Question: Please read the following discussion case. Help Tyler Stasney compute his net income for the year by completing the adjusting entries and creating an income

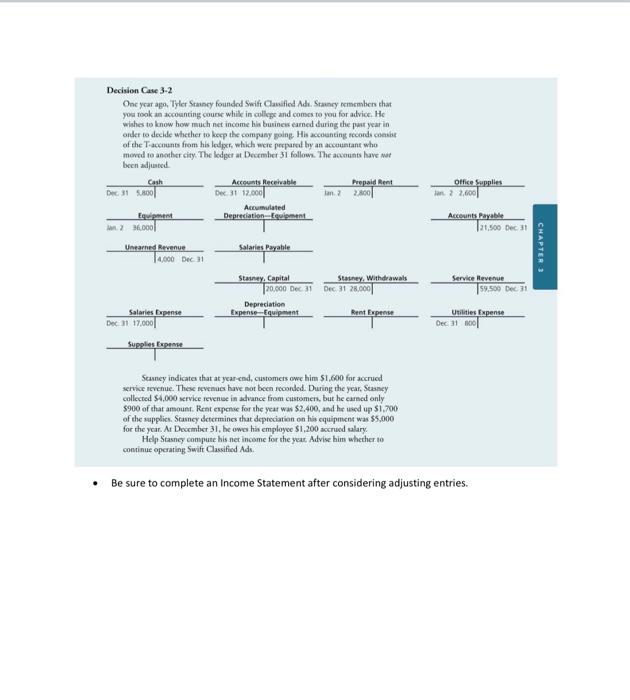

Please read the following discussion case. Help Tyler Stasney compute his net income for the year by completing the adjusting entries and creating an income statement for the business. Based on your findings, advise Mr. Stasney as to whether or not he should continue operating Swift Classified Ads. Scoring Rubric Income Statement (8 total points) Adjusted Revenues Total (2pts) Adjusted Expenses Total (5pts) Net Income (1pt) Recommendation (2 total points) Recommendation based on the Income Statement for Swift Classified Ads (1pt) Reasoning for recommendation (1pt) I need an Adjusted revenues total, An adjusted expenses total, a net income, and an updated T chart for all. Decision Case 3-2 One year ago, Tyler Stancy founded Swift Classified Ads. Staney remembers that you took an accounting course while in college and comes to you for advice. He wishes to know how much net income his business earned during the past year in order to decide whether to keep the company going Hh accounting records.com of the T-accounts from his ledger, which were perpared by an accountant who moved to another city. The ledger at December 31 follows. The accounts have a been adjusted Cash Accounts Receivable Prepaid Rent DC315.000 Dec 31 12.000 lan 2 2800 Accumulated Equipment Depreciation Equipment M.000! Office Supplies Jan 2.600 Accounts Payable 12,500 Dec 31 CHAPTER Unearhed Revenue 14.000 Dec Salaries Payable Service Revenue 59.500 Dec 31 Stasnay, Capital Stasney Withdrawals 20.000 Dec 31 Dec 31 28.000 Depreciation Expense-Equipment Rent Expense Utilities Expense Dec 160 Salaries Expanse Dec 17,000 Supplies Expense Sarney indicates that at year-end, customers owe him $1,600 for accrued service revenue. These revenues have not been recorded. During the year. Stancy collected $1,000 service revenue in advance from customers, but he cared only $900 of that amount. Rent expense for the year was $2.400, and he used up $1.700 of the supplies. Scanney determines that depreciation on his equipment was $5,000 for the year. At December 31, he owes his employee S1,200 accred calary. Help Stancy compute his net income for the year Advise him whether to continue operating Swift Classified Ads Be sure to complete an Income Statement after considering adjusting entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts