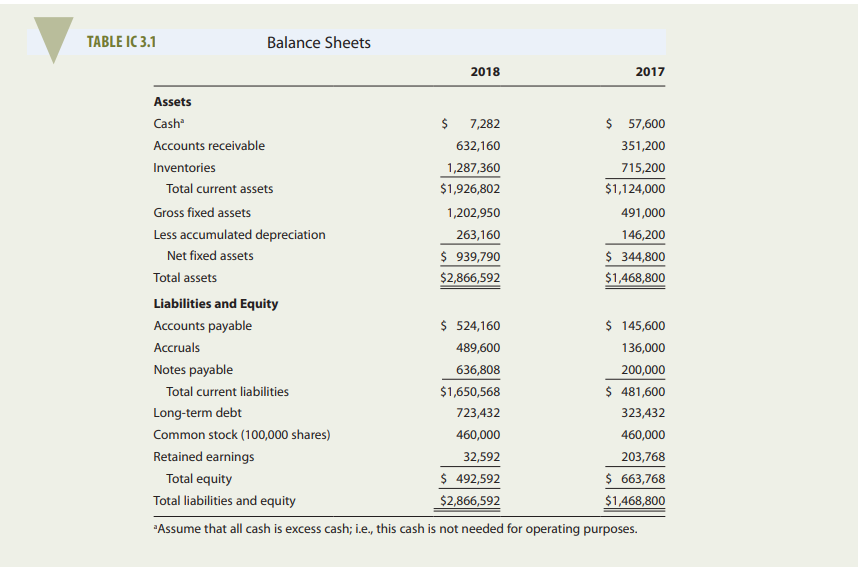

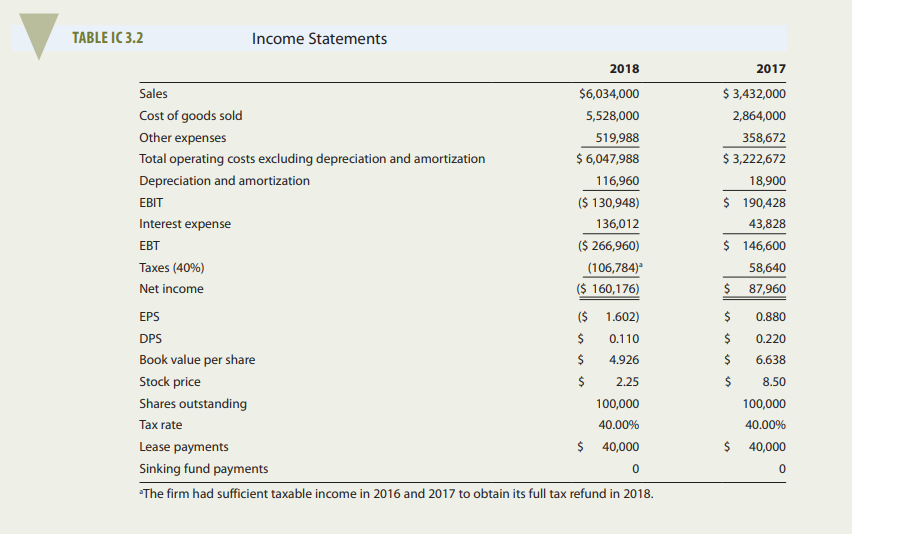

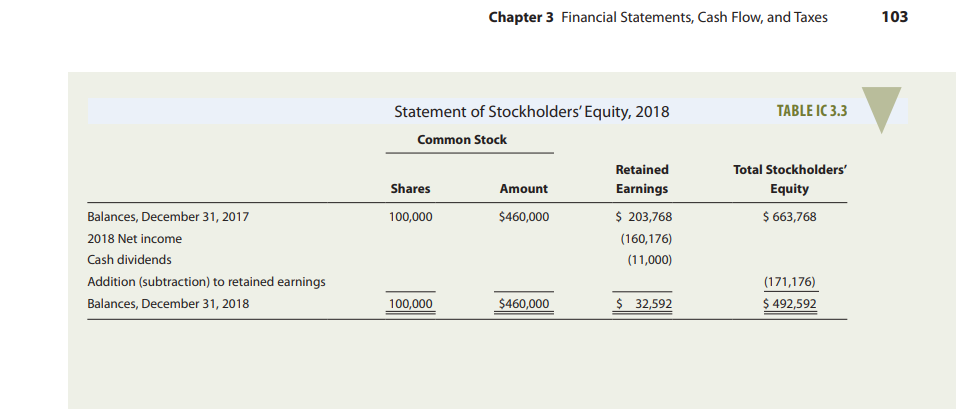

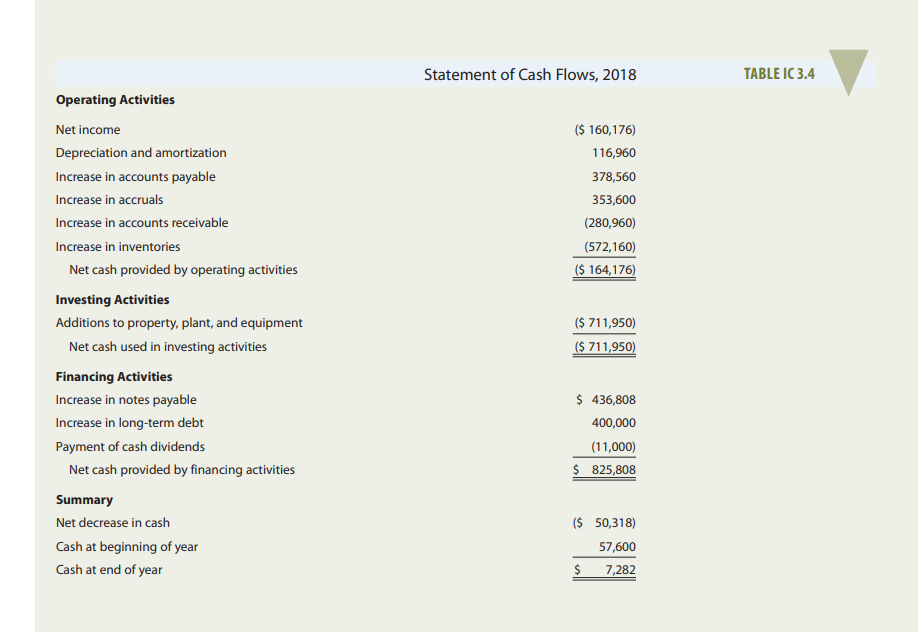

Jamison began by gathering the financial statements and other data given in Tables IC 3.1, IC 3.2, IC 3.3, and IC 3.4. Assume that you are Jamisons assistant.

FINANCIAL STATEMENTS AND TAXES (PART 2)

Part I of this case, discussed the situation of DLeon Inc., a regional snack foods producer, after an expansion program. DLeon had increased plant capacity and undertaken a major marketing campaign in an attempt to go national. Thus far, sales have not been up to the forecasted level, costs have been higher than were projected, and a large loss occurred in 2018 rather than the expected profit. As a result, its managers, directors, and investors are concerned about the firms survival.

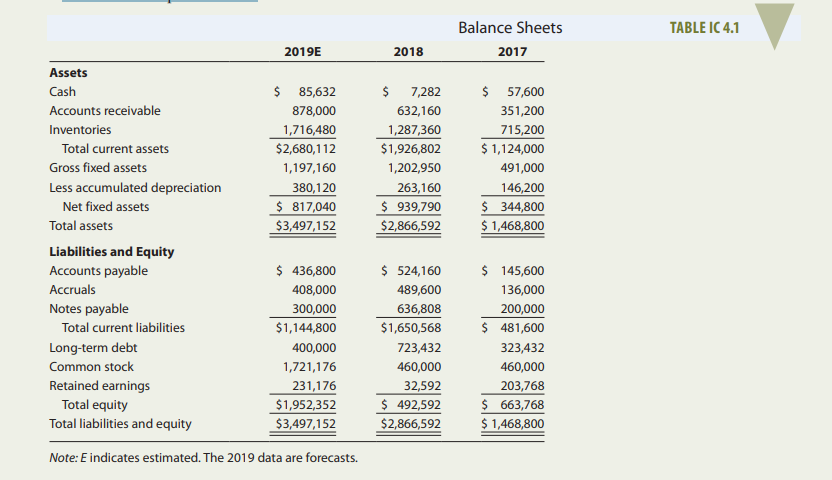

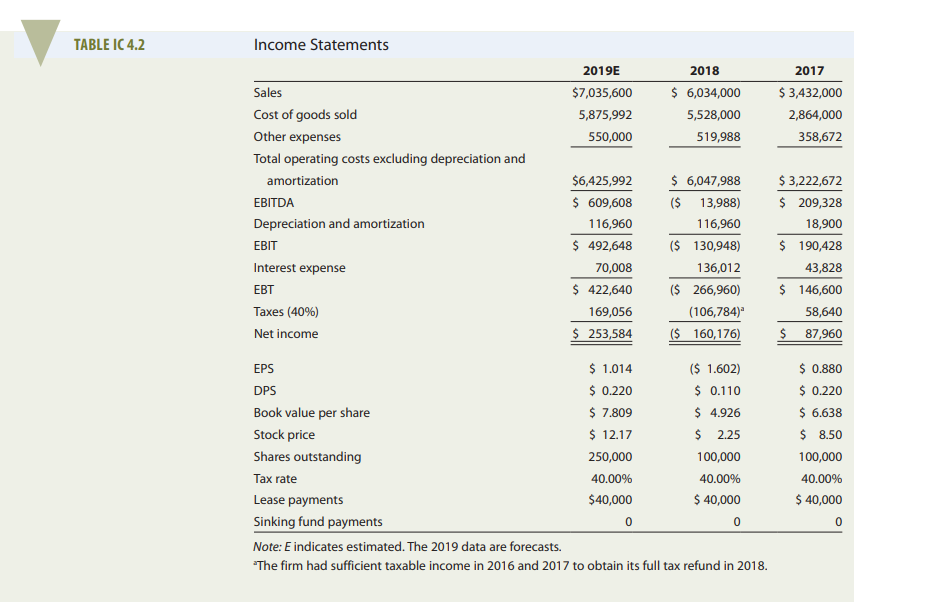

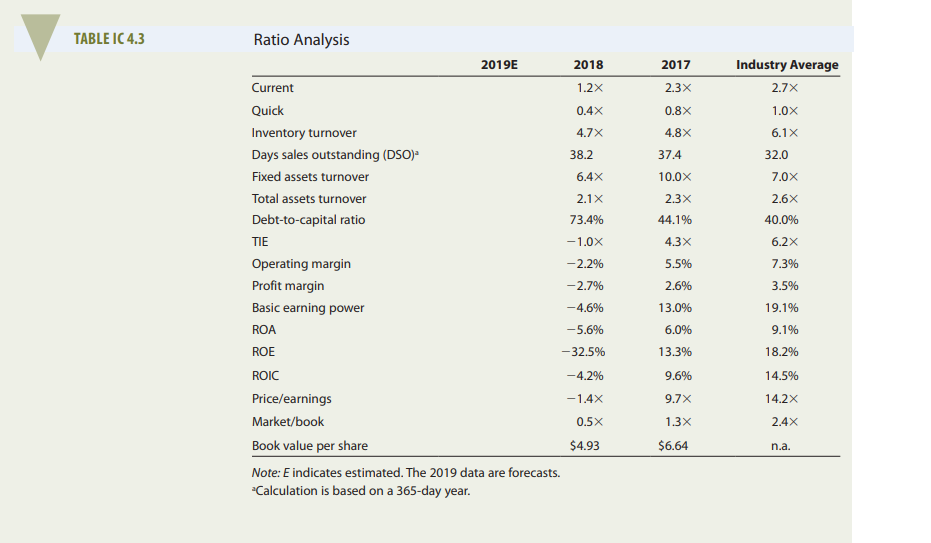

Donna Jamison was brought in as assistant to Fred Campo, DLeons chairman, who had the task of getting the company back into a sound financial position. DLeons 2017 and 2018 balance sheets and income statements, together with projections for 2019, are given in Tables IC 4.1 and IC 4.2. In addition, Table IC 4.3 gives the companys 2017 and 2018 financial ratios, together with industry average data. The 2019 projected financial statement data represent Jamisons and Campos best guess for 2019 results, assuming that some new financing is arranged to get the company over the hump.

Jamison examined monthly data for 2018 (not given in the case), and she detected an improving pattern during the year. Monthly sales were rising, costs were falling, and large losses in the early months had turned to a small profit by December. Thus, the annual data look somewhat worse than final monthly data. Also, it appears to be taking longer for the advertising program to get the message out, for the new sales offices to generate sales, and for the new manufacturing facilities to operate efficiently. In other words, the lags between spending money and deriving benefits were longer than DLeons managers had anticipated. For these reasons, Jamison and Campo see hope for the companyprovided it can survive in the short run.

Jamison must prepare an analysis of where the company is now, what it must do to regain its financial health, and what actions should be taken.

Your assignment is to help her answer the following questions. Provide clear explanations, not yes or no answers.

a. Why are ratios useful? What are the five major categories of ratios?

b. Calculate DLeons 2019 current and quick ratios based on the projected balance sheet and income statement data. What can you say about the companys liquidity positions in 2017, in 2018, and as projected for 2019? We often think of ratios as being useful (1) to managers to help run the business, (2) to bankers for credit analysis, and (3) to stockholders for stock valuation. Would these different types of analysts have an equal interest in the companys liquidity ratios? Explain your answer.

c. Calculate the 2019 inventory turnover, days sales outstanding (DSO), fixed assets turnover, and total assets turnover. How does DLeons utilization of assets stack up against other firms in the industry?

d. Calculate the 2019 debt-to-capital and times-interest-earned ratios. How does DLeon compare with the industry with respect to financial leverage? What can you conclude from these ratios?

e. Calculate the 2019 operating margin, profit margin, basic earning power (BEP), return on assets (ROA), return on equity (ROE), and return on invested capital (ROIC). What can you say about these ratios?

f. Calculate the 2019 price/earnings ratio and market/book ratio. Do these ratios indicate that investors are expected to have a high or low opinion of the company?

g. Use the DuPont equation to provide a summary and overview of DLeons financial condition as projected for 2019. What are the firms major strengths and weaknesses?

h. Use the following simplified 2019 balance sheet to show, in general terms, how an improvement in the DSO would tend to affect the stock price. For example, if the company could improve its collection procedures and thereby lower its DSO from 45.6 days to the 32-day industry average without affecting sales, how would that change ripple through the financial statements (shown in thousands below) and influence the stock price?

| Accounts receivable | $ 878 | Current liabilities | $ 845 |

| Other current assets | 1,802 | Debt | 700 |

| Net fixed assets | 817 | Equity | 1,952 |

| Total assets | $3,497 | Liabilities plus equity | $3,497 |

l. What are some potential problems and limitations of financial ratio analysis?

m. What are some qualitative factors that analysts should consider when evaluating a companys likely future financial performance?

TABLE IC 3.1 Balance Sheets assume that all cash is excess cash; i.e., this cash is not needed for operating purposes. TABLE IC 3.2 Income Statements The firm had sufficient taxable income in 2016 and 2017 to obtain its full tax refund in 2018. Chapter 3 Financial Statements, Cash Flow, and Taxes Statement of Cash Flows, 2018 TABLE IC 3.4 Operating Activities Net income Depreciation and amortization Increase in accounts payable Increase in accruals Increase in accounts receivable Increase in inventories Net cash provided by operating activities Investing Activities Additions to property, plant, and equipment Net cash used in investing activities Financing Activities Increase in notes payable Increase in long-term debt Payment of cash dividends Net cash provided by financing activities Summary Net decrease in cash Cash at beginning of year Cash at end of year ($160,176)116,960378,560353,600(280,960)(572,160)($164,176) ($711,950)($711,950) $436,808 400,000 (11,000)$825,808 (\$ 50,318) \begin{tabular}{rr} 57,600 \\ \hline$7,282 \\ \hline \end{tabular} Note: E indicates estimated. The 2019 data are forecasts. The firm had sufficient taxable income in 2016 and 2017 to obtain its full tax refund in 2018. Note: E indicates estimated. The 2019 data are forecasts. "Calculation is based on a 365-day year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts