Question: Please read the instruction and fill out the yellow boxes in the image provided at the very end. During the 2020 year, Ricky has net

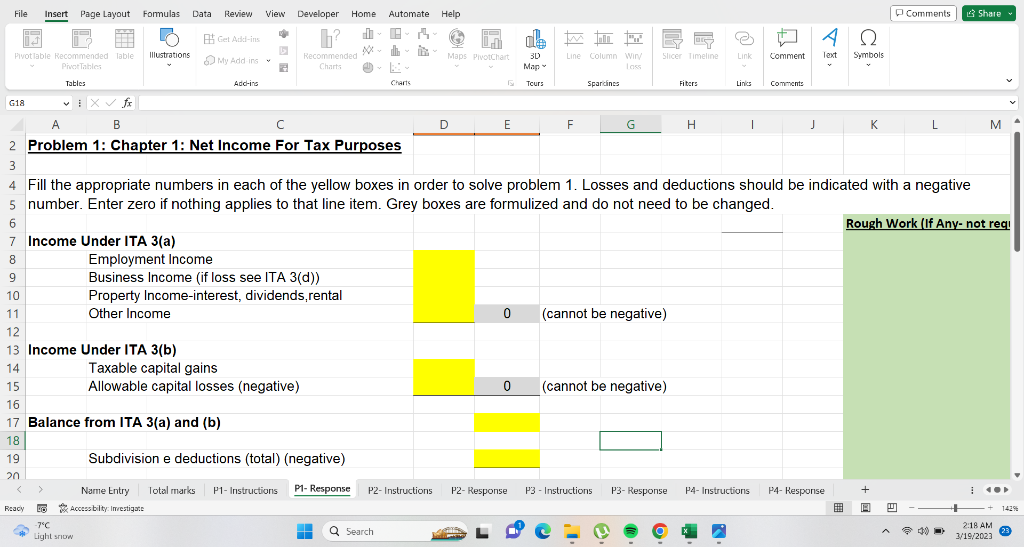

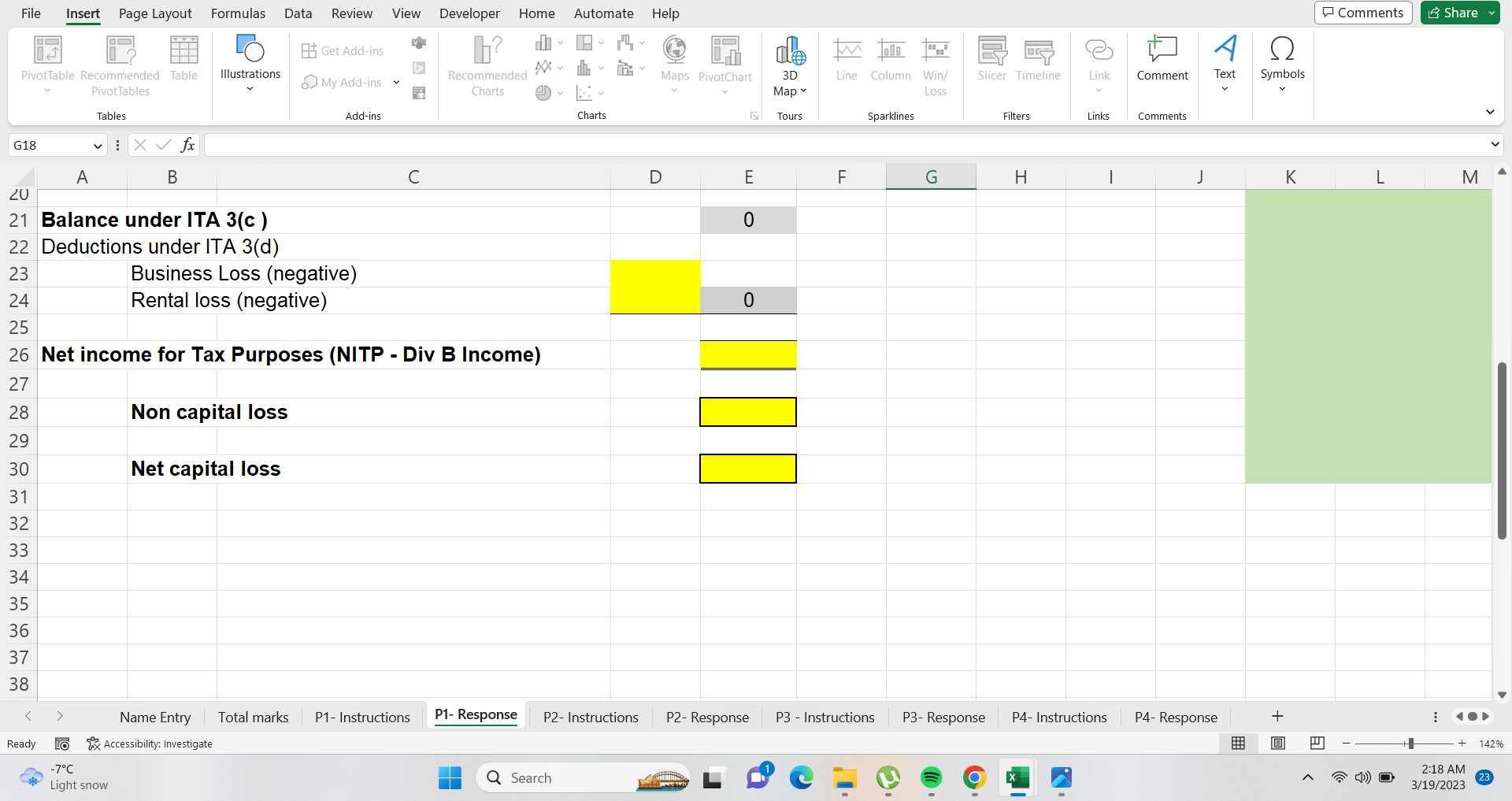

Please read the instruction and fill out the yellow boxes in the image provided at the very end.

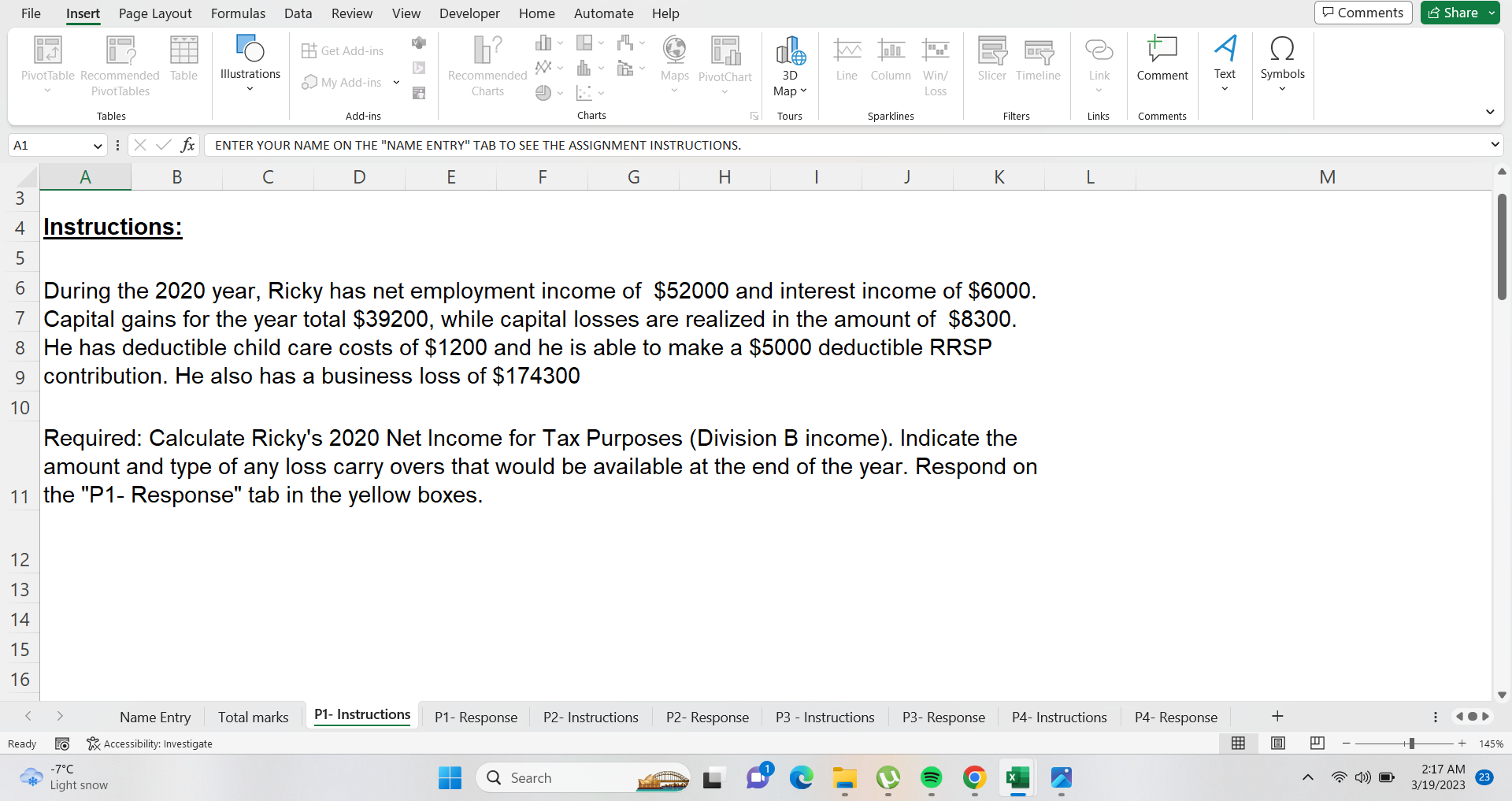

During the 2020 year, Ricky has net employment income of $52000 and interest income of $6000. Capital gains for the year total $39200, while capital losses are realized in the amount of $8300. He has deductible child care costs of $1200 and he is able to make a $5000 deductible RRSP contribution. He also has a business loss of $174300 Required: Calculate Ricky's 2020 Net Income for Tax Purposes (Division B income). Indicate the amount and type of any loss carry overs that would be available at the end of the year. Respond on the "P1- Response" tab in the yellow boxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts