Question: Please read the following case study, think from Financial Management perspectives and please broadly cover what we discussed in the class and structure your short

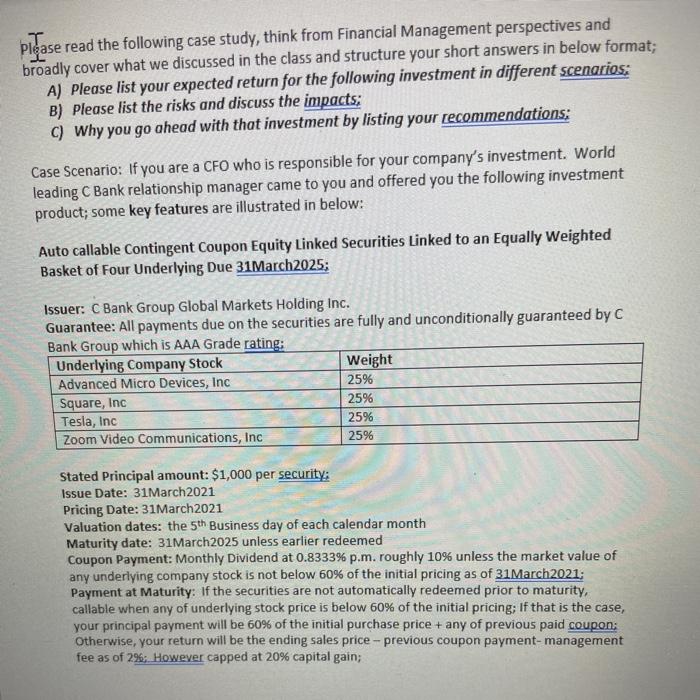

Please read the following case study, think from Financial Management perspectives and please broadly cover what we discussed in the class and structure your short answers in below format; A) Please list your expected return for the following investment in different scenarios; B) Please list the risks and discuss the impacts; C) Why you go ahead with that investment by listing your recommendations: Case Scenario: If you are a CFO who is responsible for your company's investment. World leading C Bank relationship manager came to you and offered you the following investment product; some key features are illustrated in below: Auto callable Contingent Coupon Equity Linked Securities Linked to an Equally Weighted Basket of Four Underlying Due 31 March2025; Issuer: C Bank Group Global Markets Holding Inc. Guarantee: All payments due on the securities are fully and unconditionally guaranteed by C Bank Group which is AAA Grade rating: Underlying Company Stock Weight Advanced Micro Devices, Inc 25% Square, Inc 25% Tesla, Inc 2596 Zoom Video Communications, Inc 25% Stated Principal amount: $1,000 per security: Issue Date: 31 March 2021 Pricing Date: 31 March 2021 Valuation dates: the 5th Business day of each calendar month Maturity date: 31 March 2025 unless earlier redeemed Coupon Payment: Monthly Dividend at 0.8333%p.m. roughly 10% unless the market value of any underlying company stock is not below 60% of the initial pricing as of 31 March 2021; Payment at Maturity: If the securities are not automatically redeemed prior to maturity, callable when any of underlying stock price is below 60% of the initial pricing; If that is the case, your principal payment will be 60% of the initial purchase price + any of previous paid coupon; Otherwise, your return will be the ending sales price - previous coupon payment-management fee as of 296; However capped at 20% capital gain; Please read the following case study, think from Financial Management perspectives and please broadly cover what we discussed in the class and structure your short answers in below format; A) Please list your expected return for the following investment in different scenarios; B) Please list the risks and discuss the impacts; C) Why you go ahead with that investment by listing your recommendations: Case Scenario: If you are a CFO who is responsible for your company's investment. World leading C Bank relationship manager came to you and offered you the following investment product; some key features are illustrated in below: Auto callable Contingent Coupon Equity Linked Securities Linked to an Equally Weighted Basket of Four Underlying Due 31 March2025; Issuer: C Bank Group Global Markets Holding Inc. Guarantee: All payments due on the securities are fully and unconditionally guaranteed by C Bank Group which is AAA Grade rating: Underlying Company Stock Weight Advanced Micro Devices, Inc 25% Square, Inc 25% Tesla, Inc 2596 Zoom Video Communications, Inc 25% Stated Principal amount: $1,000 per security: Issue Date: 31 March 2021 Pricing Date: 31 March 2021 Valuation dates: the 5th Business day of each calendar month Maturity date: 31 March 2025 unless earlier redeemed Coupon Payment: Monthly Dividend at 0.8333%p.m. roughly 10% unless the market value of any underlying company stock is not below 60% of the initial pricing as of 31 March 2021; Payment at Maturity: If the securities are not automatically redeemed prior to maturity, callable when any of underlying stock price is below 60% of the initial pricing; If that is the case, your principal payment will be 60% of the initial purchase price + any of previous paid coupon; Otherwise, your return will be the ending sales price - previous coupon payment-management fee as of 296; However capped at 20% capital gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts